September 2025 Consumer Credit Pulse: The Current Trends

Highlights:

-

Consumer originations across all lending categories rose year-over-year through May 2025, with outstanding mortgage and revolving consumer debt continuing to climb as of July 2025.

-

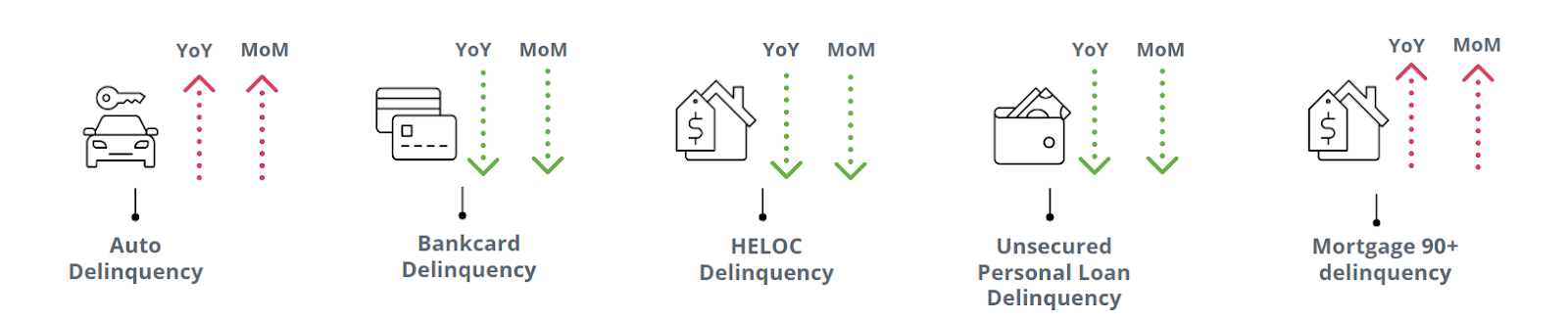

While bankcard utilization slightly decreased in July 2025, credit limits increased. Delinquencies for mortgage and auto rose year-over-year, but bankcard, HELOC, and personal loan delinquencies improved.

The September Market Pulse webinar showcased insights from Equifax Senior Advisor Dave Sojka around current consumer credit trends. While this overview is meant to be a snapshot of the larger discussion, you can receive full access to the standard charts and graphs by reaching out to the Equifax Advisory team: RiskAdvisors@Equifax.com.

September 2025 Key Insights: Today’s Consumer Credit Trends

Through May 2025, consumer originations rose year-over-year across all lending categories.¹

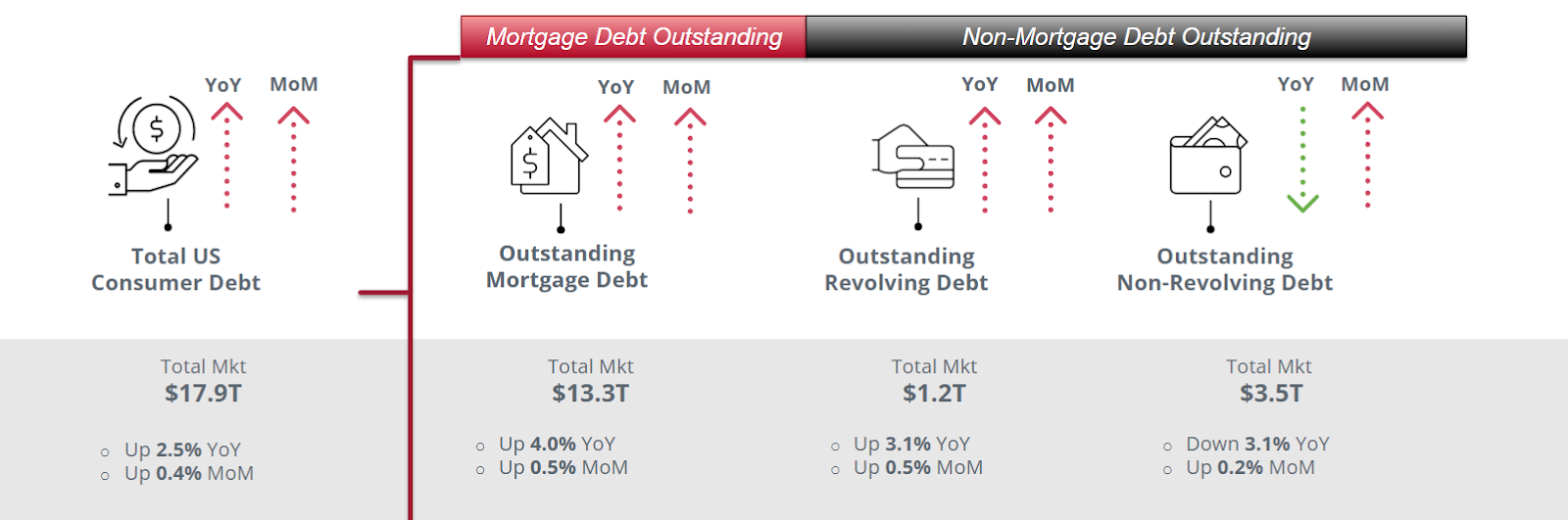

As of July 2025, outstanding mortgage and revolving consumer debt continue to climb year-over-year; non-revolving has slowed year-over-year, but rose month-over-month.²

As of July 2025, non-mortgage outstanding consumer debt has increased for auto, bankcards,personal loans, and HELOC (Home Equity Line of Credit) year-over-year. Student loans continue to be lower.²

July 2025 saw utilization decrease slightly for bankcard, while credit limit for bankcard increased. Home equity metrics continue to increase, while private label card metrics are mixed.²

July 2025 delinquencies for mortgage and auto increased year-over-year, while bankcard, HELOC, and personal loans improved year-over-year.²

Keep Your Business Goals Within Sight

Reach out to the Equifax Risk Advisory team at RiskAdvisors@Equifax.com for full access to the standard charts and graphs referenced in this report.

We hope you will join us for our October 2025 Market Pulse webinar taking place on Thursday, October 16, 2025, where our talented and dynamic panel will discuss their latest insights on overall consumer financial health and navigating uncertainty and consumer shifts as we head into the holiday shopping season. To ask questions in real time and gain deeper insights before anyone else, you must be there. Don’t miss it!

Find our monthly Small Business Insights, National Consumer Credit Trends reports, the Market Pulse podcast, and more at our Market Pulse hub.

Broaden your perspective with insights that inspire bold innovation, confident adaptation, and decisive leadership through Trend and Insights.

Finally, connect with us on YouTube and LinkedIn for even deeper insights.

Sources:

-

Equifax US National Consumer Credit Trends Originations Report from Aug 2025 - Data through May 2025

-

Equifax US National Consumer Credit Trends Portfolio Report from Aug 2025 - Data as of July 2025

-

New York Federal Reserve

-

Equifax Credit Trends and ACRO

(c) Equifax Inc. 2025. All Rights Reserved. The statistics provided herein are for informational and illustrative purposes only and shall not be used for any other purpose.

*The opinions, estimates, and forecasts presented herein are for general information use only. This material is based upon information that we consider to be reliable, but we do not represent that it is accurate or complete. No person should consider distribution of this material as making any representation or warranty with respect to such material and should not rely upon it as such. Equifax does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice. The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you