Recent Articles by this Author

Recent Articles

Conventional wisdom tells us there are two main ways to achieve your revenue targets in 2022. For most companies, it boils down to either [...]

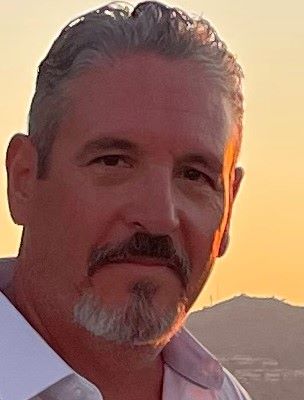

At the Virtual Consumer Data Industry Association (CDIA) Law & Industry Conference on July 12-14 2021, Peter Maynard, Senior Vice Pr [...]

Many businesses operate in a transactional environment that requires fast credit decisioning. However, a variety of obstacles prevent them [...]

Equifax has come a long way since its founding in 1899 by a pair of Tennessee-based grocers. Those long-ago grocers compiled lists of cu [...]

Updated 5/11/2023: The White House declared the end of the Covid-19 Health Emergency May 11, 2023 so some of the details mentioned in th [...]

This question sounds absurd. But this is one of the most important questions lenders must ask themselves when making consumer credit de [...]

Market Conditions Ripe for More Consumer Lending An improving economy means more people feel confident in their ability to pa [...]

.png)

.png)