EXPLORE OUR TOPICS

EXPLORE OUR TOPICS

TRENDING NOW

Can Medical Collection Debt Impact Credit Scores?

Learn how the changes to medical collection debt reporting on credit reports affects credit scores, and actions you can take to help prevent debt from medical bills.

Credit Scores

Understand credit scores, credit worthiness, and how credit scores are used in day-to-day life.

What Is a Rapid Rescore?

Changes in your credit history may take time to be reflected in your credit scores. A rapid rescore aims to accelerate the updating process. Learn what a rapid rescore is and when it might make sense for you.

How Much House Can I Afford?

Learn how different financial factors can impact how much house you’re able to afford, including costs beyond the mortgage itself.

Are Scores from FICO and VantageScore Different?

There are many different ways of calculating credit scores. What are the differences between FICO and VantageScore credit scores?

Credit Reports

Understand how your financial behavior impacts you and your credit, along with what is included on your credit reports and why.

Good Debt vs. Bad Debt

Did you know there are certain types of debt that may be considered "good" rather than "bad?" Learn more about what kind of debt could be considered "good."

9 Things You May Not Know About the Fair Credit Reporting Act - But Should

The purpose of the Fair Credit Reporting Act is to restrict who has access to your credit information and how they can use it.

4 Ways Your Credit History May Affect Everyday Life

You may know credit scores matter when you apply for a credit card or a home loan. But did you know other ways your credit history and credit scores may play a role in everyday life?

Fraud & Identity Theft

Explore ways to better protect your information, plus warning signs of fraud and identity theft, and what to do if you believe your identity has been stolen.

How to Protect Yourself from Social Security Number Identity Theft

Your Social Security number can be an identity theft target. Here’s how you can help protect yourself and your Social Security number.

What Are Phishing and Smishing?

What are phishing and smishing and how can you avoid falling victim? Click here to learn more about how to spot phishing scams and how to protect yourself with help from Equifax!

Tax-Related ID Theft: A Primer

Learn what tax-related identity theft is; steps to take if you believe you're a victim; and how to help better protect yourself against tax-related identity theft.

Life Stages

Whether you’re saving up for a car, home, or college, learn how your credit can help remove friction from making milestone purchases.

What Are the Types of Retirement Accounts Available to You?

Do you know the types of retirement accounts available to you? Learn all about IRAs, ESOPs, 403(b) plans and other retirement accounts.

After a Natural Disaster: Steps to Rebuild, Assistance and Other Resources

If you’re a natural disaster survivor, you’ll need to think about your finances, important documents, and steps to take to better protect against identity theft. Here are some things to do or consider as you begin to rebuild.

How Long Will My Money Last in Retirement?

Wondering how long your money will last in retirement? Estimate how much money you might need to retire, learn how to track your spending and more.

Personal Finance

Discover personal finance tips and tricks around everything from managing your money to saving and planning for the future.

What Is a Digital Wallet?

With a smartphone in everyone’s pocket, digital wallets are increasing in popularity. What is a digital wallet?

Comparing Auto Loans: New Car Loans vs Used Car Loans

Is it better to finance a new or used car? We compare the advantages of buying a new car vs. a used car. Learn more with Equifax.

What Is Inflation?

Inflation has a big impact on your finances. Learn what inflation is, what causes it, how you can spot the signs of inflation and how you can help better protect yourself.

Debt Management

Learn how debt can affect your credit scores, plus the different types of debt (both good and bad), and best practices for paying it off.

What Is a Debt Consolidation Loan? Does Debt Consolidation Hurt Your Credit?

When considering debt consolidation, it's good to know how this repayment strategy might impact your credit. At Equifax, we cover why debt consolidation may be a good idea, including the pros and cons.

What Is Wage Garnishment?

A wage garnishment is when money is withheld from an employee’s earnings to pay back debt. Learn about garnished wages and what to do if it happens to you.

What Can a Debt Collection Agency Do?

Collection agencies are used by creditors and lenders to collect funds that are past due or in default. Learn more about your rights and what collection agencies can and cannot do.

Credit Cards

Explore tips on getting the right credit card for you and what it means for your credit. Plus, managing credit card debt and what to do if you lost your card.

What Is Credit Card Fraud?

Learn about the different types of credit card fraud, including card cloning and skimming. See how you can better protect yourself and your finances.

You Ask, Equifax Answers: How Often Do Credit Card Companies Report to the Credit Bureaus?

How often do your credit card providers report your information to the three Nationwide Credit Reporting Agencies? Does it vary from card to card?

What Are Pre-Approved Credit Card Offers?

Pre-approved credit cards are offered from credit card companies to qualifying consumers. Learn exactly what you need to know about pre-approved credit cards and how to access any offers you might receive.

Loans

Explore the nuances of the different types of loans, including personal and student loans, and the potential pros and cons of co-signing a loan.

What is a Co-Signer?

Before you co-sign a loan or lease, be sure to understand the pros and cons, as well as the responsibilities that come with being a co-signer.

How Can Student Loans Affect Credit Reports?

Similar to other financial commitments, student loans -- and how you repay them -- can appear on credit reports and can impact credit scores, for better or worse.

Can I Get a Loan With Bad Credit?

If you're concerned your credit scores may hurt your ability to get a loan or line of credit, there are some steps you can take and options you can consider.

Cybersecurity

Understand how to shop online more safely, how to create and store stronger passwords, and more.

Teaching Your Kids About Internet Safety

You can begin educating kids about basic Internet safety even at an early age. Here's a guide to what to talk about with kids as they grow older.

Shopping Online? Help Keep Your Identity and Financial Information Safe

There's no denying that online shopping can be convenient. Here are some suggestions to help avoid ID theft and scams while browsing.

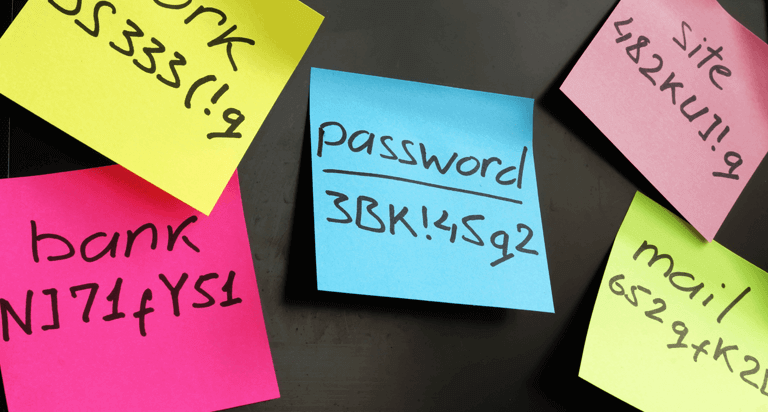

Password Safety: Are Yours Secure Enough?

Passwords are one of the most common ways hackers break into computers and steal personal data. Here are some suggestions for how to create strong passwords -- and storing all your passwords securely.

Información crediticia de EE. UU.

Información útil en español que cubre informes de crédito de Equifax® en los EE. UU., puntajes de crédito y consejos de administración del dinero.

¿Qué es un puntaje de crédito?

Entender su puntaje de crédito es fundamental para su salud financiera y es una parte importante para construir su futuro financiero.

¿Qué es un puntaje de crédito?

¿Qué es un puntaje de crédito? Equifax® puede contarle todo sobre el rango de puntaje de crédito, cómo se calculan los puntajes de crédito y mucho más.

¿Qué es un informe de crédito y qué contiene?

¡Conozca qué es un informe de crédito en Equifax®! Lea sobre las agencias nacionales de informes del consumidor, vea cómo obtener un informe de crédito, descubra qué hay en un informe de crédito y mucho más.

Videos

Useful information for US consumers about credit scores, credit reports and money management tips.

Ways to Cut Down Debt

Debt management is not a one-size-fits-all approach. In this video, we'll help you better understand debt management and how to begin to pay off your debts.

Should I Have Multiple Credit Cards?

There's not a one-size-fits-all solution for the number of credit cards a person should have. In this video, we’ll help you better understand credit cards.

Should I Pay Off Debt or Save Money First?

If you have high debt and little to no savings, is it more important to sock away for the future or pay what you owe? Learn how to balance savings and debt.

The Knowledge Center at Equifax

Here we'll cover everything from what's on your Equifax credit report to the nuances of how credit scores can help better your everyday life (not to mention potentially making milestone purchases less complicated). If you have questions about your credit cards, from applying for new credit cards, to best practices for getting out of credit card debt, advice is only a click away.

Are you seeking how to better protect your online presence from identity theft and fraud? We go over warning signs of identity theft, plus ways to better protect you and your loved ones through cybersecurity best practices. Are you considering loan options? We cover the different types of loans, plus what you should be looking out for and advice on ways to find the best loans for you and your family.

Debt management can be challenging on your own, but with the right tools and information at the ready, you can look forward to a brighter financial future. The aspects of personal finance shift during different stages of your life, and you may be left questioning what to do next, whether you're saving up for something big or looking to set up a new budget.

No matter the type of credit or personal finance questions you may have, the Equifax knowledge center is here to help.