Shift Your Marketing Strategy During COVID-19

During the COVID-19 crisis, the ability to shift your customer strategy and your marketing strategy depends heavily on having the right data and insights. Marketers’ worlds have changed in less time than it takes to run an email campaign. It’s now assumed that the COVID-19 crisis will have a greater impact on U.S. ad spend than the 2008-09 financial crisis.

An Advertiser Perceptions study predicts a significant drop in ad spending for the second quarter. Nearly half of marketers said they paused or delayed a campaign or shifted media budget due to the pandemic. One large ad agency changed its forecast from 6.6 percent growth to a 2.8 percent drop in U.S. digital advertising for 2020. Even as marketers pull back, their goals haven’t vanished. They must continue to feed the pipeline and retain the customers who show the most potential lifetime value.

With fewer resources, you need to be smart and precise – adjusting your strategies, message and media choices to meet your customers’ needs. One way to do this is to refine how you target. An Interactive Advertising Bureau (IAB) survey says around 40 percent of marketers have increased their audience and demographic targeting.

Evaluate your data for targeting

The question is: How good is the data used for your targeted marketing strategy? Now more than ever, marketers should be examining the data they’re using and ensuring they have what they really need to be effective:

- Do you know the source of your data? Data based on surveys can often lead you down the wrong path whereas direct-measured data gives you the true picture.

- What about your data provider’s data hygiene – are they doing frequent cleanses to dedupe, update contact information, etc.?

- Privacy regulations haven’t gone away with the crisis – is your provider and service bureau current with the latest regulatory and privacy rules?

The right data can help you really understand which of your customers are at risk of financial hardship. These insights go beyond what you see in your own data and maybe some basic demographics. You can learn who might need an alternative product from you right now, as well as identify and double down on high-value audiences that have the capacity to spend today or months in the future.

The last thing you want to do during a crisis is send an unapproachable offer to the targets you think can afford them but cannot. Nor do you want to abandon customers whose circumstances may have changed for the moment. Many of them will eventually work their way back to better status and rebound as your strongest loyalists. Now is the time to challenge your data to help you refine your marketing strategy based on your customers’ needs right now and their ability to spend going forward.

Customer economics matter

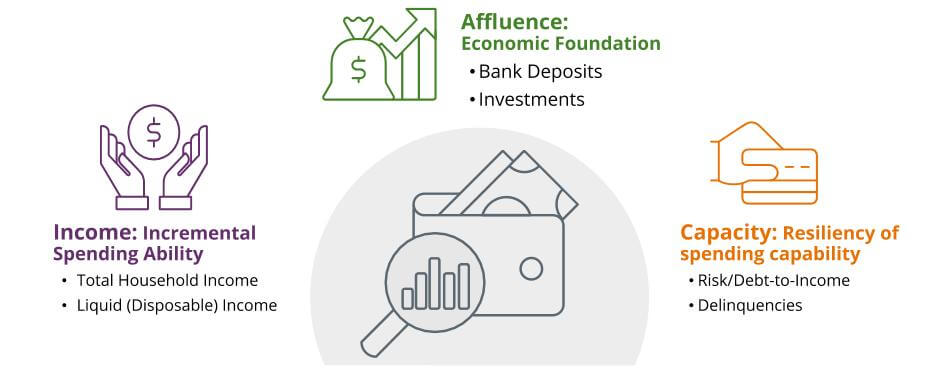

Marketers often rely on demographic data with income getting the most weight as a guide for customers’ financial capacity. But income is not a sufficient proxy for total capacity – especially in tough times. Now more than ever, with job losses on the rise, income data is not enough. The full consumer wallet is now more critical for marketers to understand. At Equifax, our economic data directly measures three core elements of wealth to help marketers understand the full consumer wallet:

- Affluence, or consumer wealth, based on bank deposits and investments is the economic foundation,

- Income from the household level rather than a range reported through a survey, and

- Capacity -- what’s left to spend after household commitments like debt.

If you know those three components for a household, you can have a sharper and more accurate understanding of a consumer. You can understand their ability to invest, utilize financial services, and purchase goods – especially goods outside of the mass market.

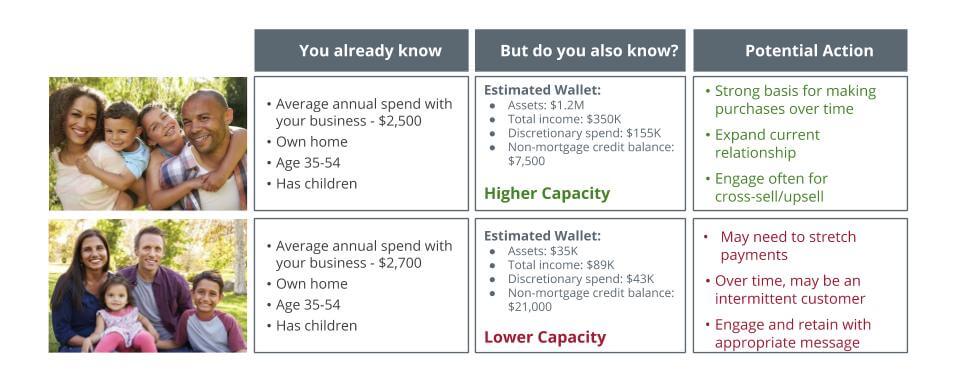

For example, you may have two customers that look the same

on paper based on traditional demographic segmentation. However,

layering on economic data shows vastly different situations that

affect their ability to spend.

Because it comes directly from financial institutions, rather than surveys, our economic data is more reliable. And it gives you insights to help you build a fuller picture of your customers and adjust your marketing appropriately. Once you have teased out some important distinctions within your customer base or prospects, you’ll be able to make smarter decisions. You can make more appropriate offers, create more relevant and personalized messages, and make more informed decisions about channel mix. In turn, you’ll make better use of precious budgets and market smarter. And, you’ll position yourself to meet your business’s acquisition, retention and growth goals while confronting COVID-19 headwinds. Learn more about our differentiated data for marketers.