3 Key Statistics FI's Should Know About Fraud

I grew up watching various science fiction drama TV shows and recall one particular character that could shape-shift. He would shape-shift into tiny spaces like air vents to more easily pursue his victims. This concept of shape-shifting reminds me of what’s going on with fraud in the financial industry. Since the advent of chip cards, fraudsters no longer only focus on credit card fraud; they have shape-shifted into account takeover and new account fraud forms.

What is Account Takeover and New Account Fraud?

These are relatively new concepts of identity theft that, unfortunately, are becoming more and more familiar to consumers.

- Account takeover is when a person or group of people hijack another person’s bank account or credit card account for the illegitimate gain of goods or services – or to even extract funds from a person’s bank account. Typically, fraudsters accomplish this through a data breach, phishing or malware. However, they can also use less sophisticated methods such as stealing account numbers from the trash, mail or a person’s wallet.

- New account fraud is when a person or group of people open an account illegitimately using a person’s personal information and good credit rating with the intent to defraud the account owner. Typically, fraudsters open the account, run it up to its credit limit and then move on to another account, knowing they won’t have to pay it off. While this type of fraud plagues revolving credit accounts, it also impacts loan products such as mortgages, car loans and HELOCs (Home Equity Lines of Credit), as well as other areas like merchant debit cards and prepaid cards, reward programs and mobile phone accounts.

These Types of Fraud are on the Rise

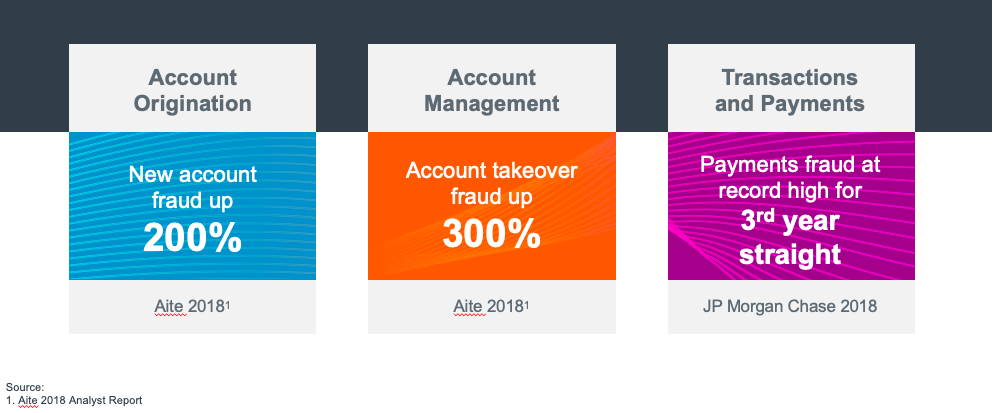

In the following graph consider these important statistics

as a barometer of the problem.

You may be wondering what is feeding this fraud frenzy. Well, a big part of the problem is that technology is constantly changing. Consumers want the convenience and seek the latest and greatest in devices. In fact, we see that almost half of consumers will upgrade their devices as soon as they possibly can - which becomes fertile ground for fraudsters. The reality is that it can be hard to keep up. And, when it’s hard to keep up, that’s when fraudsters find another path around that wall.

Best Practices for Combating Fraud

Hear about best practices Financial Institutions are using to identify fraud, reduce false positives and properly assign collections. Watch the webinar, Be a Game Changer: How to Outpace Evolving Fraud, on-demand as we discuss growing fraud trends and emerging tactics to help you optimize and win against fraud.

For more on how you can combat against fraud, visit our Luminate page today. After all, the fraudsters will continue to shape-shift, unless you stop them with the best methods for prevention.

Recommended for you