Why Trended Data Impacts Credit Decisions

Today, many lenders rely strictly on a static credit score.

This provides a snapshot in time of a consumer’s credit profile. For

example, two people with vastly different spending patterns both

reflect a 720 credit score at a specific point in time. However, all

you see is a score. Based on this score, both consumers look like they

carry the same risk and may qualify for the same interest rate on a

loan.

Incorporating trended credit data into your decisioning criteria may show you a very different picture.

Trended data solutions (also called time series, historical or longitudinal data) analyze a set of data over a specific period of time to identify patterns of past behavior. These patterns are indicative of future behavior.

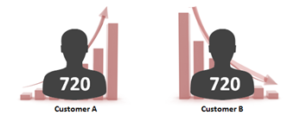

Trended Data Provides a Different Picture

The two customers above reflect a traditional point-in-time credit score of 720. But you get a very different view of their financial behaviors if you consider:

- How much and how fast they've paid down their debt over the past six months

- How much they've charged on their open credit lines over the past year

In this illustration, Customer A is charging increasingly more on

his revolving lines of credit -- and paying less each month. Customer

B is actually paying much more than his minimum payment each month,

driving down his total balance. All things equal, to which customer

would you choose to extend credit?

In this illustration, Customer A is charging increasingly more on

his revolving lines of credit -- and paying less each month. Customer

B is actually paying much more than his minimum payment each month,

driving down his total balance. All things equal, to which customer

would you choose to extend credit?

Depending on your risk appetite, you may prefer to extend credit to the revolver (paying the minimum and carrying a balance each month) or you may prefer to extend credit to the transactor (paying all or most of his revolving debt each month). Analyzing dynamic spending and payment behavior over time can help you see beyond a point-in-time snapshot of a consumer’s credit file. As a result, this can help you make a more informed credit decision.

Trended Data Solutions Drive Growth

At Equifax, trended data is a key ingredient in a number of our solutions, helping to maximize customer value and deliver more predictive insights. Learn how our trended data solutions can help you drive more profitable growth and better manage risk.

Recommended for you