3 Opportunities to Grow Assets Based on Recent Market Trends

Consumers have kept a close eye on their portfolios during the past year. Despite the threat of a possible recession, consumers have continued to invest and overall the markets are up.

How can financial marketers find opportunities to grow assets? Here are 3 ways that firms can gather more assets and grow their book of business.

1. Market to investors

Let’s look at the first six months of 2023 in a nutshell: Investments are up. Deposits are down.

Consumers continued to plow funds into the market,

even while coping with inflation and higher interest rates. While a

segment of the U.S. population is struggling to pay their bills, there

is still a huge number of consumers who are committed to investing.

Here’s how financial marketers can find investors:

-

Gather insights on households’ likely total assets and total investments - including those held at other firms.

-

Differentiate investors with the most potential to transfer significant assets to your firm.

-

Focus your efforts on capturing their assets.

2. Increase marketing toward regions with rising assets

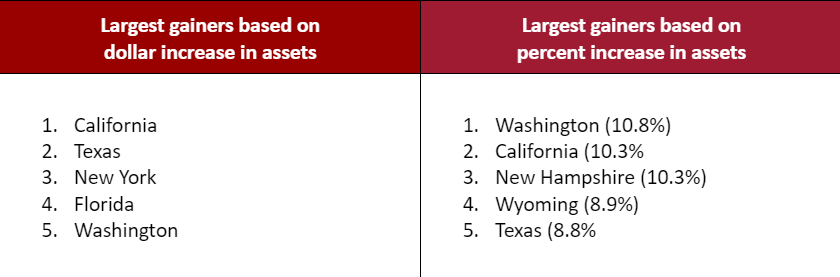

Check out the table below. Which states saw the most growth in assets during the first half of 2023? Did you notice that two low population states had a huge jump in percent increase in assets?

Financial marketers can grow assets under management by shifting advertising efforts toward these high asset growth states.

Pro tip: Just below are some of the states that experienced low growth in dollar assets. Financial marketers may want to consider minimizing advertising and marketing budgets in the following states:

-

South Dakota

-

Alaska

-

Minnesota

-

West Virginia

-

North Dakota

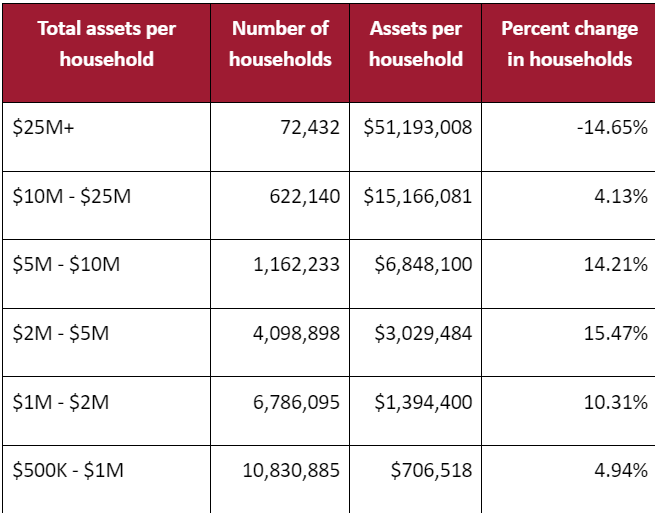

3. Market to the 1.9 million households that are newly included in the $500K+ asset segment

Over 1.9 million MORE households now hold over $500K in average assets than they did before the start of 2023. In fact, there are over 23 million households that hold over $500K in average assets. Our asset-based solutions can help marketers find these households.

Don’t miss out on marketing to these high-asset consumers. Financial institutions that are part of the IXI Network can fuel their marketing with household and regional asset estimates that are based on a foundation of direct measurement of over 45% of the nation’s assets. If you are not already a member, please contact us about joining.

Source of all data: Equifax analytics

Recommended for you