Latest Small Business Lending, Delinquency, and Default Data

Small business continues to dominate news headlines. In this recap of our webinar, “Small Business Insights: August 2021,” Elaine Makdah, Senior Index Developer of Equifax, presents the latest economic trends and Equifax small business lending, delinquency, and default data - known as our Small Business Indices.

This webinar was moderated by Jennifer Ostyn, Commercial Senior Vice President at Equifax, who had a one-on-one chat with Hany Fam, CEO and Founder of Markaaz, where they discussed how Markaaz small business customers will leverage the indices data and help foster financial inclusion.

You can find a recap of their conversation here. *

What are Small Business Indices?

Small businesses respond to changes in economic conditions more rapidly than large businesses. That is why Elaine Makdah reported that Equifax provides Small Business Indices. Small Business Indices serve as a leading indicator of the economy, are calculated from the most recent data, and are reliable predictors of financial stress and unemployment change.

Here at Equifax, we produce the following Small Business Indices data:

- Small

Business Delinquency (SBDI)

Three measures of delinquency: 31-90, 91-180, and 31-180 days past due. - Small Business Default (SBDFI)

- Small Business Lending (SBLI)

- APD County-NAICS Outlook

Next, Makdah further explained the different types of small business indices data produced at Equifax.

Small Business Lending (SBLI)

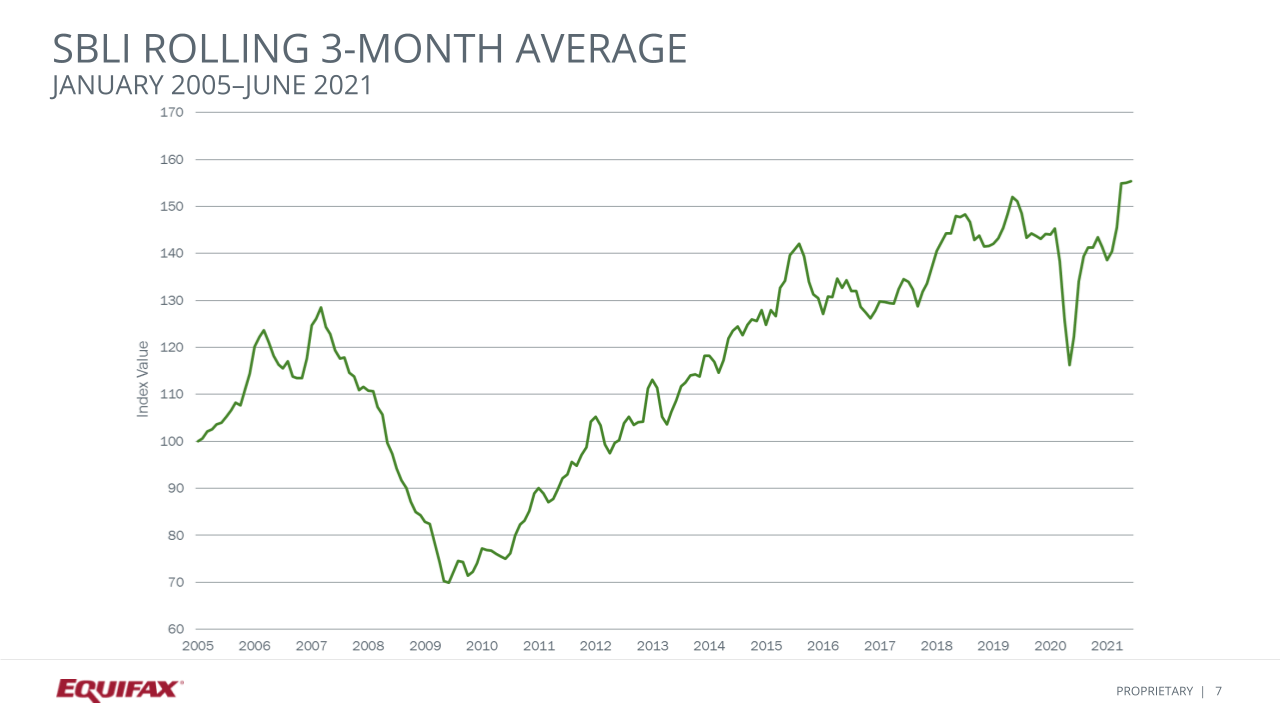

According to Makdah, Small Business Lending improved in June and increased 8% from May to June. The three month rolling index (shown below) increased slightly from 155 in May to 155.4 in June. Makdah further explained, this is the highest level since the beginning of the time series. This level is 27% above the level from one year ago.

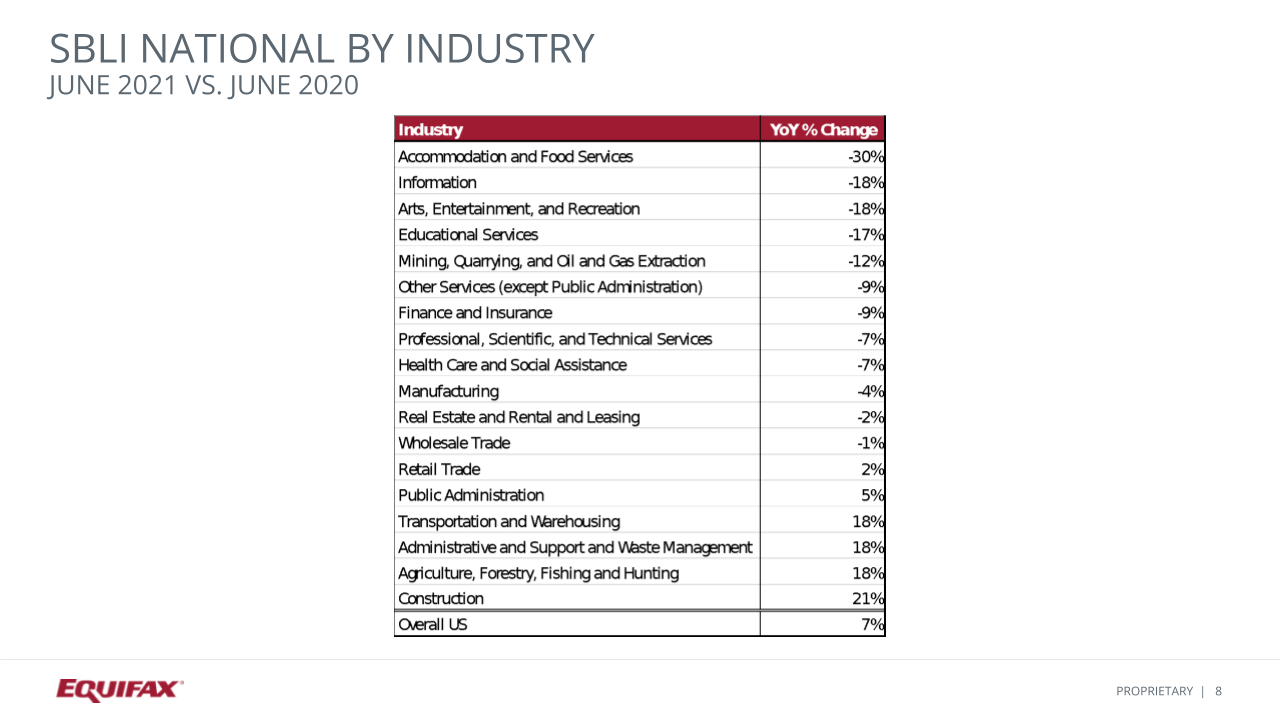

Makdah also looked at the year-over-year data indicating that lending remains well below the level one year ago for accommodations and food service. Information, arts, entertainment, and recommendations are down 18% and education is down 17%. On the other hand, lending is up 21% in construction and 18% in agriculture and administrative support and waste management. The rest of the industries are shown below.

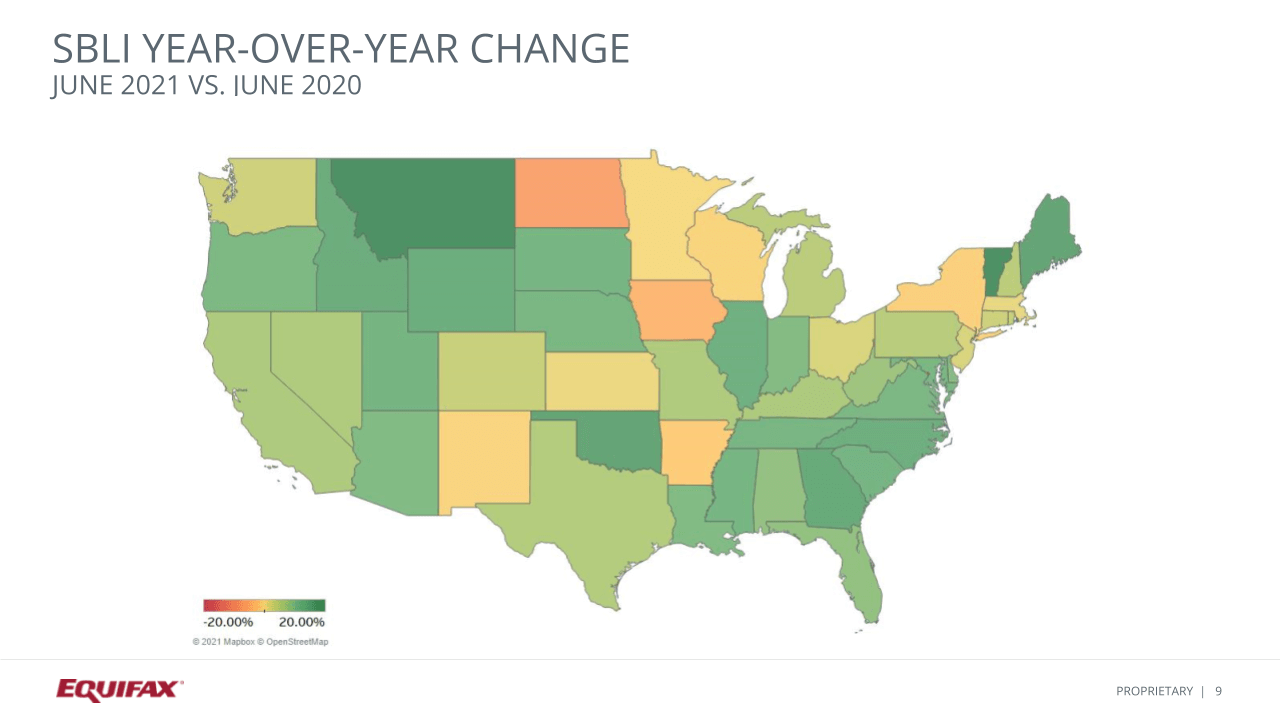

The chart below shows what the small business lending index year-over year change looked like for each state. 43 states saw an increase in lending, led by Vermont at 25% and Montana with 24%. When examining the 10 largest states based on population 9 out of 10 of those states saw an increase in lending and Georgia saw the largest increase at 15%. However, New York is the only large state to decrease at 1% down year-over-year.

Small Business Delinquency (SBDI)

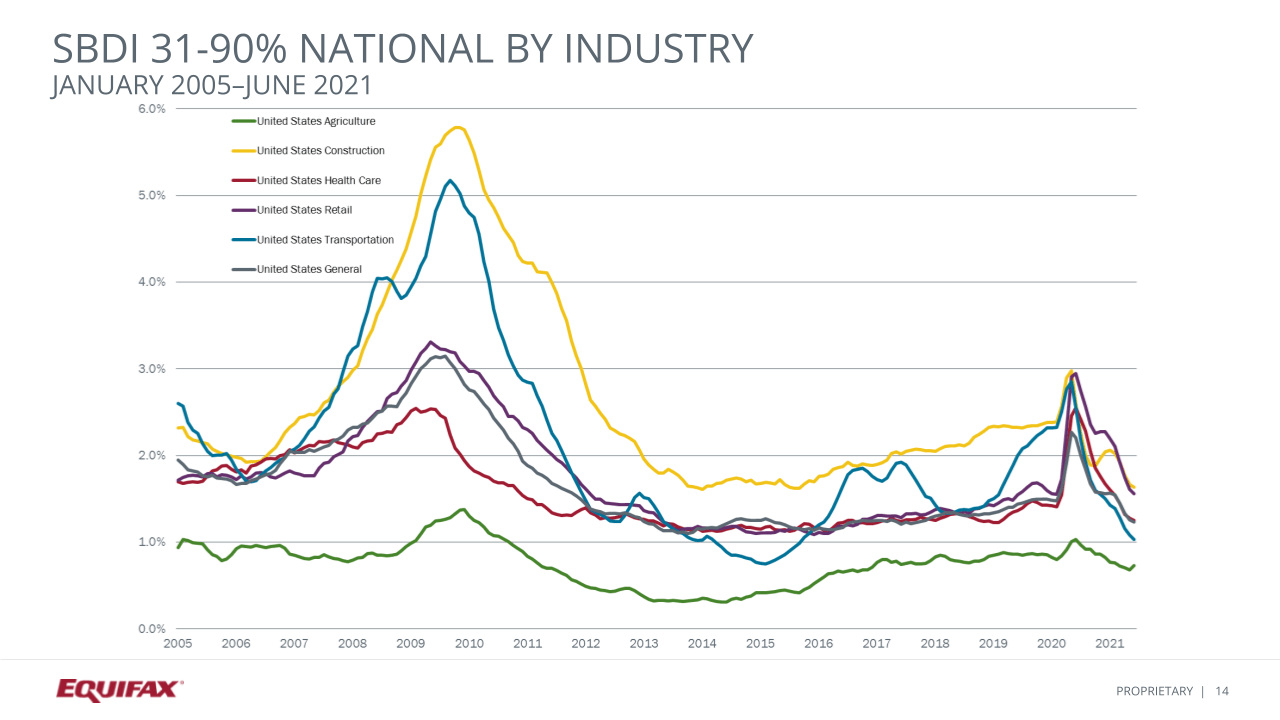

Makdah continued by presenting the small business delinquency index. Compared to one year ago, the small business delinquency index for 31-90 days past due was down 44%. This makes this month the fourth consecutive month of year-over-year decreases. Delinquency levels for all industry segments are below the pre-pandemic level. Agriculture in June saw a five basis point increase in delinquency, while retail and transportation decreased five basis points, construction decreased four basis points, and healthcare was down three basis points. The largest industry delinquency decrease when compared to last year was transportation, followed by healthcare. However, all segments decreased and the smallest decrease was in agriculture.

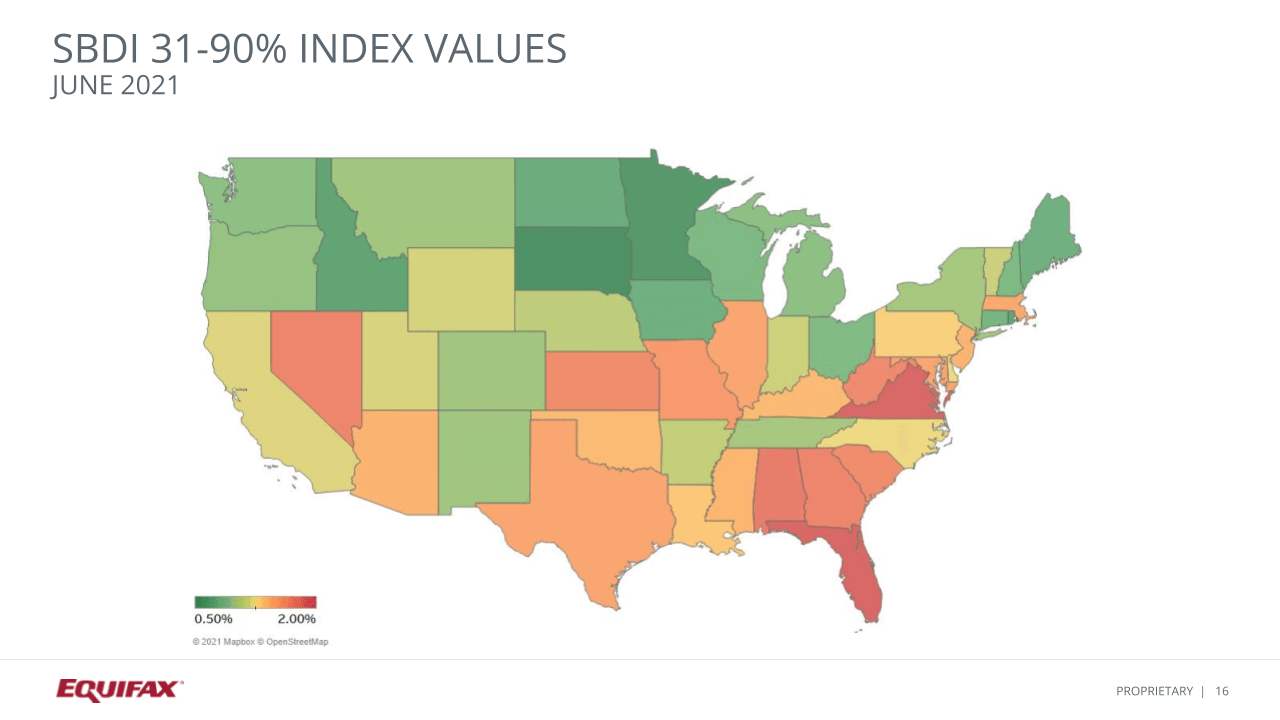

According to Makdah, the index value by state for June 2021 showed that states in the south central and south atlantic regions had higher delinquency than states in the north. Florida and Virginia had a delinquency rate just under 2% and Minnesota and South Dakota had around 50% at the lowest spectrum. The chart below when compared to June 2020 shows that the delinquency rates for June 2021 are significantly below the levels in June 2020. Makdah further elaborated by mentioning that when looking at the ten largest states, New York has the largest decrease in delinquency at 56% and the smallest year-over-year decrease was 29% in North Carolina.

Small Business Default (SBDFI)

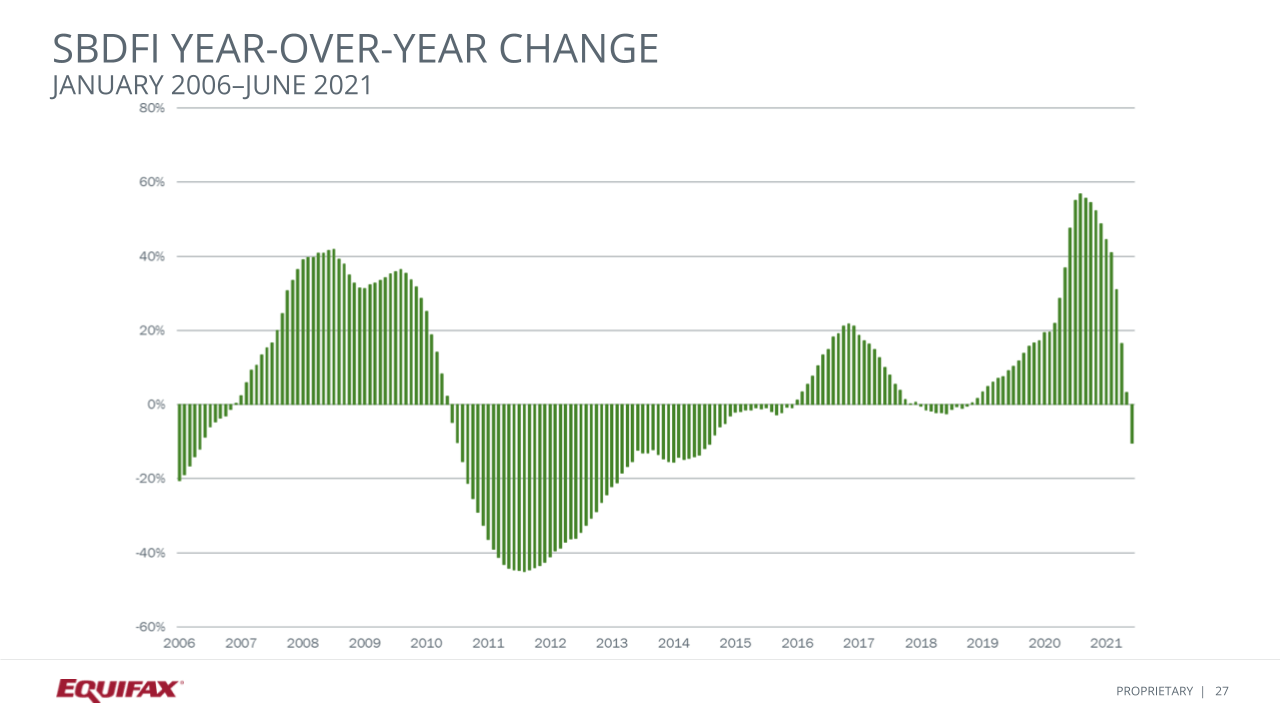

The next type of Small Business Indices data Makdah noted was the small business default index shown below. It reached a peak default rate of 6.35% in 2009 after the great recession and a high of 3% in October 2020 after COVID-19. However, the small business default index has decreased over the last seven months. Compared to one year ago, default decreased 30 basis points. This is the first year-over-year default decrease since 2018.

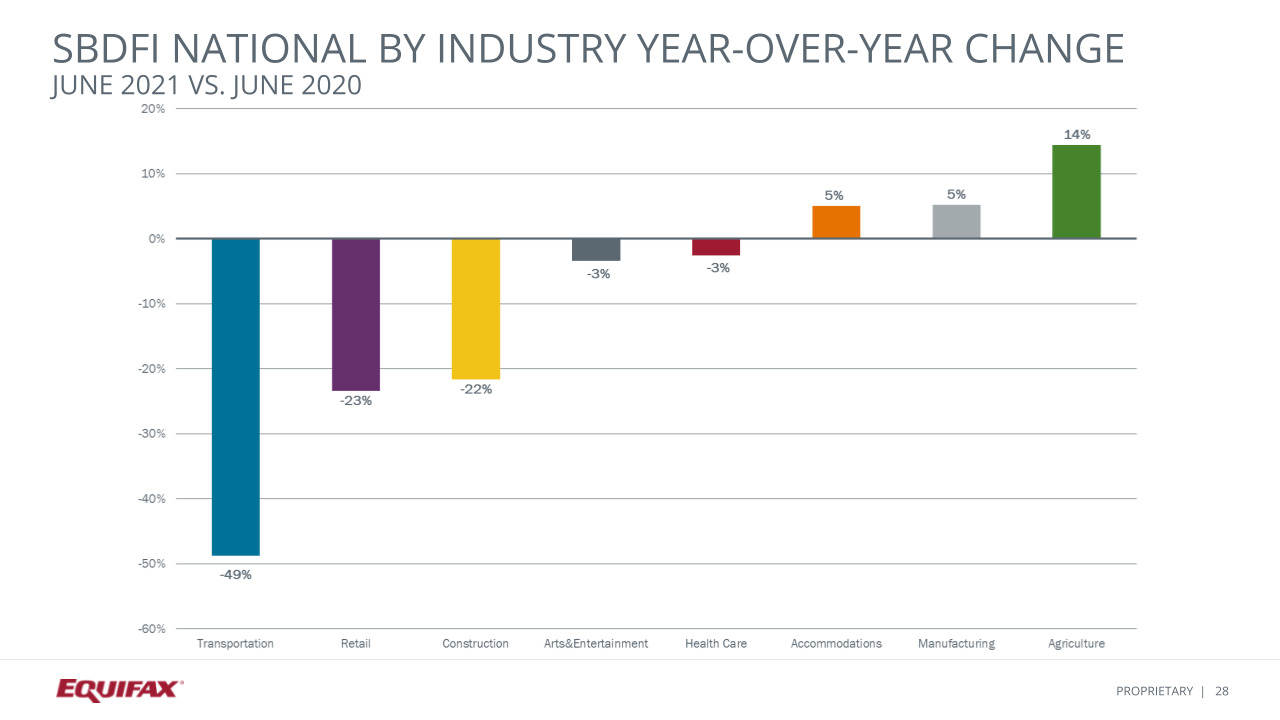

11 of the 18 industries Equifax tracks with small business default index had a decrease in year-over-year default rates. Transportation had the largest decrease at 49% followed by retail and construction.

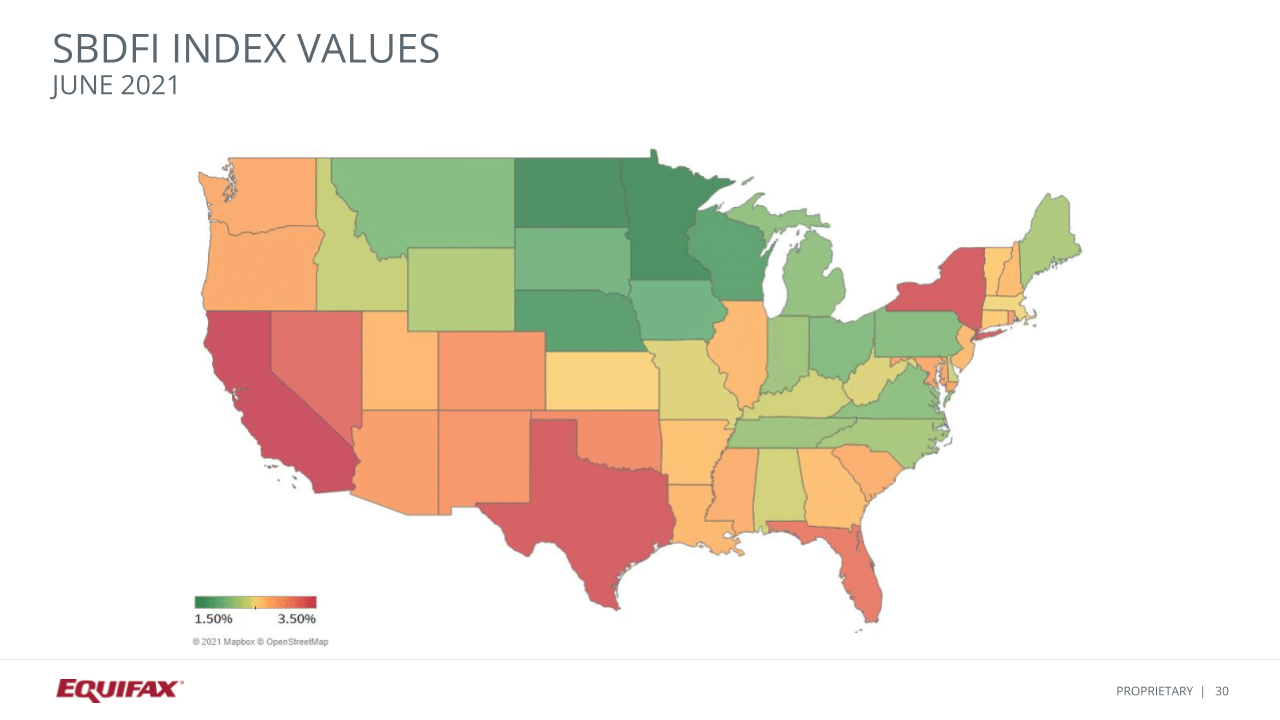

Makdah continued with index values by state. California, New York, and Texas have the highest default rates. Minnesota, North Dakota, and Nebraska have lowest default rates. Only 10 states continue to see year-over-year decreases in default rate. When analyzing the 10 largest states, defaults are down year-over-year in nine states. Only Illinois is seeing a year-over-year increase at 10%. Georgia had the largest decrease at 32% followed by Florida at 24%, and Michigan at 20%.

APD County-NAICS Outlook

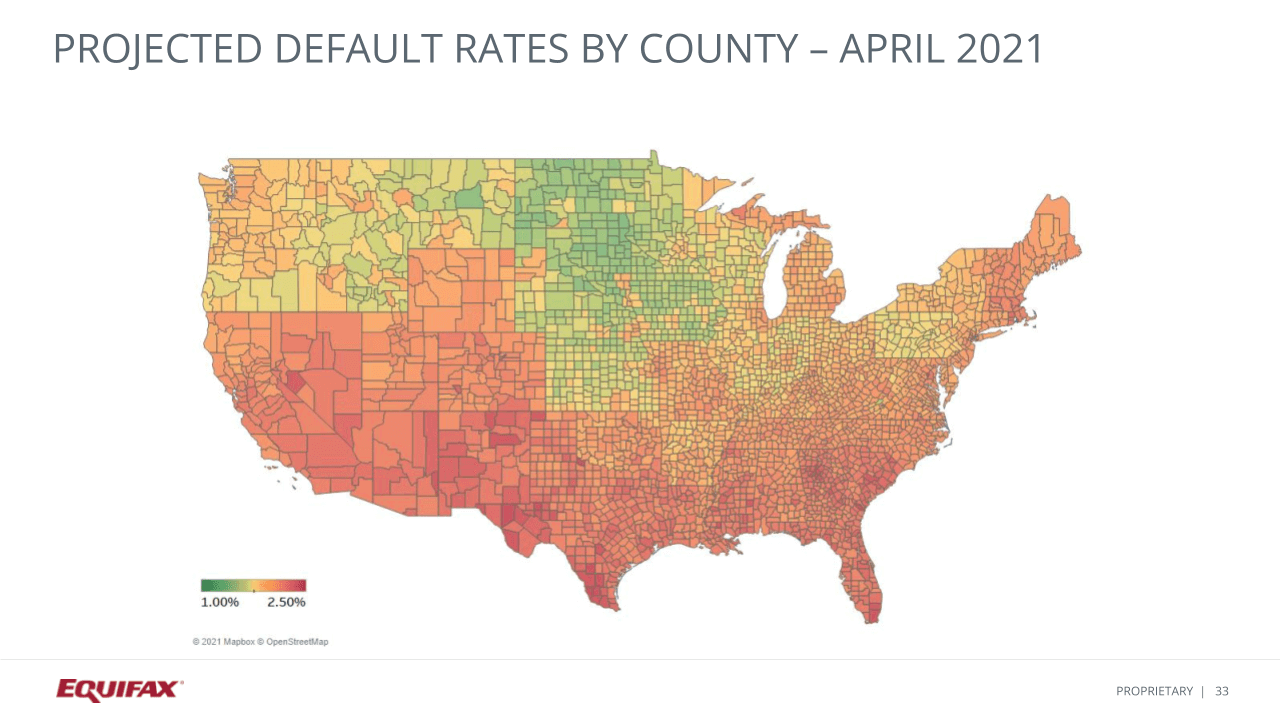

Makdah concluded with APD County-NAICS. She cited that projected default rates by county show higher default rates for the south and west (shown below) in April 2021. Texas, Georgia, and Florida have the highest projected default rate of over 2%. The lowest project default rates are around 1.7%.

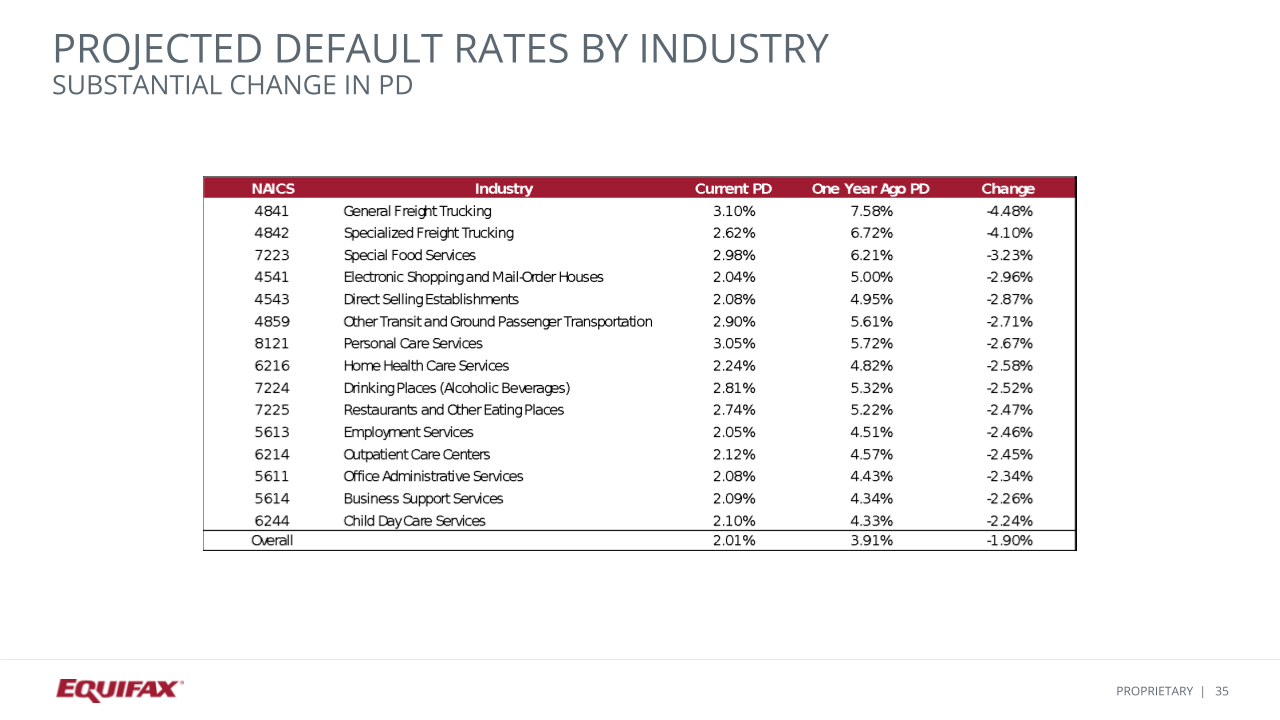

Lastly, Makdah showed the 15 industries that showed the most substantial default rates as of last year (shown below). This data shown below, further breaks down the 15 industries and their default rates, with the general freight trucking industry being the biggest decrease as of last year.

The full webinar recording can be accessed by visiting “Small Business Insights: August 2021,” and you can download a copy of the presentation slides here.

And, if you would like to speak to an Equifax representative about any of the data or solutions mentioned in this blog, please contact us today.

* The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you