Small Business Focus: Commercial Hurdles in Today’s Economic Environment

We are excited to be celebrating small business week (April 28 - May 4)!

In the April 2024 Market Pulse webinar, we discussed dynamics in the commercial environment. These dynamics will help you focus on the future and build resilience for your organization. This is important even during uncertain times.

Dr. Robert Wescott, President at Keybridge, LLC, spoke at this month’s webinar. He started by giving a macroeconomic update. Jesse Hardin from the Equifax Risk Advisory Practice joined us. He shared consumer credit trends and small business indices. Also from Equifax we had David Adams, our Product Marketing Leader in the Commercial space. And finally we had Matt Modelmog, the Vice President and Commercial Product Leader. They offered a valuable discussion on overcoming commercial challenges.

Macroeconomic Update - Presented by Dr. Robert Westcott, President Keybridge, LLC

Over the past year, the U.S. economy has had many drivers of growth. Notable trends and concerns have emerged in different sectors.

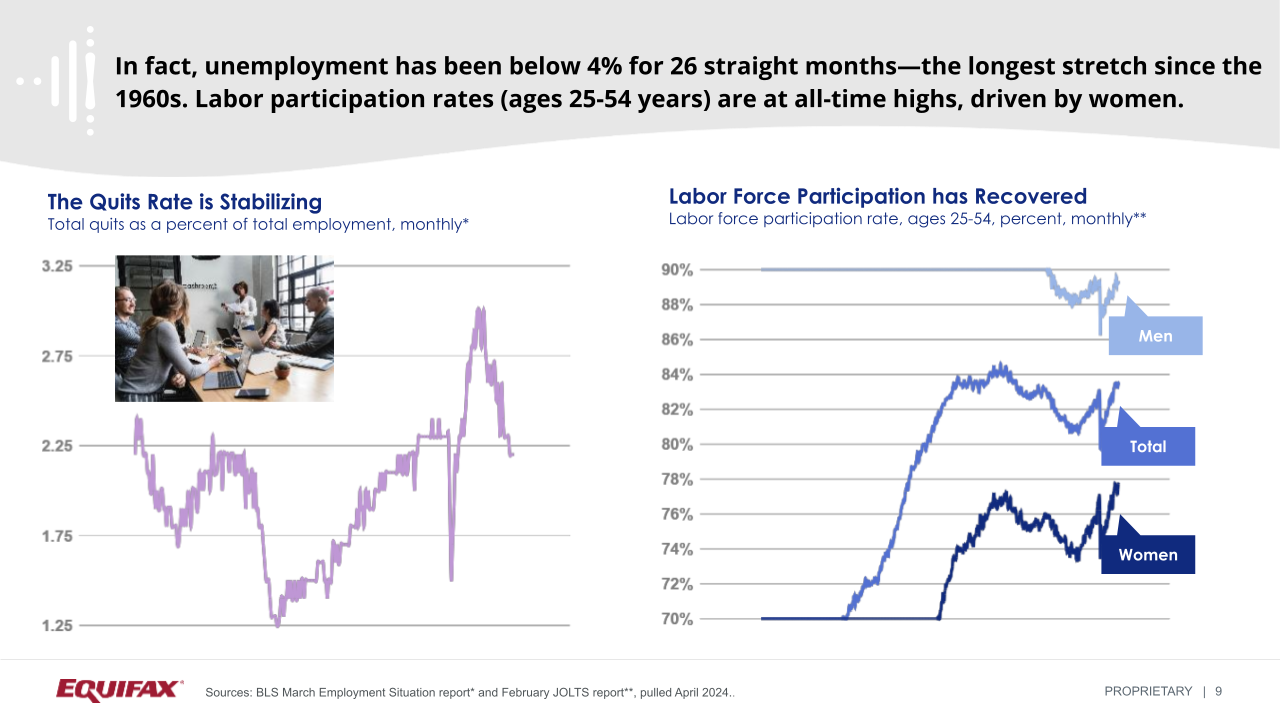

First, the labor market has remained robust, with historically low unemployment rates in 25 states and consistent job market strength for 26 consecutive months. And, the job market has been strong for 26 months.

However, concerns arise from consumer spending patterns, as expenditures have outpaced income growth in six of the past nine months, leading to a decline in the household saving rate to a nearly 50-year low. 1

Inflation is still a worry. This worry is what keeps the Federal Reserve cautious (see slide above).

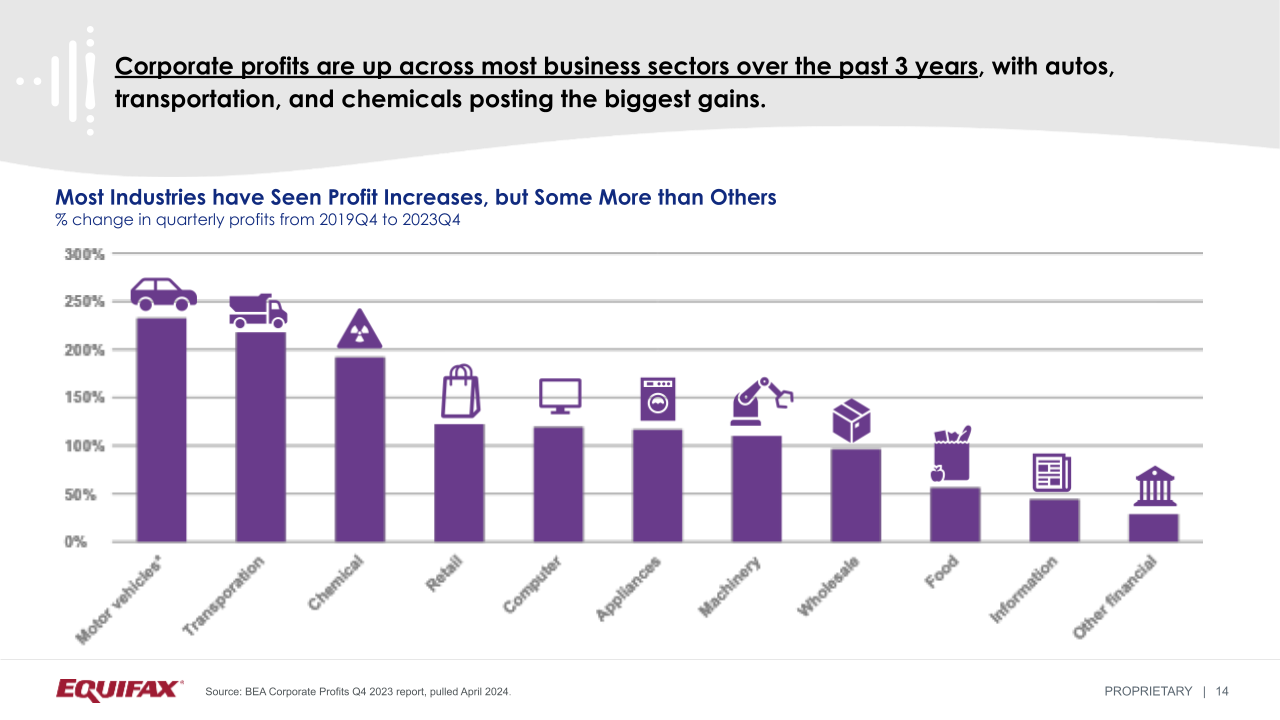

(See slide above) Corporate profits have slowed after initial

spikes post-COVID. But, notable gains have come in sectors like autos,

transportation, and chemicals.1

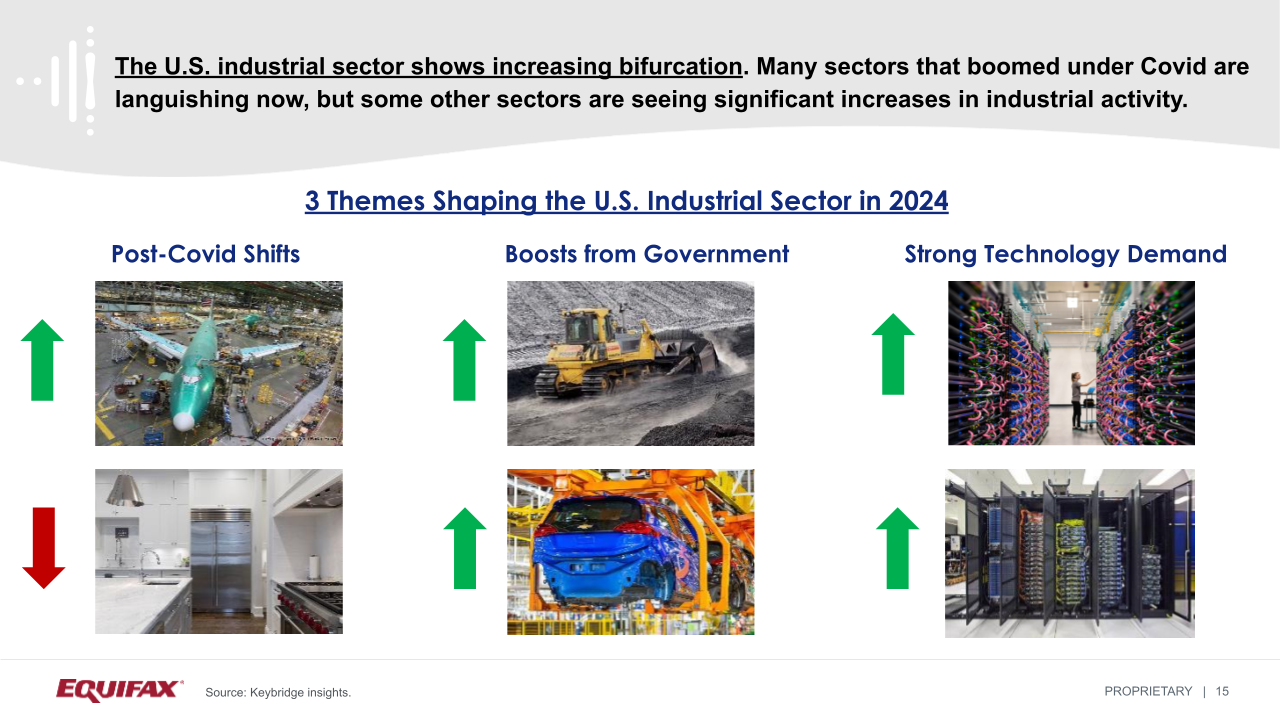

The U.S. industrial sector shows a mixed picture, with certain

industries booming post-pandemic while others struggle (see slide

above). Demand for data centers is surging. Data centers drive

investment in steel, concrete, and electrical equipment. But, it poses

challenges, such as supply chain backlogs and more electricity usage.

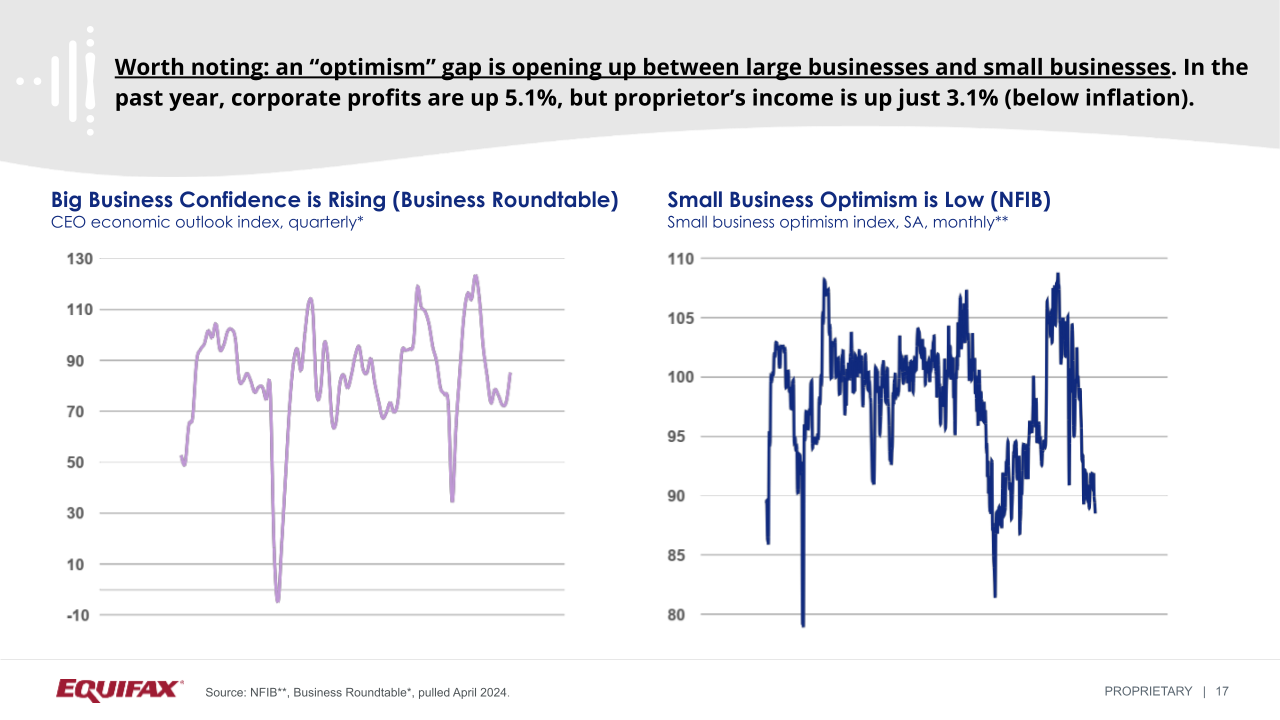

An "optimism gap" has emerged. Large businesses are doing better than small ones. Corporate profits are rising faster than proprietor's income. Also, remote work trends raise risks for commercial real estate. They have caused record-high office vacancy rates. This trend could affect commercial real estate loans. These loans are a significant part of small and medium-sized banks' assets. There are concerns. But, it's too early to gauge the effects on the wider financial system.

Consumer Credit Trends and Small Business Indices - Presented by Jesse Hardin, Equifax Risk Advisory Practice

CREDIT TRENDS

Since December 2023, several trends emerged in consumer debt and originations across various sectors:

-

Mortgage originations have decreased. They fell below 2015 levels. Auto originations have also declined. There was a drop in subprime shares compared to 2018 – 2020 levels. 2

-

But, bank card originations have increased year over year. There's been notable growth in the number of new accounts, totaling 81.8 million. This marks an 11.3% increase from the previous year. Risk levels have been managed through lower credit limits per account. 2

-

Year-over-year, private label originations saw a decrease in limits and new cards. They reached their lowest point since 2020. 2

-

Home equity revolving originations declined after a peak in 2022. But, they stayed higher than 2020 – 2021 levels. 2

-

Mortgage debt has grown to $12.5 trillion. This growth is due to a surge in new mortgages since May 2020. Non-mortgage debt decreased for the second month. Total consumer debt is now $15.57 trillion. This debt is dominated by mortgage and home equity debt. 3

-

Revolving debt reached its highest level in February 2024, with non-revolving debt decreasing. Despite some recovery during the holiday season, revolving balances remain below pre-pandemic levels. 3

-

Use of bank cards, private label cards, and home equity lines increased. Credit limits rose for bank cards and home equity.

-

Delinquencies rose in many asset classes month over month. But, overall delinquency rates are at historic lows. Auto delinquencies are at 2015 levels. Severe delinquencies in mortgages are at their lowest since 2006. Delinquencies for bank cards and retail private label cards are historically low. But, they have seen some seasonal increases. 3

SMALL BUSINESS INDICES

The latest Small Business Indices reveal recent movements within the small business landscape. They shed light on broader economic trends.

Lately, lending has been increasing steadily. It's gone up by 3.6% each month and stayed around 3.5% for the past three months. People are still borrowing money. But, there are worries about how many jobs are being created and if prices start rising too fast.

Businesses worry about prices rising too much. But, recently, prices have been fairly stable. These trends could affect the Federal Reserve's stance on interest rates. These trends will also affect market expectations.

Discussion

David Adams and Matt Moddelmog shared key challenges and top topics for commercial businesses. They explained how we can navigate these challenges now.

DELINQUENCY AND DEFAULT RATES

Across all six industry segments we tracked, delinquency is up year over year. Although transportation has been hit particularly hard, delinquency has affected all sectors. For example, the retail default rate is up 64% year over year, while professional services are up 23%. 1

Researchers project that default rates will increase to 4.4% in 2024 and 5.5% in 2025. Default rates in 2024 will be high in many industries. They will be over 5% in sectors like transportation, accommodations, and construction. 1

HIGH BUSINESS CREATION RATE

Since 2021, over 5 million new businesses are created each year. This surpasses pre-pandemic levels and presents many opportunities.

RISK OF CLOSURE

New businesses are surging. But, there is high risk. This is shown by a disproportionate number of businesses going out of business. Corporate bankruptcies reached a decade high in 2023. 1

CONCERNS ABOUT EXISTING BUSINESS

Some of the new businesses are started by existing small business owners. This raises questions. Do the new ventures come from struggles with their current businesses or from financial challenges? This question shows how hard it is to evaluate the health and motives of business creation.

Here are a few other notable points from the discussion:

-

21% of small business owners started a new business.1

-

Approximately 60% of losses to small businesses are never recovered.1

-

Between 2020 and 2022, fraudsters stole over $200 billion from federal aid.1

-

The current default rate for small businesses is approximately 2.9%. 1

The appetite to lend to small businesses remains strong. If lenders can tap into a holistic view of businesses, merging traditional and non-traditional commercial data, they will be able to make more informed decisions across the customer journey.

Conclusion

If you enjoyed these insights, visit our Market Pulse page. There, you can find our monthly Main Street Lending Report. You can also check out national consumer credit trends: Originations and Portfolio.

Stay on top of all our updates on the Equifax for Business LinkedIn page. And, don't miss our Market Pulse podcasts where we cover relevant financial topics.

Sources:

Recommended for you