Who Uses BNPL Financing?

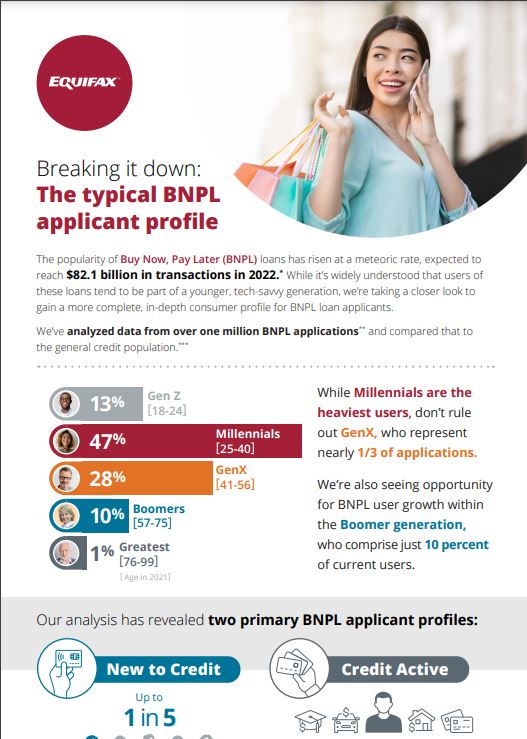

50 Million US consumers have used BNPL over the last 12 months. A large scale data study by Equifax reveals insights about consumers that apply for BNPL loans.

20%

up to 20% BNPL applicants are new to credit and have no credit file.

4x

more likely than general credit users to be a credit rebuilder with a sub-prime score.

60%

lower household savings and investments. Applicants are younger and less affluent.

Who We Serve

BNPL Resources

1 - 11 of 11 Results

Insights from Our Experts

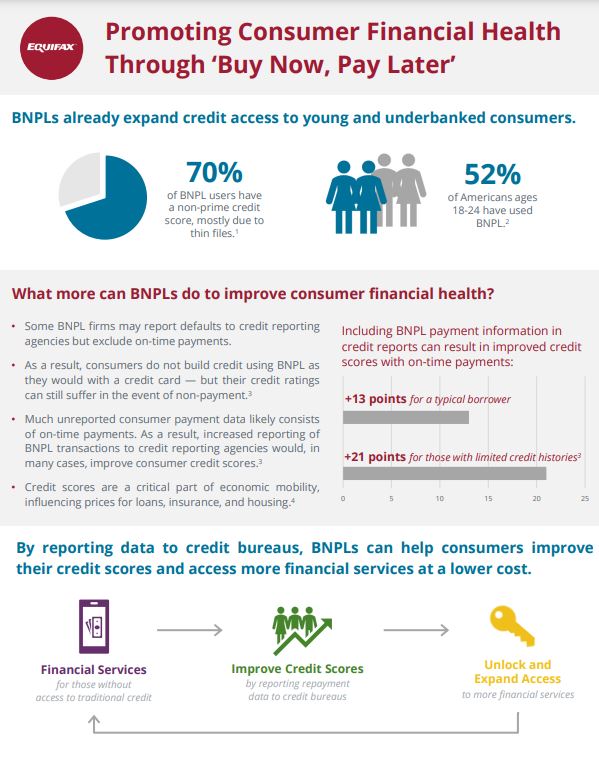

- February 12, 2024 How BNPL Firms can Unlock Profitability During Uncertain Economic Times Two years ago, Buy Now Pay Later (BNPL) firms were legit Fintech superstars. Globally, transaction [...]

- October 31, 2022 Preparing for the Holiday Shopping Season: Your Questions Answered Shopping is one of America’s favorite pastimes. During our last Market Pulse Webinar, "How to Prepar [...]

- October 27, 2022 How To Prepare For The Upcoming Holiday Shopping Season Many Americans are preparing for much-needed family time, general merriment, and gift giving this ho [...]

- September 16, 2022 BNPL Tailwinds and Headwinds After experiencing remarkable growth over the past couple years, what lies ahead for Buy Now Pay Lat [...]

- June 23, 2022 5 Data Nuggets to Boost BNPL Profits 2021 was a breakout year for BNPL in the U.S. BNPL gross merchandise value accelerated to $49 billio [...]

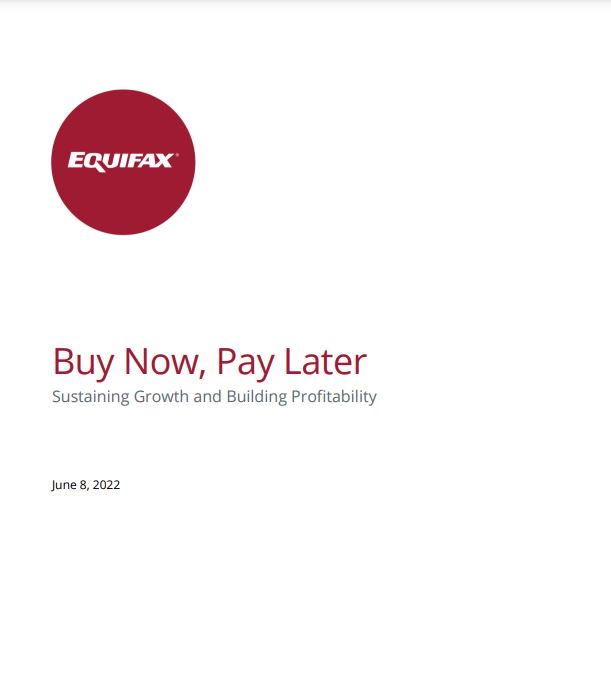

- May 11, 2022 Promoting Consumer Financial Health with BNPL As U.S. consumers continue to migrate their shopping habits toward online merchants and become more [...]

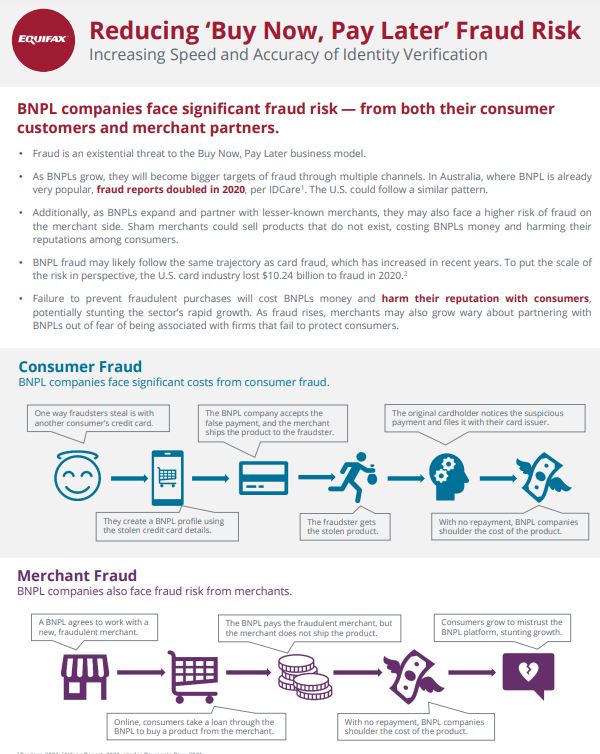

- March 21, 2022 Reduce Buy Now, Pay Later Fraud Risk The boom of BNPL and the fraud that comes with it Everyone is talking about Buy Now, Pay Late [...]

- March 01, 2022 Analysis: How Buy Now, Pay Later can Impact Consumer Credit Scores For our February 10 Market Pulse webinar, we discussed Buy Now, Pay Later and their effect on consum [...]

- February 28, 2022 FICO® and Equifax Answer Your Questions on BNPL We had an overwhelming attendance and response at this month’s Market Pulse webinar on the rising fi [...]

- December 17, 2021 Powering the Energy Market: Your Questions Answered For our December 2 Market Pulse webinar, our panel of experts discussed the current and future state [...]

- December 16, 2021 What to know about Buy Now, Pay Later Buy Now, Pay Later has continued global growth, with U.S. adoption up sharply over the last two year [...]

- December 10, 2021 Podcast: ‘Tis the Season for Buy Now, Pay Later Buy Now, Pay Later (BNPL) financing is soaring in popularity this holiday season. Consumers are usin [...]