6 Ways Equifax Can Protect You From Potential Losses

Real Solutions. Real Results.

See how customers have monitored and managed risk.

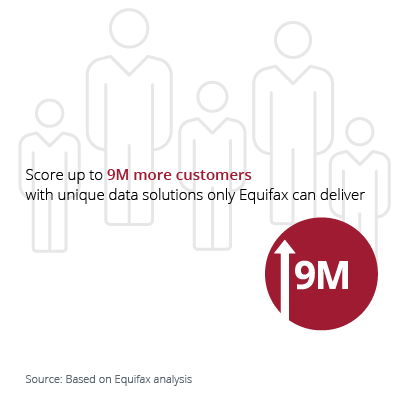

Solutions to Identify New Customer Risk

Ready to Complete Your Task?

Recommended Products

AMP Insights

Rate, compare, and evaluate the risk and ROI of multi-family complexes more effectively

Advanced Energy Plus

Advanced Energy Plus incorporates Equifax Amplify AI to help make better risk decisions while leveraging the strength of the telco and utility data

Archives on Demand

A cloud-based, self-serve platform that provides fast access to historical and geographic data

Bankruptcy Navigator Index 5.0

Maximize your portfolio profitability and protect against the immediate, long-term or surprise risk of bankruptcy

Business Credit Reports

Help spot immediate and future risk with the Equifax Business Credit Report

Business Credit Reports for Small Business

Understand the financial health of a business – before you do business

Business Principal Report

Get a view into credit-worthiness of business owners and principal guarantors

Business Risk Scores

Quickly set appropriate credit terms based on potential for business failure and payment delinquency

Business Value Advisor

Prospecting through a visualization engine built for advisors

BusinessConnect

BusinessConnect™ is a B2B automated credit decisioning tool that makes it easy for sales teams to qualify businesses with the push of a button

Cashflow Insights

Leverage consumer-permissioned bank account and transaction data to expand consumer access to credit

Commercial Merchant Data

Get a more complete picture of a business and their revenues based on transaction data

Consumer Attributes

The industry’s largest, most powerful portfolio of credit attributes delivering enhanced predictability and performance

Consumer Credit File

Make more accurate credit decisions with robust consumer credit data

Consumer IncomeView+

Consumer IncomeView leverages Equifax Amplify AI to help make stronger, confident decisions with a more accurate estimate of consumer income

Credit Review Express

Create a customized credit review process based on level of risk to increase efficiency

Credit Trends

Fuel your market strategies with comprehensive consumer credit perspectives

Custom Scoring Variables v2

Custom Score Variables v2 provides valuable components to help you build models with powerful predictive capabilities

DataX Credit Report

Bring more borrowers into view with non-traditional credit data

Equifax Ignite®

Unified data and analytics ecosystem for faster decision making

FICO Risk Score

Help build greater profitability with proven predictive scoring

FICO® Score XD

FICO® Score XD is a credit risk score for "unscoreables"

Freddie Mac Income & Asset Assessment

Automated income modeler for a reimagined mortgage experience

Inflection Insurance Score

Creating valuable insight into policyholder risk

InnovationX

A strategic ideation experience where Equifax and its customers collaborate to solve complicated business challenges using advanced data and analytics

Insight Score for Auto

A credit risk score optimized for the auto industry, Insight Score for Auto leverages Equifax Amplify AI and helps score more consumers, reduce risk, and improve portfolio performance

Insight Score for Personal Loans

An innovative, FCRA risk score optimized for unsecured personal loans

Insight Score for Retail Banking

Optimize DDA acquisition with a wider view of customers

MasterScore® v2

MasterScore v2’s powerful ability to predict borrowers’ risk leads to improved decisioning and increased profitability

OneScore for Alternative Finance

OneScore leverages Equifax Amplify AI to deliver a multi-data credit score for alternative finance lending

OneView

Rethinking credit: The new standard in credit insights delivery

Open Banking Solutions

Expand access to credit with insights from bank transaction and cash flow data

Payment Insights

Consumer-permissioned utility and telco data to help lenders gain a more comprehensive view of consumers' financial picture

Precheck

Proactively identify consumers with locked or frozen credit files prior to the application process

Prescreen

Target the right consumers for lending offers

Prescreen Direct with Property

Zero in on property data for more targeted home equity and mortgage marketing

Risk Decisioning Suite powered by InterConnect®

Grow your business with an automated, rules-driven credit and risk decisioning platform fueled by diverse data

Risk Insight Suite

The Risk Insight Suite® provides invaluable information and resources that help you make profitable decisions

ServiceLink National Flood

Reliable, compliant flood zone determinations

TIN Match

Establish the legitimacy of a business by confirming their EIN status with the IRS

Undisclosed Debt Monitoring™ (UDM)

Avoid last-minute surprises and boost efficiency in mortgage lending

Undisclosed Debt Pre-Close and Compare Reports

Identify potential credit liabilities with a tri-bureau view into a borrower's undisclosed debt

VantageScore

A new standard for credit scoring

Anchor Text

Need Help Deciding?

Connect with our sales team today to get a product consultation.