Trended Data - Benefits to Lenders

This is the second article in a 5-part series. We originally published this post on December 20, 2016 and updated it on July 17, 2019.

Many companies successfully conduct their own in-house trending and data analysis. However, they are limited to analyzing their own internal customer data (“on us” data), and perhaps some limited data purchased through a third party, such as demographics. Unfortunately in this case, a company is not able to assess current balances, payment amounts and other key financial information from outside their own organization (“off us” data). While helpful, this internal view of a consumer’s financial profile can limit their ability to assess a consumer’s total financial profile. It also limits their ability to assess income patterns over time (trended data). Ultimately, this is a key indicator in a customer’s future financial standing.

Sharpen Your Decision Making: Benefits of Trended Data

There is a more holistic approach. It involves assessing the broader financial health and trajectory of your current and prospective customer base. This can be done be evaluating a more complete financial profile of consumers, including trending of “off us” data. This added view of data external to an organization can help companies make stronger decisions around:

- acquisition

- portfolio management

- retention strategies

Furthermore, companies can view trended data as yet another tool that can help improve marketing and credit risk decisions.

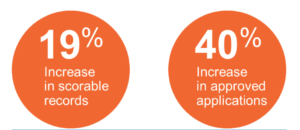

“In an analysis done by Equifax where we looked at the impact of adding just alternative and trended credit data in the auto industry, we were able to increase the number of scorable records by 19%, and increase approved applications by 40%.” – Amy Graybill, VP of Customer Co-Innovation and Design, Equifax

In conclusion, Equifax takes a very deliberate and measured approach to incorporating trended data into our solutions. We incorporate trended data into product enhancements and new product innovations where we believe there is a significant benefit. In fact, we view trended data as one of many building blocks in creating the best products for our customers. Learn more about Equifax Trended Data Solutions and how we can help you drive more profitable growth and better manage risk. Don't miss our other posts in this series:

Recommended for you