How To Prepare For The Upcoming Holiday Shopping Season

Many Americans are preparing for much-needed family time, general merriment, and gift giving this holiday season. But with erratic geopolitical developments, consumer price index (CPI) uncertainty, bond markets woes, and more jarring the US economic nervous system, will Scrooge get his way with a deceleration in consumer spending? During our October 13th Market Pulse webinar, our experts broke down what the macroeconomic, consumer credit, and 2021 holiday spend trends could mean for the upcoming holiday season.

What are the top-line indicators?

Robert Wescott, President of Keybridge LLC and former special Assistant to the President for Economic Policy at the National Economic Council, opened the webinar with the $20 trillion-dollar question: are we in a recession? He shared that the National Bureau of Economics’s assessment is that we are not currently in a recession.. Their findings are based on five indicators:

- Employment (Growth)

- Industrial Production (Flat)

- Real Personal Income (Flat)

- Real Consumer Spending (Growth)

- Real Wholesale/Retail Sales (Flat)

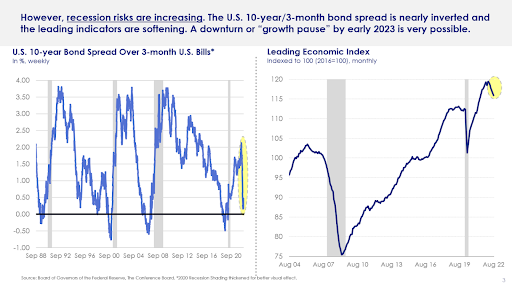

However, apprehensions are in overdrive. There are growing signs in the last quarter of 2022. We are either heading into a recession or, at the least, a “growth pause.” The U.S. Bond Yield Curve is nearly inverted per interest rate hikes, and the Index of Leading Economic Indicators has started to hook down, shown in Figure 1 below.

Figure 1

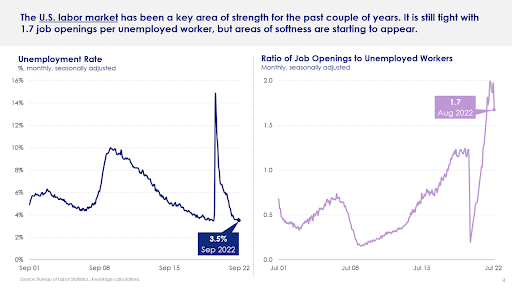

And Wescott shared that the labor market is showing signs of softening. The unemployment rate remains low. However, the ratio of open jobs to unemployed workers is dipping, shown in Figure 2 below.

Figure 2

As he has on past months’ Market Pulse webinars, Westcott reiterated it appears inflation is becoming embedded in the economy. The stark reality is the September CPI is at 8.2%. He also shared that his firm’s measure of inflation is running at 8.0%. Here his firm tracks things like rent, wireless, grocery, and vet services but does not take into account supply constraints or energy.

The Federal Government is committed to bringing inflation back down with steeper than expected interest-rate hikes. These rates may reach 4.5% to 5.0% by February 2023.

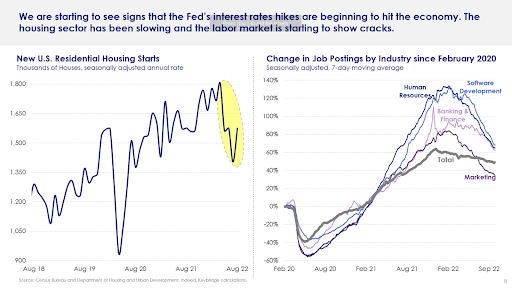

Reacting to the hikes, Westcott shared that the housing sector and labor market are showing cracks. New residential housing starts have dipped since April. We can expect housing to slow down even more in the next few months. Meanwhile, job postings have dipped, even for in-demand skillets like software developers, shown in Figure 3 below.

Figure 3

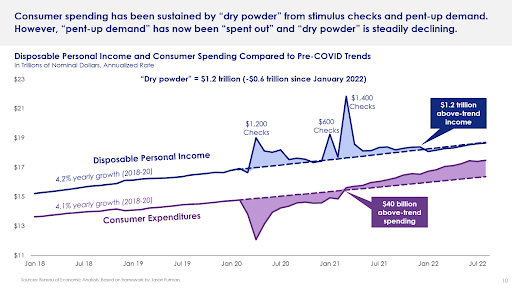

We’re seeing disposable income down as COVID-19 relief checks have been spent. And with supply chains healing, pent-up demand from shortages is easing, shown below in Figure 4. U.S. households are dipping deeper into their savings to maintain spending. The personal savings rate is now at a 10-year low.

Figure 4

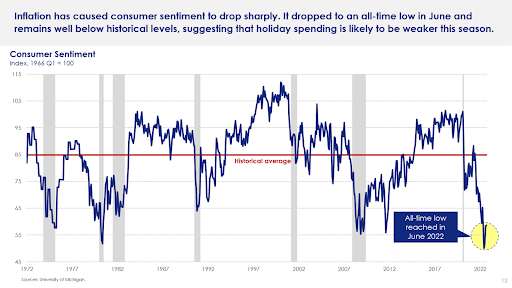

All of these factors have caused consumer sentiment to drop sharply. The Consumer Sentiment Index reached an all-time low in June 2022, shown below in Figure 5.

Figure 5

And as supply chains fully recover, what this could mean for retailers is surplus. We may be pivoting from an economy where there is abundant spending power but not enough goods to an economy where there’s little money to buy an abundance of goods.

How is this impacting consumer credit?

Tom Aliff, Equifax Risk Consulting Leader, shared June 2022 YTD credit trends and insights. He started with first mortgage originations coming down from the 2021 boom as well as auto originations continuing slight growth off of massive increases seen in 2021. The subprime auto share continues dropping from 2018-2020 levels. Bankcard limit originations are now above pre-pandemic levels; subprime share has been growing steadily, and the number of new cards originated is above all prior year levels.

Unsecured personal loan originations balances are at all time high levels; subprime share has been declining steadily, and the number of new loans originated is also a new high. Home Equity Revolving limit and unit originations are higher than they have been since 2008. Mortgage debt is at $11.9T, and non-mortgage debt has returned to a pre-recession increasing trend.

Aliff also shared that revolving debt in August 2022 is seasonally above 2019 levels, and non-revolving debt is continuing to rise. Mortgage debt is at $11.7 trillion while non-mortgage debt has returned to keeping pace with an increasing trend aligned to pre-recession. Credit limits and utilization have started to slowly increase for both bankcard and private label card. Home equity line utilization continues to decrease. Auto delinquencies are rising. Bankcard and private label delinquencies are below pre-pandemic levels. First mortgage delinquencies remain historically low.

As student loan accommodations roll off, it’s expected repayment will return to the bottom of the payment hierarchy. For consumers with a mortgage loan, auto loan payments remain the highest priority whereas home equity loans remain at the bottom. Post COVID-19, consumers have become more likely to pay their telecommunications loans. For subprime (<620) consumers, retail and bankcars are the lowest repayment priority. For prime (>720) consumers, telecommunications remains the lowest priority. Retail and bank cards are the most likely to be paid for this consumer segment.

What might this all mean for the upcoming holiday season?

Mike Spriggs, an expert in using market research and consumer demographic data to optimize sales and market penetration, joined us as a guest speaker from Fiserv to talk about what this might mean for retailers planning for holiday spend. He began with perspective building and shared learnings from the 2021 holiday season. Spending did not follow established norms. Merchants offered promotions earlier than usual to capitalize on demand and mitigate supply chain misses. “Doorbuster” events and overnight lines ahead of Black Friday were almost completely absent. However, if we accept an expanded definition of the “holiday” selling period, spending growth was strong.

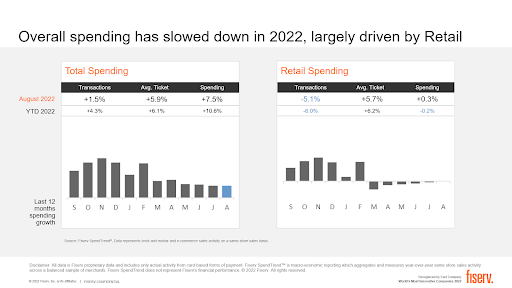

Moving into 2022, Mike shared that overall spending has slowed down, largely driven by retail, shown below in Figure 6.

Figure 6

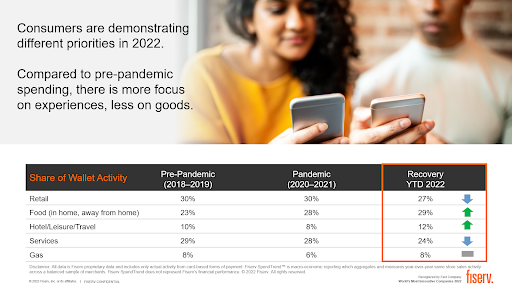

Consumers are demonstrating different priorities in 2022. Compared to pre-pandemic spending, there is more focus on experiences and less on goods, shown below in Figure 7.

Figure 7

Travel and related spending are expected to continue to expand as consumers are still making up for lost time. They’re also shopping more online. The 2021 extended shopping season is expected again this year.

Overall, the 2022 US Retail Holiday expectation should be slower growth compared to last year. High inflation plus low consumer sentiment and employment confidence will have an impact on consumer spending.

For more, download the webinar deck and watch our full recording here.

* The opinions, estimates and forecasts presented herein are

for general information use only. This material is based upon

information that we consider to be reliable, but we do not represent

that it is accurate or complete. No person should consider

distribution of this material as making any representation or

warranty with respect to such material and should not rely upon it

as such. Equifax does not assume any liability for any loss that may

result from the reliance by any person upon any such information or

opinions. Such information and opinions are subject to change

without notice. The opinions, estimates, forecasts, and other views

published herein represent the views of the presenters as of the

date indicated and do not necessarily represent the views of Equifax

or its management.

Recommended for you