Small Business Insights: October 2021

This is a recap of our October 20 Small Business Insights webinar, where our very own Sarah Briscoe, Lead Commercial Statistical Analyst at Equifax, presented the recent small business delinquency, default, and lending data.

The presentation was followed by Briscoe, who answered questions from the audience asked by moderator Olivia Voltaggio, Senior Content Manager of U.S. Information Solutions at Equifax.*

Small Business Indices

Small businesses drive the American economy, representing 99.7% of paid employee firms and half of all American workers. Indices help us understand the current state and direction of the economy.

Here at Equifax, we produce the following Small Business Indices data:

- Small Business Delinquency Index (SBDI)

- Three measures of delinquency: 31-90, 91-180, and 31-180 days past due.

- Small Business Default Index (SBDFI)

- Small Business Lending Index (SBLI)

- APD County-NAICS Outlook

Current challenges in the small business economy

To start the webinar, Sarah Briscoe went over the current challenges in the small business economy. Based on U.S. Census Bureau data, 33.7% of U.S. small businesses are having a difficult time hiring paid employees. When looking by industry, 62.3% was the largest average industry score reported by Accommodation and Food Services. Pandemic delays and restrictions continue to impact businesses around the world, leading to increased costs for shipping goods in 2021. 44.2% of U.S. small businesses have experienced a domestic supplier delay with the largest sector reported by Manufacturing.

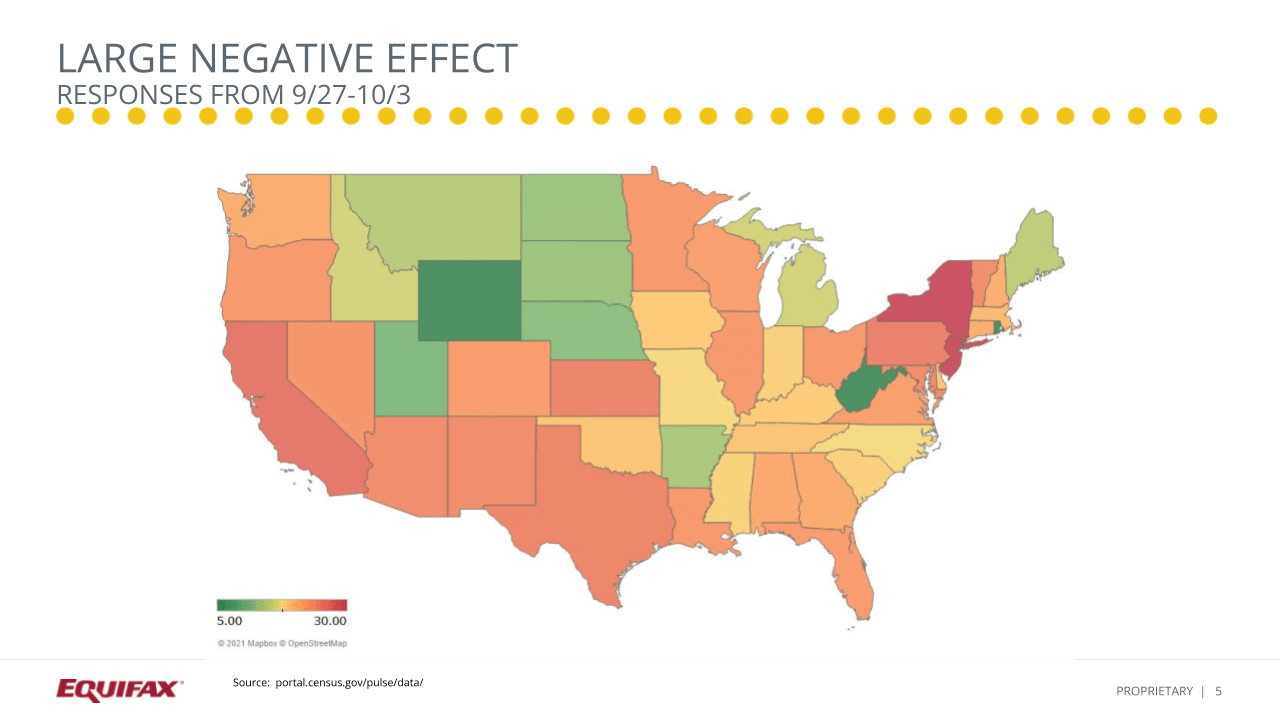

According to the Census, the pandemic has led to a large negative effect for U.S. small businesses. By state (shown below), D.C. was the largest average reported with 34.3% followed by 31.9% reported by New York.

Small Business Lending Index

The Small Business Lending Index (SBLI) seasonally adjusted originations decreased 2% from 146 in July to 148 in August. The level peaked in early 2021 and has seen slight decreases in recent months. Now the Small Business Lending Index is around the same level as pre-pandemic levels.

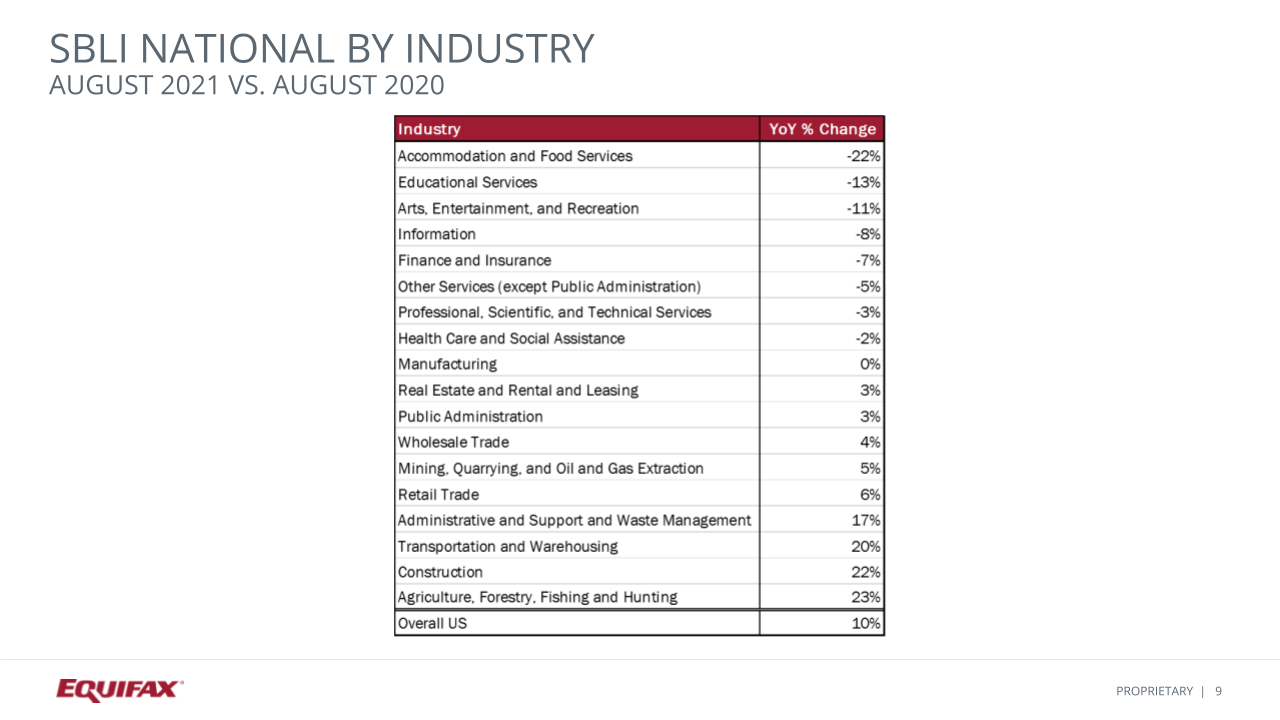

When it comes to the rolling Index, at 147.9 it is up 6% from a year ago, but flat as of last month. By industry, Accommodation & Food Services and Arts & Entertainment are all down. That being said, there are still negative effects compared to August 2020. On the positive side, Agriculture, Construction, and Transportation are showing the largest gain (shown below).

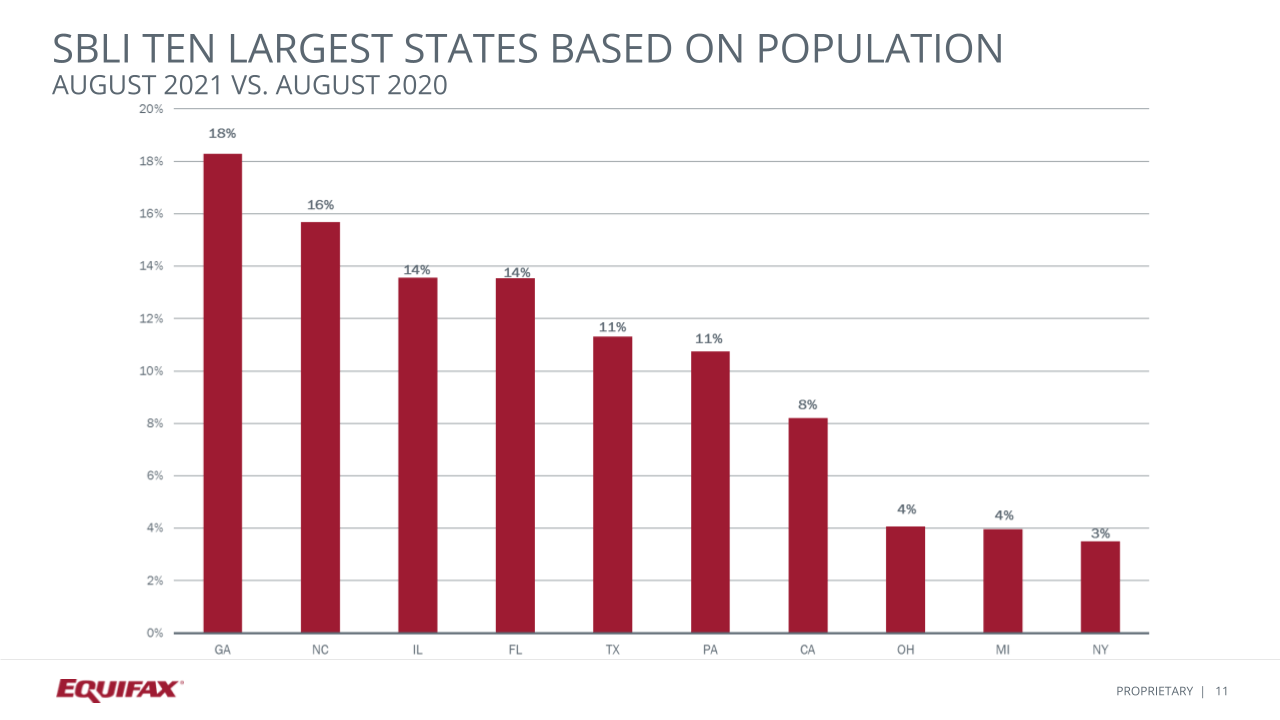

Majority of states are showing overall year-over-year growth in lending volumes. The largest gains are in southeastern states like Georgia and South Carolina and northern states like Montana and South Dakota. However, Briscoe stated that there were no states that saw a significant drop compared to last year on an overall basis. When it comes to lending volumes (shown below), Georgia is showing the highest growth at 18% over last year followed by North Carolina, Illinois, and Florida. New York, Michigan, and Ohio grew last year, but are lacking compared to peers and the national average.

Small Business Delinquency Index

Next, Briscoe went over the Small Business Delinquency Index. The overall national Small Business Delinquency Index for the measure of 31-90 days past due decreased one basis point from 1.26% to 1.25% in August and has decreased every month but one since June 2020. Briscoe continued to report that the Index is at its lowest level since 2016.

Compared to a year ago, the delinquency decreased 67 basis points, or 35%. This is the sixth consecutive month of year-over-year decreases. When looking by industry (shown below), Healthcare increased one basis point and construction two basis points with retail down the most.

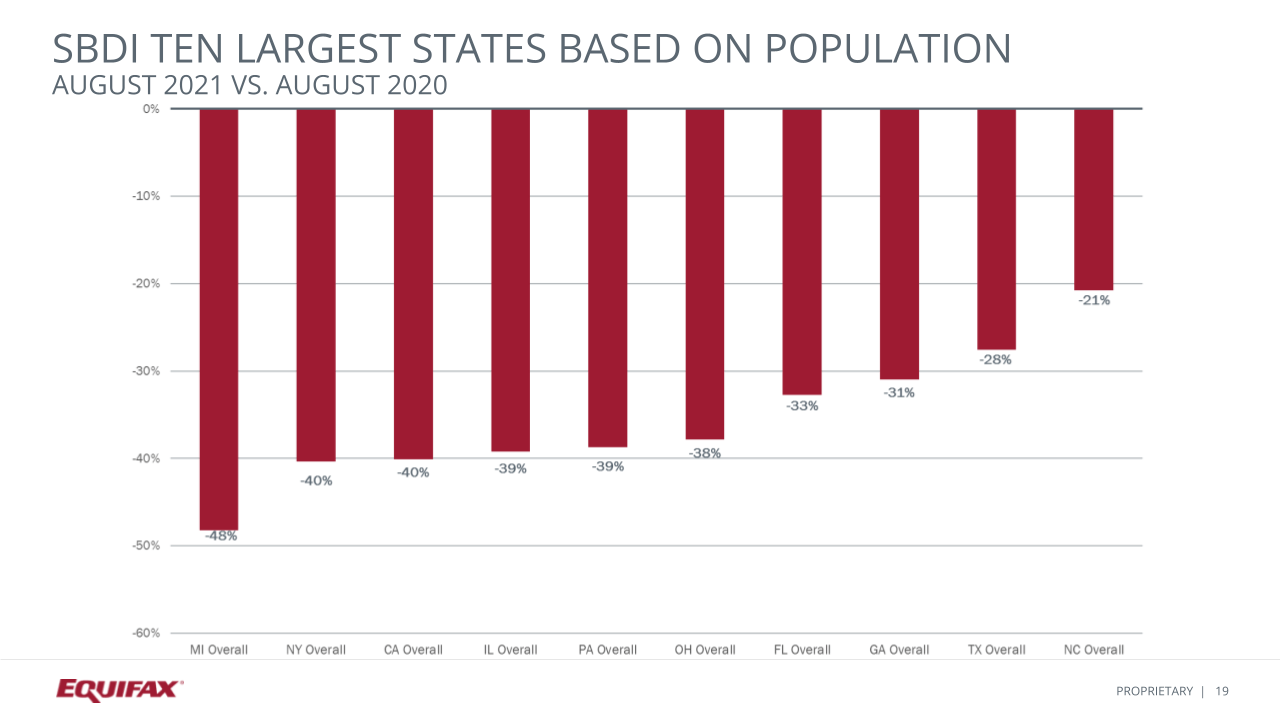

By state we saw the highest 31-90 days past due dates in the southeastern region while the northern states show lower rates. When looking at the ten largest states (shown below), there has been a large decline in the 31-90 day delinquency since last year. All states saw a decline of 20% or more in delinquency, with Michigan leading with a 48% decrease since last year.

Small Business Delinquency 91-180 days past due

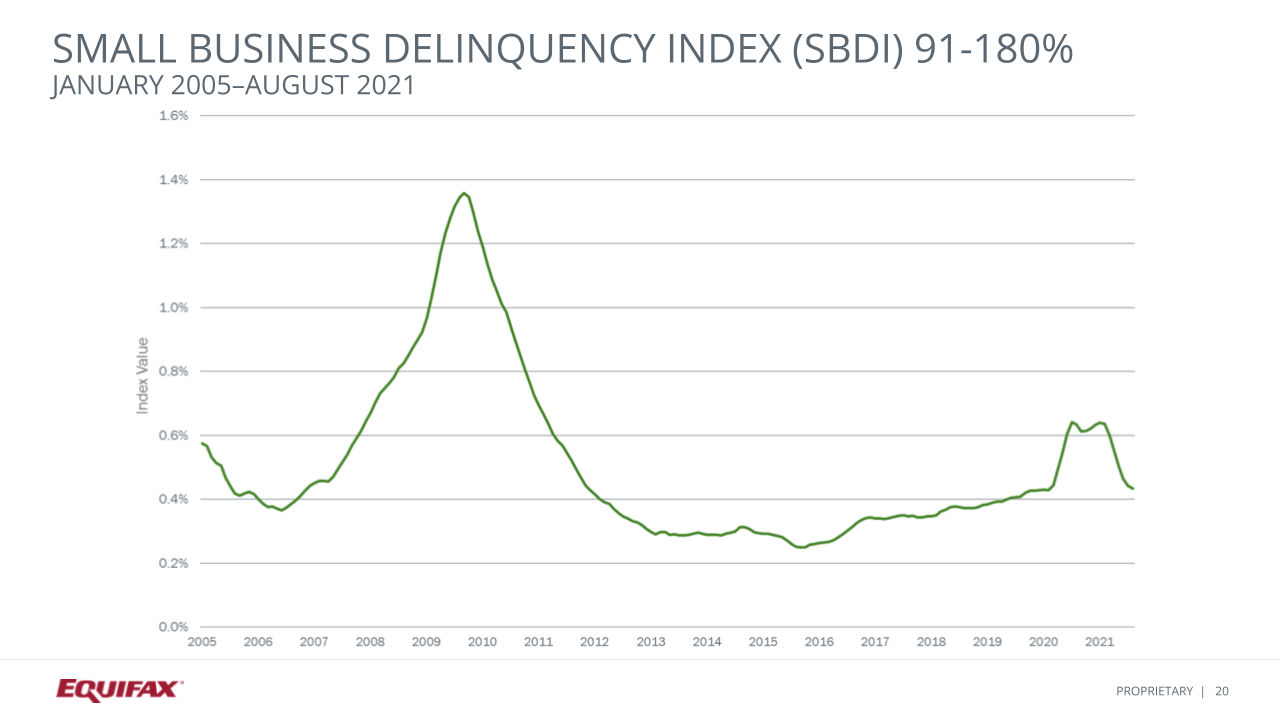

Briscoe followed with the overall U.S. Small Business Delinquency Index for 91-180 days past due. The chart below, shows that the delinquency rate decreased one basis point from July to August after plateauing for the majority of late 2020 and early 2021 period. Delinquency rates have come down and have decreased for the sixth consecutive month.

When analyzing the Small Business Delinquency Index 91-180 days past due year-over-year change, the Index is down 20 basis points from a year ago and is the fourth consecutive month of decrease following several years of the Index increasing year-over-year.

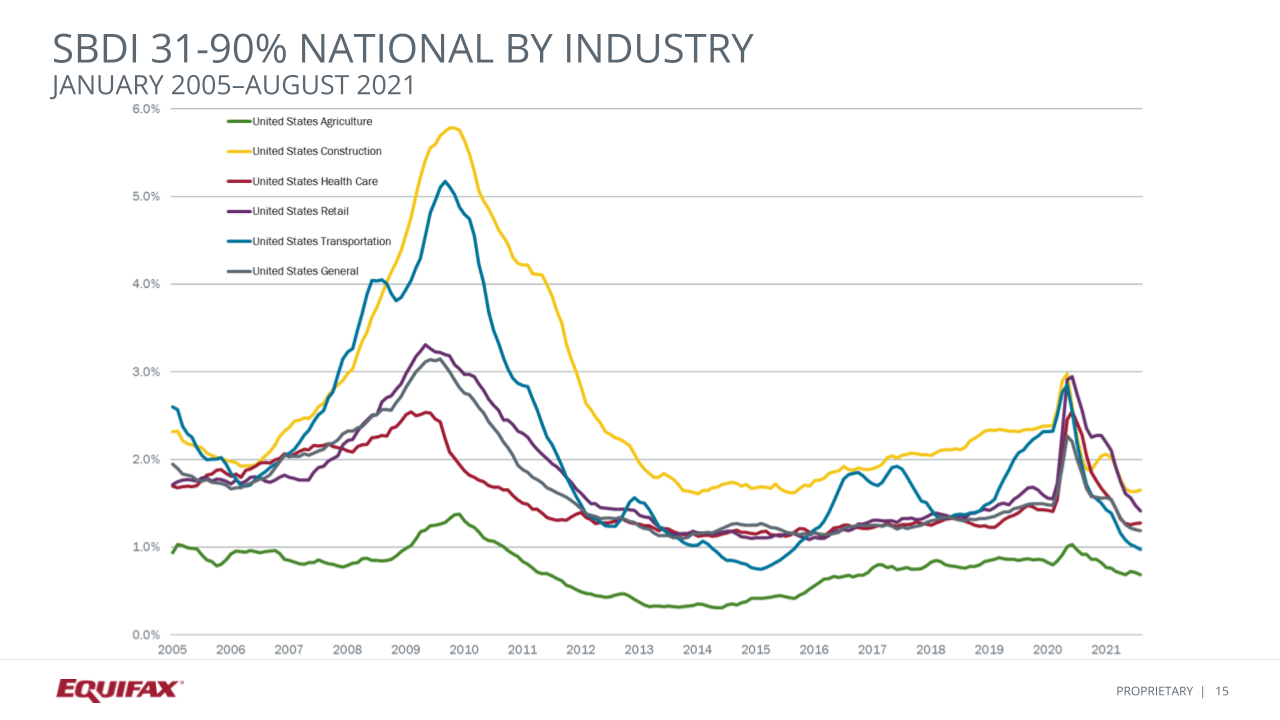

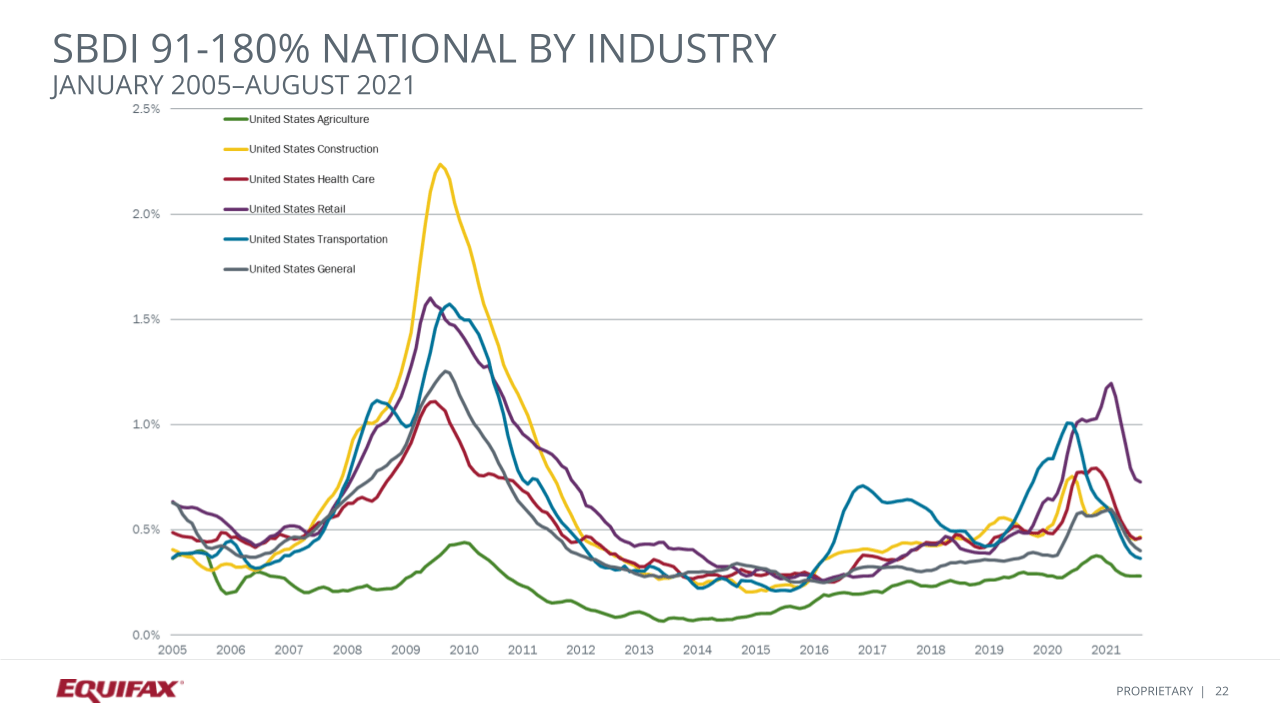

Construction is the only industry to see an increase in 91-180 delinquency this month (shown below) up two basis points following decreases from the last six months. Agriculture and Healthcare remain flat, while Retail and Transportation decreased one. Retail remains the highest delinquency by far, but improvements over the last month have been stark. Year-over-year all industries show decreases in delinquency. Transportation has seen the sharpest decline followed by Healthcare.

By state we saw 91-180 delinquency levels were highest in the southwest and southeast. Arizona and Maryland show the highest delinquency levels. Year-over-year most states are showing improvement. Only a few states like South Dakota, Arizona, and Kansas are showing slight delinquency increases, but they are very minor increases.

Small Business Default Index

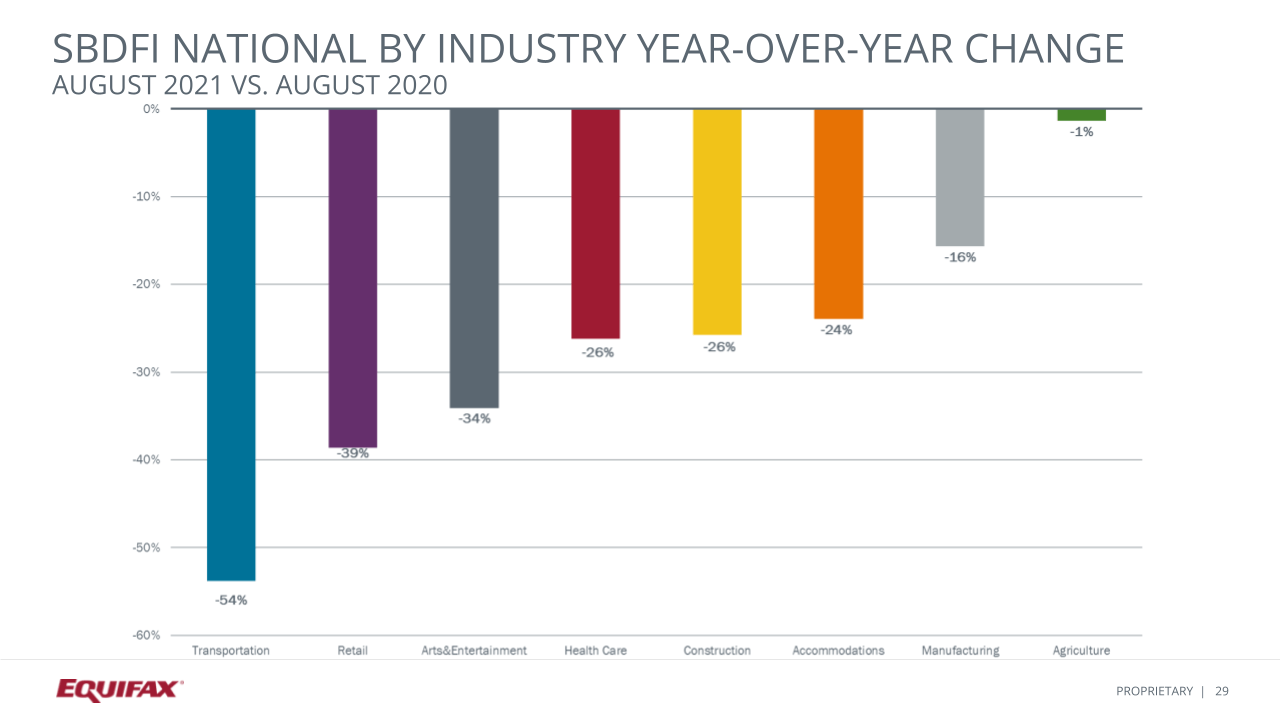

The U.S. Small Business Default Index decreased 16 basis points from 2.51% in July to 2.35% in August. According to Briscoe, the Index has decreased for six consecutive months. Compared to a year ago the Default Index decreased 88 basis points or 27%. This is the third month of year-over-year decreases following large pandemic default increases. By industry (shown below), we saw the largest improvement in default rates in the Transportation and Retail Trade industries. However, even hard hit industries are seeing improvements from the country re-opening.

By state, the highest default percentages are in the southwest and the low default rates are in northern areas such as Minnesota, Wisconsin, and Nebraska. Those are areas that have the lowest pandemic negative impact according to the Census’s survey of business owners. Florida, Michigan, and Georgia show the greatest improvement in default rates and Illinois shows the least improvement when compared to last year.

APD CNTY NAICS

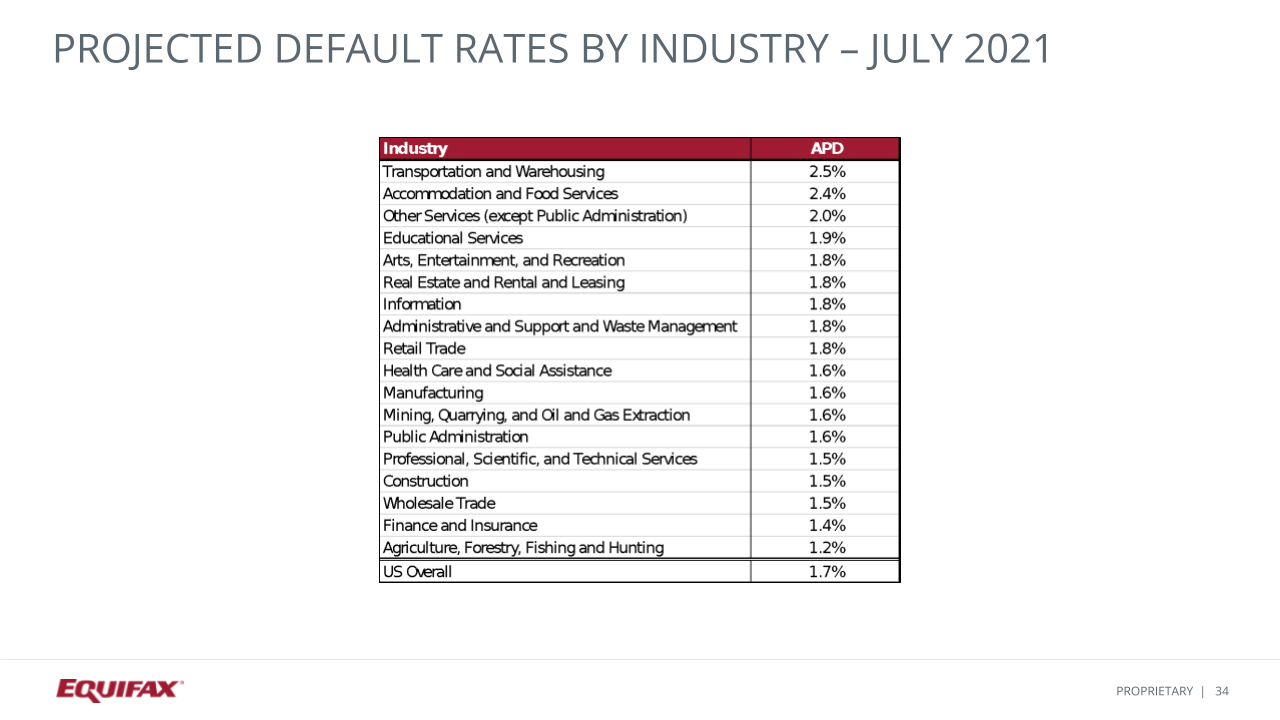

The projected default rates by county are more positive in the northern area. As we look forward, the southwest and southeast are showing higher risk. By industry, continued supply chain issues and trends lead to our highest projected defaults in Transportation and Warehousing and Accommodations and Services out of all the industries (shown below). However, overall default rates are projected to decrease as of last year.

Your questions answered

How do you define small business for these industries?

Briscoe’s Answer: Small business is defined in having less than a million dollars out in the database at the measured point in time.

What is the difference between default and delinquency indices?

Briscoe’s Answer: Default is a 12 month rolling 91 plus days past due index, meanwhile delinquency is a point in time 91-180 days past due as well as other measures like 30-91 days past due. Default has different logic meanwhile delinquency is the days past due.

Do you have an example of how a company leverages this data to improve their business?

Briscoe’s Answer: I have worked with a customer that was implementing it by looking at their credit models. If you implement this kind of index, the index can help manage that risk in terms of the credit scores rank order or magnitude of risk.

The full webinar recording can be accessed by visiting “Small Business Insights: October 2021,” and you can download a copy of the presentation slides here. Interested in joining a future Small Business Insights webinar? Register here.

And, if you would like to speak to an Equifax representative about any of the data or solutions mentioned in this blog, please contact us today.

* The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you