In honor of Small Business Month, we’re sharing tools and thought leadership to keep you in-the-know. Below, you’ll find an overview of the 2024 Market Trends and Predictions Report. Here, we will focus on default and delinquency. However, even with the economic uncertainty, there are still reasons to be optimistic about potential market growth, as you will see in this report.

Overview

Despite prolonged fears around the economic pain historically needed to bring down inflation, small businesses have continued to weather the economic dark cloud for two years. Even now the efforts to curb inflation have not yet come to pass, yet businesses are still somewhat optimistic of a soft landing. In fact, with consumers resilient, more stable conditions, and inflation` coming down from a year ago , the Federal Reserve is still considering a loosening of policy in 2024. Anxieties persist. But, steady economic growth, boosted by income gains, can help provide relief and lead to less economic pressure. This signals reasons to be optimistic.

Delinquency

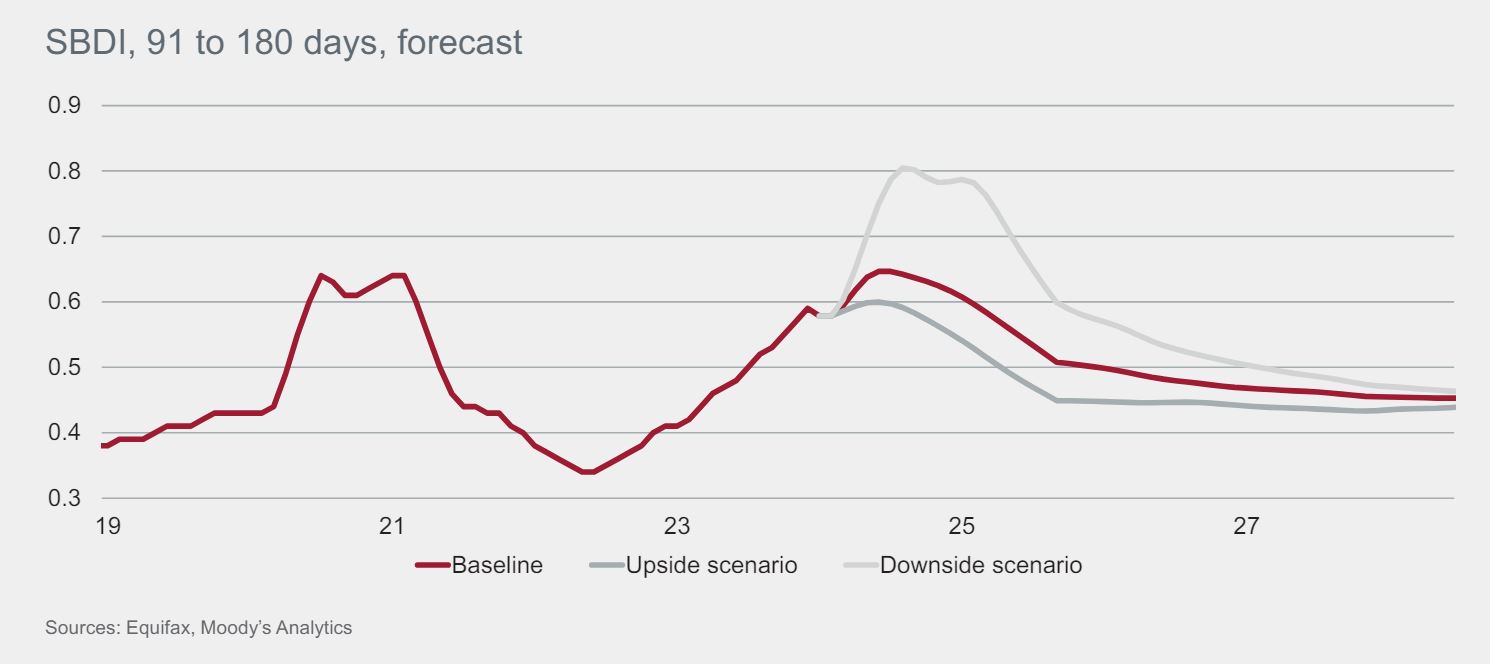

In 2023, the Small Business Delinquency Index (SBDI) rose steadily. Hitting its highest level since September 2020. Specifically, the SBDI 91 – 180 (reflecting delinquency in the 91 – 180-day range), peaked in December 2023. A trend reminiscent of early 2021. Stress persists due to inflation and interest rate hikes. But, analysts still believe relief is expected in 2024. It will come from cooling inflation and possible rate cuts by the Federal Reserve. Limiting the SBDI's increase.

According to our 2024 Market Trends and Predictions Report, if conditions are right we could see small business delinquencies peak in 2024. This is happening despite the overall conditions of the small business marketplace and the U.S. economy. If the Federal Reserve relaxes credit conditions, the SBDI could rise modestly before gradually declining. Even now, many economic experts anticipate the economy will experience a "soft landing" scenario with cooling inflation in 2024.

Default

The Small Business Default Index (SBDFI) climbed in December, marking its highest level since early 2021. Nearly 1% higher than Q4 2022. Except for the public sector, all industries had SBDFI increases in 2023. The Federal Reserve's efforts to combat high inflation is pressuring businesses with weak finances.

Despite mortgage rates peaking, homebuilders remain stable, with construction SBDFI below average. Existing homeowners prefer to keep low mortgage rates. So, they are staying in place. Resulting in high demand for new construction in the midst of low inventory.

Conclusion

Take advantage of our small business resources:

-

Learn more about this topic by reading our first blog in this series where we discuss regional small business trends. As well as part two, where we break down credit quality by U.S. population. And check out the full 2024 Market Trends and Predictions report.

-

Catch up on the implications of increased fraud in small business and get a lay of the economic landscape: Watch our small business-focused Market Pulse webinar on-demand.

-

Register for our May 16 Market Pulse webinar to gain insights into inflation trends, account management strategies, and more. Our panel of experts participate in a live Q&A at the end of the session.

Recommended for you