Undisclosed Debt: The Mortgage Blind Spot

Are you monitoring for undisclosed debt throughout the loan closing process?

The high-risk blind spot in the origination process is known as the “quiet period.” It is the waiting period between the start of origination and closing when consumers can incur undisclosed debt or new trade lines that increases their debt-to-income (DTI) ratio. As a result, this can jeopardize closing. Here we will share why undisclosed debt is a big industry issue. We will then offer best practices for addressing undisclosed debt within a tech-forward, digital origination strategy.

Why “3 percent” is a problem for lenders.

When it comes to undisclosed debt, three percent is an important number. A mere three percent jump in a borrower’s DTI ratio can spark costly loan repurchase demands. The three percent jump will negatively impact a lender's Government-Sponsored Enterprise (GSE) scorecard. It can trigger regulatory action due to non-compliance with ability-to-pay guidelines. Agencies are hyper-aware of the risk potential. This is why undisclosed liabilities are listed as one of the big six areas that lenders must thoroughly check prior to closing.

According to the data, the risk is real. A recent Equifax analysis of 98 million+ mortgage originations between 2010 and 2018 reveals that 4.5% of those borrowers applied for an auto loan during the same month as their mortgage origination. In a separate review of undisclosed debt during mortgage origination, we found that 36% of borrowers who only opened one new trade line during the quiet period increased their DTI ratio by at least three percent.

Apart from skewed DTI ratios, undisclosed debt can point to an increased risk in fraud. Misrepresented liabilities are causing 23% of loans with mortgage fraud findings, according to Fannie Mae. It also presents operational issues. Undisclosed debt can disrupt mortgage closings, overload underwriting resources, and ruin the customer experience. This will result in delaying or blocking their path to homeownership. Undisclosed debt is an industry issue. It can negatively impact loan pipelines and ultimately a lenders' bottom line.

Digital monitoring technology eliminates the blind spot.

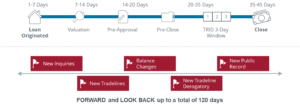

Today, given the fast-growing shift to digital strategies,

lenders have a unique opportunity to reduce risk that comes from

undisclosed debt. Automated undisclosed debt monitoring (UDM) tools are

available to continuously monitor all loan files in a lender’s

pipeline for new tradelines and other changes to a borrower’s credit.

UDM triggers daily alerts anytime relevant, new activity is

discovered. This gives lenders daily visibility into a borrower’s

credit changes. Activity monitored includes new tradelines, new

inquiries, balance changes, new late payments, public record

bankruptcy and more—from origination through closing.  The

net-net? No more last-minute surprises right before closing. Instead,

lenders can proactively work with borrowers to resolve most issues.

This will keep their closings on time and on track.

The

net-net? No more last-minute surprises right before closing. Instead,

lenders can proactively work with borrowers to resolve most issues.

This will keep their closings on time and on track.

Best practices for using Undisclosed Debt Monitoring Alerts

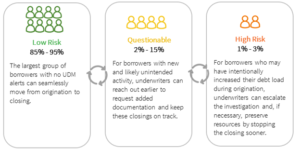

With UDM alerts, lenders can intelligently prioritize using three categories:

- Low Risk - The majority of your pipeline is low risk/good. These borrowers can move through the closing process quickly with confidence.

- Questionable - Consumers with unintentional new alerts. Identify these loans earlier in the process. Focus valuable underwriting resources on these borrowers who may require additional documentation. Then, the underwriter can proceed to closing with minimal disruption.

- High Risk - Consumers have deliberate or unintended alerts, allowing you to escalate the review process, identify re-underwrite, fraud or unintended liability. When approval is no longer valid, the underwriter can stop closing before additional costs are incurred.

As mortgage banks rapidly adopt digital processes to achieve better efficiency, cost savings and customer experiences do not forget about the “quiet period.” Instead of getting blindsided at closing, integrate undisclosed debt monitoring technology, for clear visibility into borrower credit files. Daily alerts can help lenders streamline required underwriting tasks and optimize their resources. As an end result, lenders can confidently close more loans faster and with less risk.

Contact us today. Learn how Equifax Undisclosed Debt Monitoring can be used as a standalone digital service or integrated into your technology platform.

1 https://sf.freddiemac.com/content/_assets/resources/pdf/other/freddie-mac-future-of-lending.pdf

2 Fannie Mae, Mortgage Fraud Loan Trends 2016-2020, 5-year average – https://singlefamily.fanniemae.com/media/8461/display

Recommended for you