Credit Risk

White Paper: Comprehensive Data and Insights that Drive Smarter SMB Lending

May 23, 2017 | Amy Shiptenko

Get a Big Picture View of Small Businesses

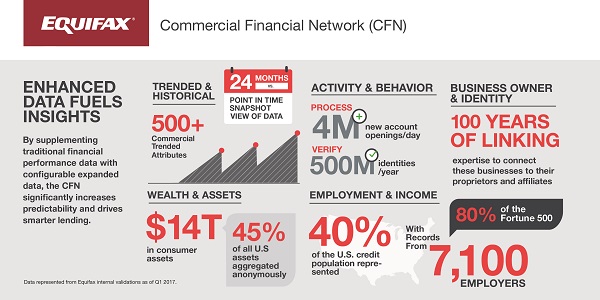

Commercial payment performance data can help provide information on how a business is paying its financial obligations, but it only paints part of the picture. To grow and thrive small businesses need access to capital and resources to help sustain their operations and increase revenue. Click on the image below to access the full White Paper.

View the full White Paper, Comprehensive Data and Insights that Drive Smarter SMB Lending.

Recommended for you

Alternative Data

How Is Alternative Data Powering the Future of Lending?

Highlights:

To meet evolving consumer demands for

personalized and supportive financial experiences,

[...]

August 19, 2025

Alternative Data

Unlock Smarter Lending with Open Banking

Highlights:

Open banking provides lenders with a more

comprehensive, real-time view of a consumer's financial healt [...]

August 11, 2025

Market Trends

July Market Pulse Q&A: Answering Your Questions on Student Loans, Credit Cards, Economic Shifts, and More

Highlights:

Student loan payments remain a low priority for

consumers, particularly lower-income individuals, poten [...]

August 08, 2025

Market Trends

The K-Shaped Economy: What It Means in 2025 and How We Got Here

Highlights:

The K-shaped economy in 2025 shows an uneven

recovery, with higher-income individuals and tech in [...]

August 07, 2025

Alternative Data

3 Simple Ways to Boost Account Opening with Alternative Data

Highlights:

Alternative data provides a comprehensive view

of consumers' financial health, enabling businesse [...]

August 06, 2025

Market Trends

July 2025 Market Pulse: Key Takeaways and Trends You Need to Know Now

Highlights:

The U.S. economy is undergoing significant

shifts, characterized by rising import costs, economic [...]

August 04, 2025