Accelerating Access to Credit: A Critical Discussion

In this recap of our June 24 webinar, “Market Pulse: Accelerating Access to Credit,” Chris Wheat, Co-President at JPMorgan Chase Institute; Kahlil Byrd, Founder and CEO of Invest America; Peter Maynard, SVP of Data & Analytics at Equifax; and Sid Singh, President of United States Information Solutions at Equifax, provide insights on the potential uses of alternative data and how the financial industry can help more consumers get access to mainstream financial services and credit.

A Closer Look at the Problem

According to the Consumer Financial Protection Bureau, roughly 26 million Americans have no credit history and are considered “credit invisible.” A disproportionate share of these 26 million Americans are Black or Hispanic. More than 12.5 million live in areas deemed credit insecure and lack formal credit opportunities. Besides these consumers, small businesses are also facing a credit gap. Below, the presenters highlighted the importance of building and supporting a more inclusive financial system and how this can be achieved.

Insight on Access to Credit from Equifax

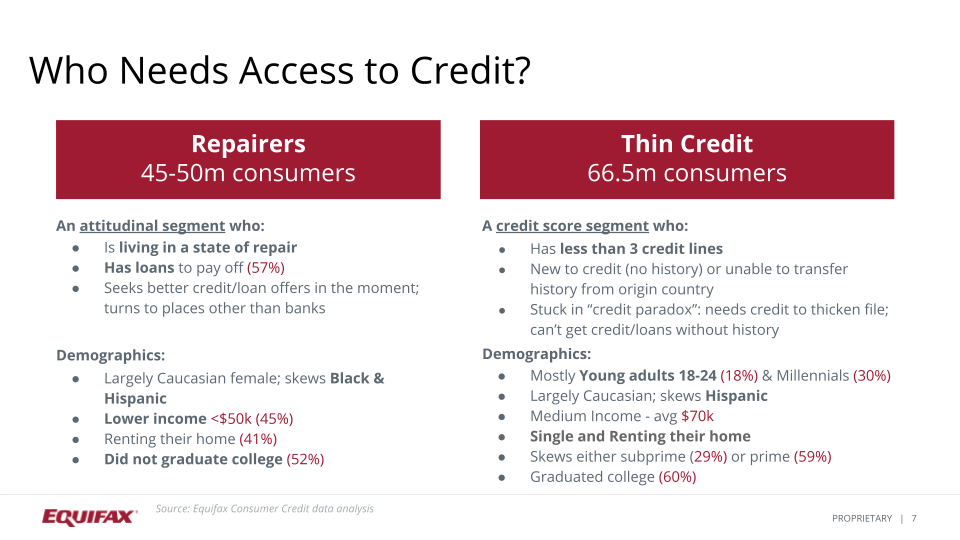

Peter Maynard began by sharing that the organization's goal going forward is to partner with its clients, stakeholders, and government agencies. This will help accelerate and generate the outcomes they want to achieve. When it comes to who needs access to credit, Maynard explained that Equifax has identified two groups (shown below).

The thin credit group (right), are individuals who are unscorable and have thin credit or no credit history. This group tends to be younger, Caucasian, and have higher income than other groups wanting access to credit.

The repairers (left), are people that have a thicker credit

file but have credit that’s not ideal. Maynard explained these

people may be looking to buy a house or a car, but have debt and are

right now unable to pay it off. Maynard stated this demographic

tends to skew more towards African Americans and Hispanics with

lower income. These individuals usually rent homes and have not

graduated college. However, these people are important. Having data

on them can help others understand that these individuals may have

had trouble with their credit in the past, but could improve it in

the future. This shows the importance of using the income and

employment data. The data would show if these individuals regain

employment and thus are able to pay off more debt.

More Data, More Opportunities

Maynard shared data from VantageScore indicating they would be able to increase the scorable rate with about 10.7 million more African-Americans and Hispanics, 1.4 million more Asians, and less than a million Native Americans. By expanding credit access and looking at different scores, different products become available. This enabled lenders to make offers of credit to people that may not have been eligible in the past. Adding alternative data from Equifax can offer a better understanding, so that financial institutions can understand who these customers are.

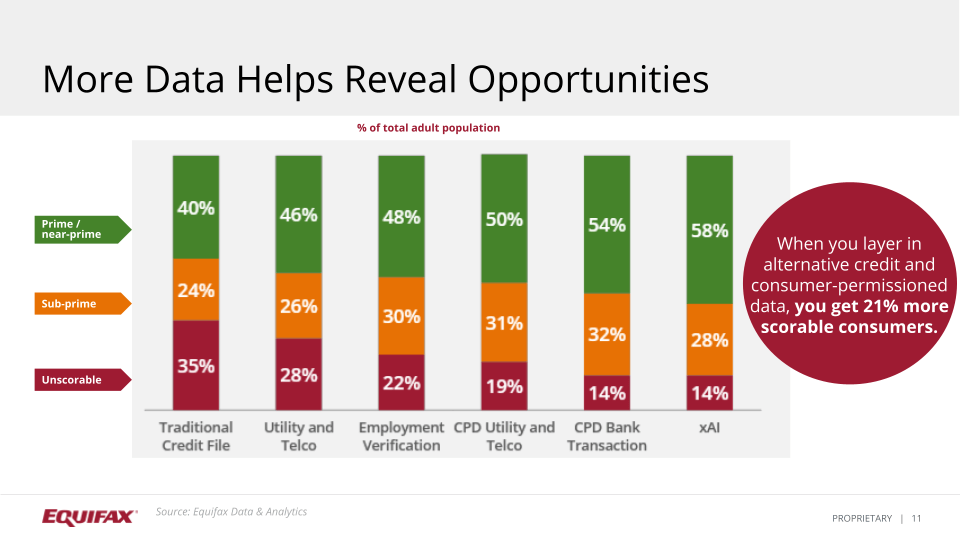

Also, they can confidently lend to those customers and give them the products that they deserve. Equifax (below) has lined up a variety of available data assets. Equifax demonstrated how layering the data assets can result in scoring additional consumers. The graph (below) shows that when you layer in alternative credit and consumer-permissioned data, you get 21% more scorable consumers.

Insight on Access to Credit from JPMorgan Chase Institute

Next, Chris Wheat, Co-President at JPMorgan Chase Institute, explained that JPMorgan Chase Institute is a global think tank dedicated to delivering data-rich analyses and expert insights for the public good. Wheat identified the concern around ways to generate equitable and well distributed growth across the U.S. economy.

The JPMorgan Chase Institute uses their customer data to determine what is happening in the U.S. economy with the goal of helping lenders make better lending decisions. JPMorgan Chase receives a view of individual transactions. These individual transactions can inform how individual households are doing in terms of their finances, both from the income and spending lens, but also increasingly more of a balance sheet view that includes debt and financial assets.

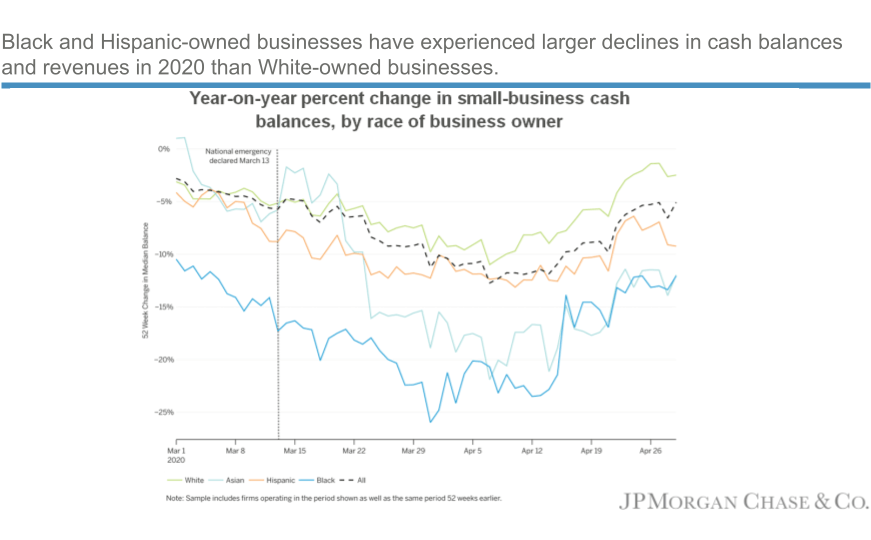

According to Wheat, JPMorgan Chase Institute has research

and dataset reports completed that will help identify certain types

of people. During the webinar, Wheat went over a few of the reports.

The slide below shows one of the company’s reports illustrating how

different demographic owned businesses have experienced larger

declines in cash balances and revenues in 2020. Wheat also went over

datasets that showed the projected time to pay off debt by race. When

reviewing the Black-White and Hispanic-White ratios of annual take

home income, Wheat concluded that median Black and Hispanic families

earn around 70 cents in take home income for every dollar earned by

white families.

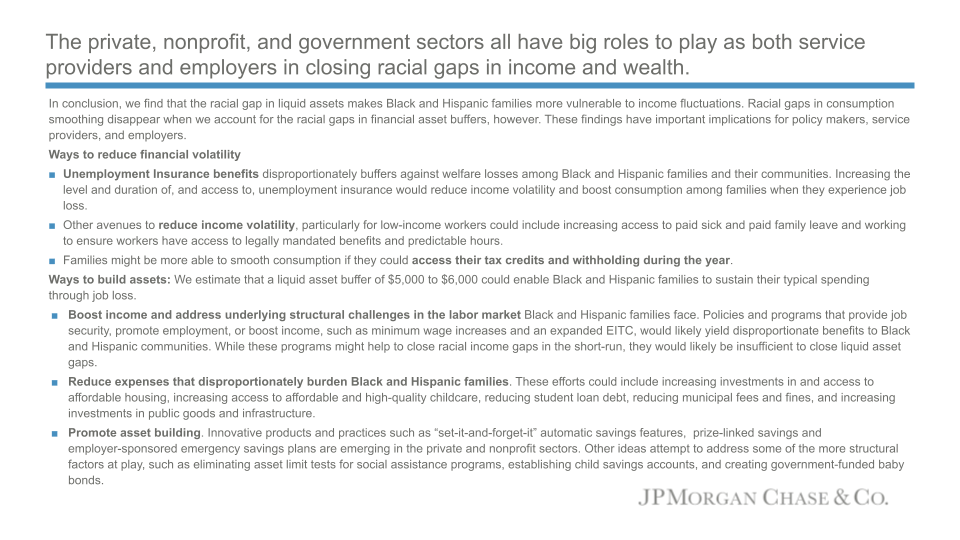

Wheat concluded by going over the following slide (below).

The slide for instance, mentioned ways to reduce financial

volatility and ways to build assets. Wheat mentioned, just like his

fellow presenters, that all sectors have a huge role to play in

closing racial gaps in income and wealth.

Insight on Access to Credit from Invest America

Next, Kahlil Byrd (KB), CEO and Co-Founder of Invest America, went over the current problem with student loans and how his company can help. Invest America provides products and services to vulnerable student loan borrowers, with a vision to ensure that every student loan borrower’s investment in themselves leads to independence, growth, and prosperity.

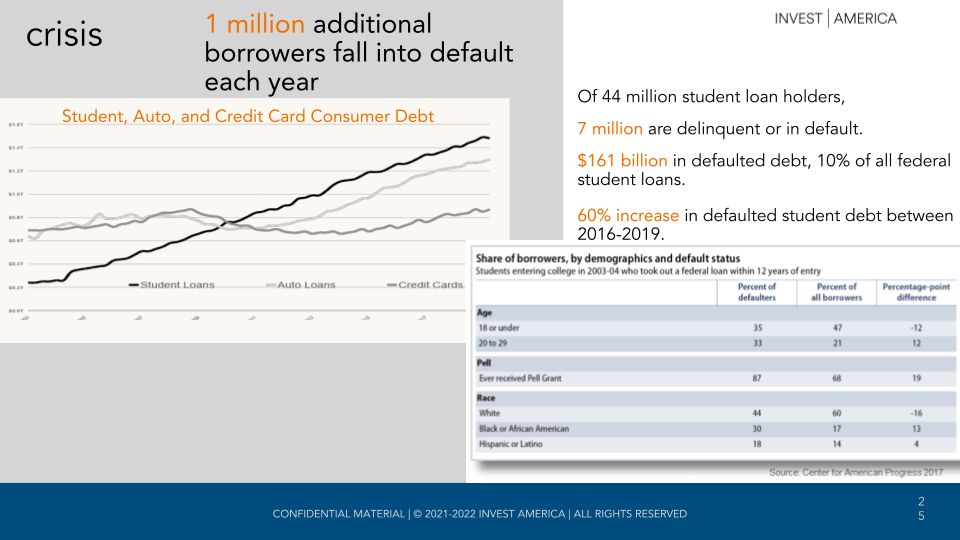

Unfortunately, due to the recent pandemic, many individuals have even more student loan debt than when the pandemic started (shown below). KB noted that Invest America focuses on delinquent and defaulted borrowers. Invest America is using data and research to understand the reality of these individuals. Millions of people fall into delinquency and default every year. Unfortunately, these people are unable to overcome this problem with the systems currently designed to lift them out of delinquency. These systems include the department of treasury, colleges and universities, credit bureaus, banks, and insurance companies.

Student Borrowers Belong at the Center

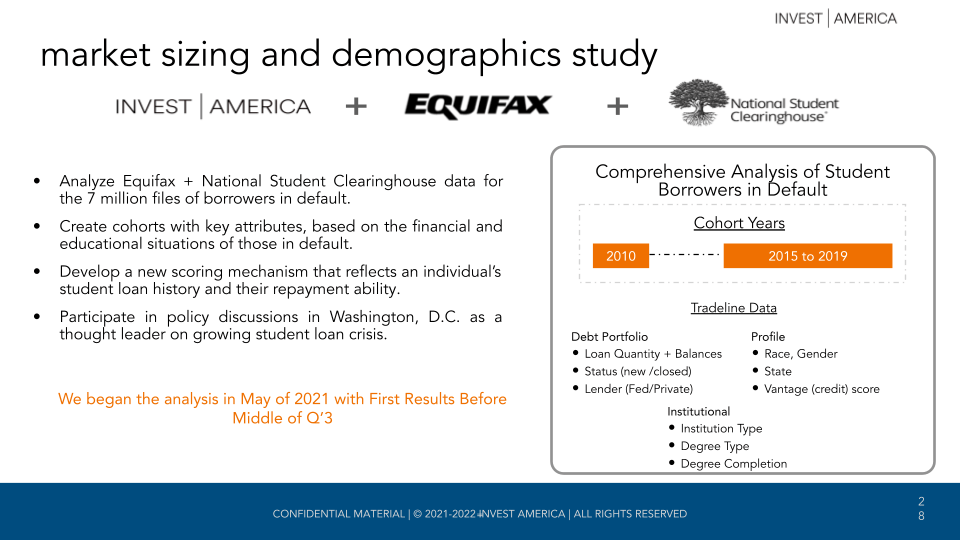

40% of people who were on time paying their student loans had a family member to support them. That being said, the people who do not have support are falling through the gaps. Invest America is working with Equifax (shown below) to understand these communities better. Through the partnership we can begin to better understand the reality of these borrowers. The goal is to keep people on the right path. This means people paying their student loans off within 10 years after they’ve left college. This will increase their probability of buying that home, creating wealth, and being that healthy financial member of their community.

The results of Equifax, Invest America, and the National Student ClearingHouse working together include:

- Moving borrowers from debt to wealth creation.

- Reimagining and improving the experience of vulnerable borrowers.

- Stream of untapped loyal clients for banks and insurance companies.

- Model for solving national challenges with forward-thinking approaches.

A Fireside Chat with Sid Singh

The webinar concluded with Sig Singh, President of United States Information Solutions at Equifax, engaging with presenters to answer critical questions. The first question asked was, “What role do they believe that financial institutions and private sectors play in helping people get equitable access to credit?”

First, Chris Wheat, of JPMorgan Chase Institute, offered that the private sector provide the products and services that people use. Wheat explained that JPMorgan Chase Institute and Equifax see what appetite private sectors have for the research they are doing. They see how it causes private sectors to be interested in their findings by way of product design versus things like providing equitable access to credit. Private sectors have a huge role because they are the primary point of interaction for most customers.

In agreement with Wheat, KB, of Invest America, followed up by confirming that he believes private sectors and financial institutions play a huge role. KB continued to mention a personal story about his Invest America co-founder, Lea Crusey. Lea has a great job and a great salary, but all this is not reflected on her particular credit report. There is no place where we can see that she helps pay for college for her niece and nephew. In addition, it does not mention that she was a first generation college student in her family, who did not have enough savings. All these factors need to be taken into account. This is the problem that KB mentioned he at Invest America, along with Equifax, is trying to solve.

Next, Peter Maynard of Equifax was asked, “What can Equifax do to help people get more equitable access to credit?”

Maynard replied that Equifax started this journey with hope that the data would tell a story about these consumers. Now, Equifax are seeing that people are hungry for data, but also looking for how the data can provide insights. People are recognizing the importance of this data. Equifax provides resources, data, etc., so that they can test their hypotheses around what they can do to build new products and new solutions. This is similar to what KB and Invest America are doing. Maynard believes that private sectors have a role of educating their government partners. For example, private sectors can do this by providing the data so that they can see what’s going on. As a result, this will help them make the right public policy responses to enabling access to credit. Equifax has a huge role in helping facilitate those conversations and exchanging that data.

Another question asked by Sid Singh during the webinar was, “Is there any hesitation from lenders to adopt some of the alternative data assets? And is one data set more important than the other?” Further, Singh reiterated the question by asking, “How comfortable do you feel the lending community is becoming with leveraging more data to drive better decisions?”

Wheat explained that he has seen a huge interest in data that applies to making lending decisions. In addition, KB added that he is in an environment of very low trust. KB mentioned he’s seeking to build datasets. KB knows he is doing the right thing. However, many people look at him with skepticism. There is not enough information so companies like Equifax and Invest America have to build those datasets themselves.

To conclude, KB reminded the audience of the importance of using anonymized data. The Equifax team is the one who handles anonymized data. That being said, Equifax has the skills and infrastructure to do it.

The full webinar recording can be accessed by visiting Market Pulse: Accelerating Access to Credit , and you can download a copy of the presentation slides here.

And, if you would like to speak to an Equifax representative about any of the data or solutions mentioned in this blog, please contact us today .

Recommended for you