2021 Outlook: What are Economists Predicting?

The year 2020 has been turbulent economically across the globe, marked by the continued escalation of the COVID-19 pandemic. In the U.S., economic uncertainty has only been further exacerbated by the recent presidential election and the continued spread of the virus leading up to the holiday season. Without clarity on when a vaccine will become available to the general public, it’s important to examine both where the U.S. economy currently stands today and what is expected to unfold in 2021.

In our latest webinar, “Economist Panel on the Outlook for 2021,” we were joined by three top economists: Dr. Mark Zandi, Chief Economist at Moody’s Analytics; Dr. Rob Wescott, President at KeyBridge Public Policy Economics; and Dr. Amy Crews Cutts, President and Chief Economist at AC Cutts & Associates LLC. Their combined knowledge and expertise bring a positive outlook for mid-to-end of 2021, but also point to a long road ahead.

We’re Doing Better, But Not Out of the Woods Yet

While this recession has so far been the shortest in history, its impacts on the economy have been tremendous with 22 million jobs lost in March and April, explained Mark Zandi. Since April, about half of the 22 million jobs lost have been regained (10 – 11 million). However, Zandi also noted that about half of the 10 – 11 million jobs that have been lost are temporary losses, while the other half is predicted to be a permanent loss. Amy Crews Cutts also noted presently we are at a job loss of 10.7 million, which was the peak of the 2008 – 2009 financial crisis after the housing bubble burst.

Zandi described this recovery as a “K” shape, with the initial major dip down caused by pandemic shutdowns and then coming halfway back up as businesses reopened. He explained that we are now on divergent paths as different groups within our country are impacted disproportionally, with lower middle income households being hit the hardest.

Overall, disposable personal income has not shown a major decrease, however Crews Cutts pointed to the massive scope of the CARES Act as the driving force behind that. Presently, the U.S. total consumer debt is at a peak ($14.3T) with residential ($184B) and auto ($26B) total debt up, while credit card ($115B) total debt is down and still falling, and new student loan origination is also down 13.6% YTD*. Additionally, Crews Cutts noted that early delinquencies have begun to rise with the CARES Act benefits and other protections expiring.

Services Oriented Businesses Hit Hardest

Rob Wescott expanded on the current economic impacts citing that global industries experiencing the hardest hits from the pandemic are those that are more services oriented. Countries with a GDP performing better, are those who focus more on manufacturing like Japan and Germany. Countries that are more services based, like France and the UK, have not been performing as well. At the bottom are countries whose primary focus is in travel and tourism. The U.S. is an outlier and has performed better than expected, but this is largely due to the $3 trillion infused into the economy through the stimulus money.

Wescott further explained that this view can be applied to states in the U.S., where more rural states that focus on agriculture have seen less unemployment and thus less economic impact. These states are contrasted by their more urban service-focused counterparts like Massachusetts and New York, who are seeing a more negative impact. Wescott also compared Nevada and Hawaii to Italy and Spain, all experiencing the most severe economic impacts, as their primary focus is tourism.

Small Business a Main Concern

It’s important to watch the small business sector, according to Wescott. “We are seeing pain building up in the small business sector. It's one of our main concerns about the economy," he said.

Wescott divides the economy into three types of main activity: manufacturing firms and two types of services, which includes those with high and those with low human contact. Low human contact services include management consulting firms, financial firms and advertising firms who are currently handling the pandemic led impacts well. High human contact service firms, such as travel, tourism, restaurants, bars and physical therapists are suffering due to the pandemic. This area is experiencing the real point of pain in the economy. And looking forward, Wescott predicts that “those are the pieces of the small business sector that are going to continue to be feeling the most pain.” Wescott cited Goldman Sachs data, highlighting that PPP money helped and months like April, May, and June showed firms holding strong. However, the default rate of small businesses is on the rise, according to PayNet, an Equifax company.

What to Expect Looking Ahead: 2021 Predictions

On a positive note, Mark Zandi predicted that the economy will continue to grow and employment will increase in 2021. But he cautioned that this will happen at a very slow rate. Zandi also pointed to the pent up demand by consumers for services, travel, restaurants and other activities halted or slowed by the pandemic. As it becomes safer to move back to these in-person activities the economy will feel the positive impacts and more jobs will be created.

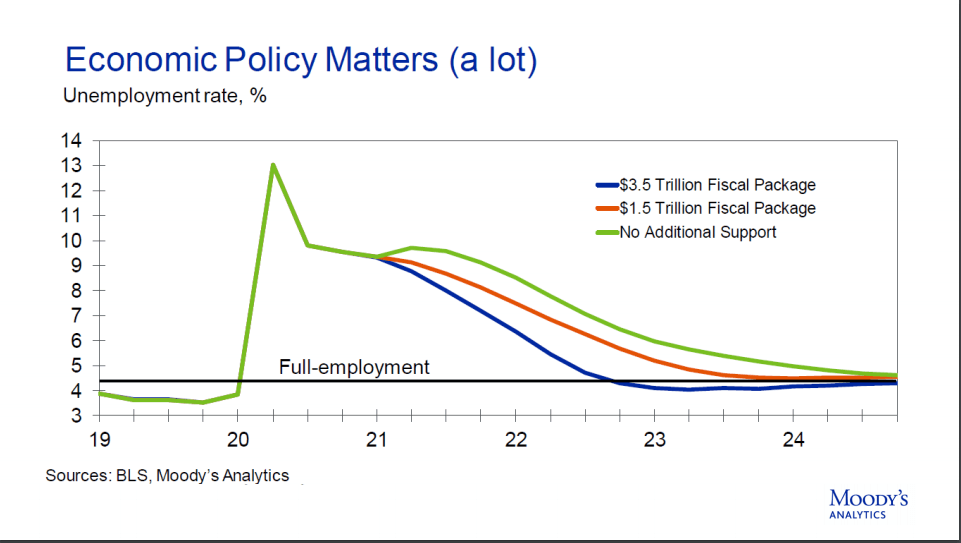

There are two major stipulations to Zandi’s more positive outlook. He cites two risks that economic growth will hinge on. The first one is the potential for further job loss as the pandemic continues to intensify. The second risk depends on economic policy and if the government will be able to respond with additional fiscal stimulus now that the CARES Act has run out. Notably, Zandi predicts that if there isn’t any additional support or not enough, it is likely that 2021 will see a further rise in unemployment, and potentially a double-dip recession.

However, if the U.S. gets an additional $1.5 trillion fiscal

support package, it could bring enough economic stability to help get

the country back to full employment by 2023, as seen in the graphic

below. A stimulus package of $3.5 trillion would likely get the

economy and unemployment levels back on track even faster. A stimulus

package coupled with the Federal Reserve keeping interest rates to a

0% rate throughout the next year will be critical to the U.S.

regaining economic stability and employment.

“By my calculation, one fifth of American workers are either unemployed or suffered a pay cut since the pandemic hit,” said Zandi.

Fiscal Support Package Needed Now

With 7.9% unemployment, Zandi believes the U.S. is in crisis mode and needs a fiscal support package now. He said is should help “small businesses, airlines, healthcare providers, schools that are struggling to stay open, and local governments just to get to the other side.” In the current economic environment, Zandi warns that he thinks the U.S. economy needs help now and cannot wait on policies. He explained, “it's not really about at this point getting back to full employment, it's kind of trying to make sure that the economy doesn't evaporate and create even more difficulty for us to get back to full employment.” Zandi recommended that the support could include additional supplemental employment insurance, possibly another round of stimulus checks with a lowered income threshold, more money for small businesses through Paycheck Protection Programs and PPP to help airlines.

Rental Assistance and Aid to State and Local Governments

Two additional actions that would make a big difference and haven’t been a big part of previous support efforts are rental assistance and aid to state and local governments. Zandi explained that at the end of January when the rental eviction moratoria comes to an end, the back rent will be about $70 - $75 billion. In many cases, this would impact middle-class Americans rather than big financial institutions. At the state and local government level, budget constraints lead to job and program cuts for workers like teachers, hospital workers, and fire and police emergency responders. All of this points to Zandi’s belief that there is further need for the government to come through with additional fiscal support. This will not only help stimulate the economy now and help employment down the road, but it will also make things less costly for taxpayers overall.

Additionally, Crews Cutts added that research from the JP Morgan Institute showed that consumer cash flow saw a big increase as a result of the stimulus checks, with extra funds for households with children, direct payments, and additional unemployment insurance benefits. Despite the initial positive effect, now that those benefits have ended the savings that consumers built up have all nearly run out as of August. This further points to the urgent need for additional fiscal stimulus.

Housing Demand Up, Inventory Low

Crews Cutts also explained that the CARES Act forbearance on federally backed mortgage loans will end in March to June of 2021. But those who are unable to continue with their payments are in a better spot than in 2008, according to Crews Cutts. She explained that house prices and demand are both up. While housing inventory is down, those who are still experiencing financial distress after their forbearance ends have the opportunity to sell and “hopefully have some equity that they can take with them out of that. Contrast that with 2008 when house prices started slowing in 2005, falling in 2006, and everything blows up in 2008. Homeowners had no equity.”

Although the results of the election were not yet clear at the time of this webinar, Zandi pointed to strong financial markets as clear indicators that investors are confident that a resolution would come soon. Zandi additionally cited that the equity market was up, while bond yields were down. This was a clear message that investors were anticipating a split government. Wescott added that investors generally have more confidence with a divided government because it can help block major changes like a corporate tax increase.

Bright Spots Ahead?

Despite the challenges of 2020, the U.S. has a history of overcoming obstacles and building on our experiences, explained Zandi. The country has learned from these challenges and that is partially why Zandi believes the financial system has held up through the stress of the pandemic. For example, the reform of the financial system and the banking system after the 2008 financial crisis placed the country on more solid ground going into COVID-19. And, Zandi predicts that the U.S. will learn from the pandemic as well and help make the country more resistant to healthcare problems in the future.

Wescott also noted that there are 30 firms currently working on COVID-19 vaccine trials and remains optimistic for a vaccine becoming available within 12 months that can help save millions of lives around the world. Finally, Crews Cutts celebrated the agility of companies as they quickly adapted and moved to virtual platforms. The ability of financial sectors to move to digital platforms and the continued innovation in the banking sector are all excellent examples of overcoming challenges and adapting to changes outside of our control. Crews Cutts is most optimistic for the role that alternative data platforms will play in the next months and years.

To access a replay of this webinar or download the presentation, please visit the Market Pulse website.

*AC Cutts and Associates, Equifax Consumer Credit Trends Report, Federal Reserve, Cox Automotive

Recommended for you