As U.S. consumers continue to migrate their shopping habits toward online merchants and become more aware of point of sale financing alternatives, the popular Pay-in-4 option, also known as Buy Now Pay Later (BNPL), continues remarkable growth. Following the surge of transactions during the pandemic, BNPL growth is expected to exceed 65% this year. Convenient and affordable access to credit remains a significant draw. And while the BNPL user demographic remains skewed toward younger shoppers, the total number of U.S. consumers that choose BNPL is expanding. A recent study by Juniper Research found that BNPL payments are expected to account for nearly a quarter of all global ecommerce transactions by 2026, up from just 9% in 2021.

With more consumers using BNPL financing, some lenders have expressed concern about the lack of transparency. Consumer lenders use information found in credit files to assess the credit worthiness of applicants, but most Pay-in-4 tradelines are not currently reported to the credit bureaus, creating a blindspot as lenders try to assess borrowers’ existing loan obligations. The risk of allowing a consumer to become over extended creates potential hardship for the borrower and the lender.

Equifax is helping to lead an industry response, furthering its commitment to expand access to credit by making BNPL payment information part of credit reports, as identified by a new business industry code. The new industry code will classify BNPL tradelines, including payment history and give Equifax customers and scoring partners the ability to view and decide how to incorporate the information into their decisioning to potentially open up new financial services opportunities to more consumers.

Regulatory agencies have also taken notice of questions about consumer financial impact. In December, the Consumer Financial Protection Bureau (CFPB) issued a market-monitoring inquiry into BNPL products and business practices. The action required the named Buy Now Pay Later providers to submit information on the risks and benefits of this rapidly growing loan type so the bureau could collect information about the industry and current risks. In January, the CFPB invited other interested parties to submit comments. At this point, the stated objective is to better understand how people interact with BNPL providers, and how the providers’ business models impact the broader e-commerce and consumer credit marketplaces. However, stakeholders are watching for clues of additional regulations that might be introduced.

Benefits of BNPL reporting to credit bureaus

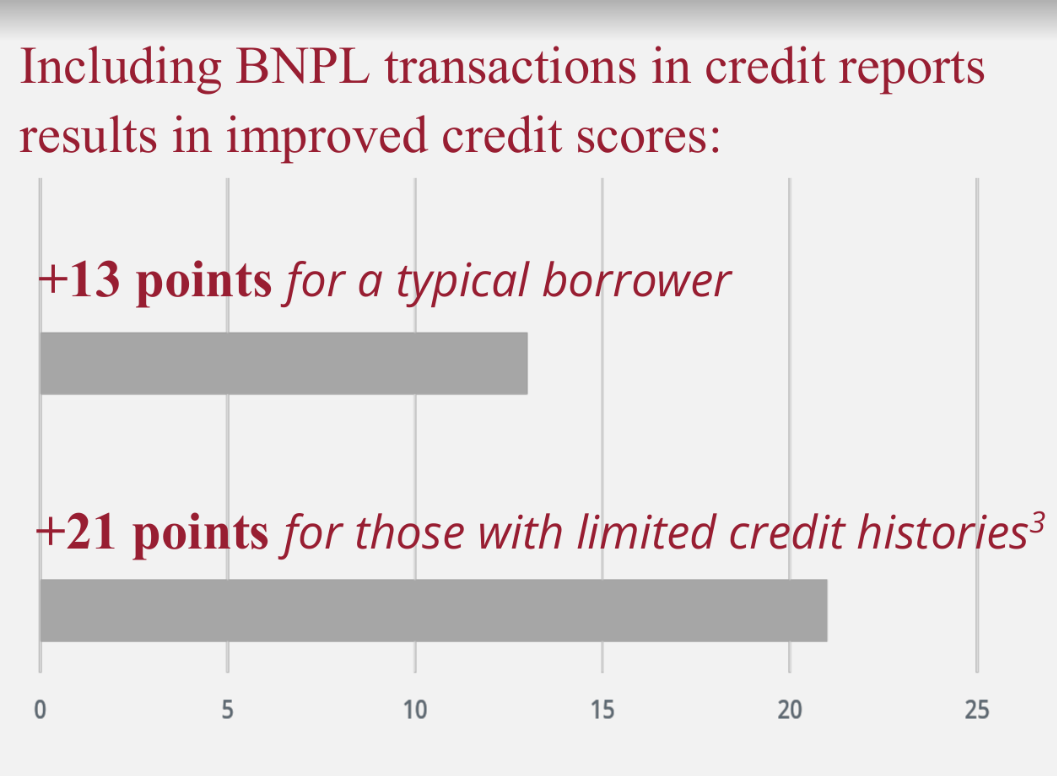

Let’s first address the benefits for consumers. When considering BNPL reporting, one of the top questions asked is, ‘how will reporting to the credit bureaus impact consumers?’. Equifax has undertaken several data studies to help answer that question. In the first, we researched the effect of BNPL products reported as a revolving line of credit on the consumers’ FICO® Scores.

The majority of consumers experience a positive impact on FICO® Score with paid on-time BNPL trades in their credit file. On average, individuals with either a “thin” credit file (<3 tradelines) or a “young” credit file (24 months or less on file) benefitted the most.

As a result, BNPL reporting as a line of credit can potentially open access to more financial services at lower costs. More favorable terms are often available to underbanked and thin-file consumers as they have opportunities to demonstrate creditworthiness through on-time payments.

Reporting to credit bureaus offers tangible benefits for BNPL providers as well. The Equifax reporting solution allows providers to better assess risk and understand a consumer’s ability to repay by seeing all credit obligations, including BNPL loans through another provider, without requiring any additional coding or additional fees. And BNPL providers that report to Equifax can post soft inquiries to assess a consumer’s risk without impact for qualified BNPL products.

BNPL providers that report to credit bureaus have an opportunity to build customer loyalty and incentivize stronger payment performance. Rising second-pay defaults place negative pressure on profitability. Results from multiple surveys agree that at least 1 in 3 BNPL users have missed a payment. With a high concentration of subprime (FICO® Score 8 <670) applicants according to Equifax analysis, it’s important to help consumers understand that their payment behavior matters. In addition to the immediate benefit of better payment performance, BNPL providers can build consumer loyalty for their brand by helping consumers establish credit or develop a stronger financial profile.

At Equifax, we help lenders expand access to credit with responsible lending decisions, including solutions to help BNPL providers sustain growth and build profitability. For more on BNPL, visit our website here, or read my other blogs on Buy Now, Pay Later:

- What to know about Buy Now, Pay Later

- Expand Credit Access with Buy Now, Pay Later

- Reduce Buy Now, Pay Later Fraud Risk

1 why buy now pay later is a 2022 trend to watch

2 consumer financial bureau opens inquiry into buy now pay later credit

3 the appeal and proliferation of buy now pay later consumer and merchant perspectives

Recommended for you

.png)