Who Uses BNPL Financing?

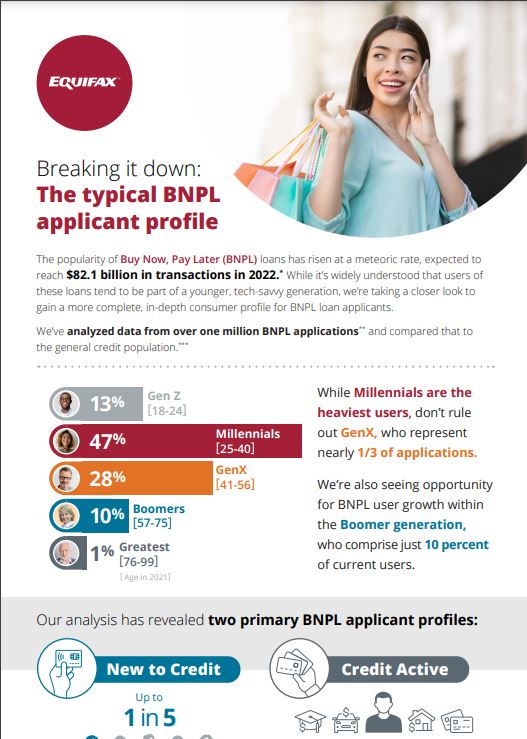

50 Million US consumers have used BNPL over the last 12 months. A large scale data study by Equifax reveals insights about consumers that apply for BNPL loans.

20%

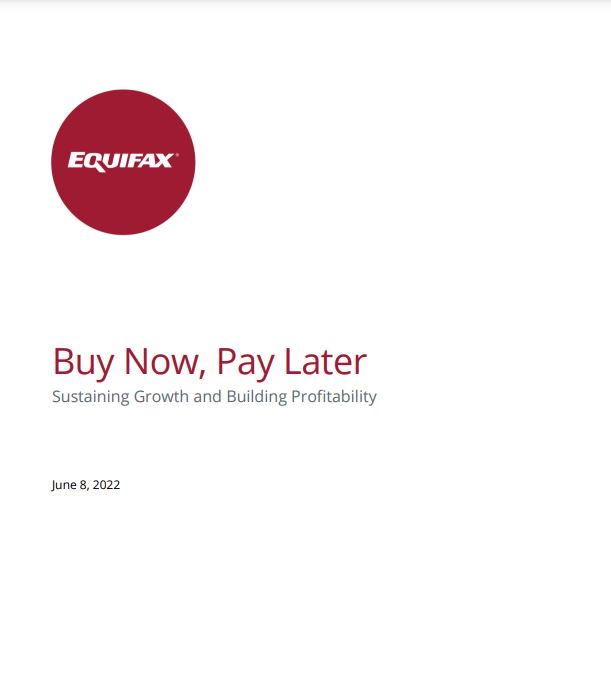

up to 20% BNPL applicants are new to credit and have no credit file.

4x

more likely than general credit users to be a credit rebuilder with a sub-prime score.

60%

lower household savings and investments. Applicants are younger and less affluent.

Who We Serve

BNPL Resources

1 - 9

of 9 Results