Credit Risk

White Paper: Comprehensive Data and Insights that Drive Smarter SMB Lending

May 23, 2017 | Amy Shiptenko

Get a Big Picture View of Small Businesses

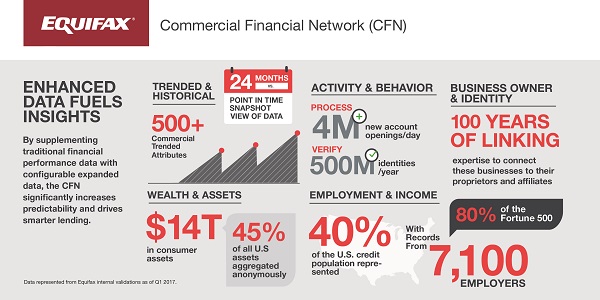

Commercial payment performance data can help provide information on how a business is paying its financial obligations, but it only paints part of the picture. To grow and thrive small businesses need access to capital and resources to help sustain their operations and increase revenue. Click on the image below to access the full White Paper.

View the full White Paper, Comprehensive Data and Insights that Drive Smarter SMB Lending.

Recommended for you

Credit Risk

Lending Smarter: Why Financial Capacity is the Missing Dimension in Credit Risk

Stop relying on backward-looking credit scores. Learn how Equifax's Consumer Affordability View predicts a consumer's dollar-amount repaymen [...]

March 06, 2026

Market Trends

The K-Shaped Economy in 2026: Understanding What It Is and What It Means For You Now

Understand the K-Shaped Economy in 2026. Discover how the widening wealth gap affects consumer spending, lending strategies, and business ri [...]

March 03, 2026

Market Trends

Macroeconomic Headwinds & Opportunities in the Mortgage Market: A Recap of the February 2026 Market Pulse

Navigate mortgage market headwinds: The February 2026 Market Pulse covers K-shaped economy, rising 'all-in' costs, VantageScore 4.0, and str [...]

February 24, 2026

Market Trends

February 2026 Consumer Pulse: The Latest Consumer Credit Trends

Get the latest consumer credit trends from Equifax's February 2026 Market Pulse. See key changes in consumer debt, originations, and delinqu [...]

February 23, 2026

Identity & Fraud

The AI Fraud Arms Race: New Strategies for Detecting Synthetic Identity and Sophisticated Attacks

The AI fraud arms race is accelerating. Discover how fraudsters use sophisticated AI for synthetic identity attacks and learn new, machine l [...]

February 18, 2026

Market Trends

5 Years Of Market Pulse Insights: How Has Consumer Credit Changed Since 2020?

Explore the 5-year evolution of consumer credit, from the hidden risk of 2020 to today's K-shaped economy. Learn how lenders must adapt with [...]

February 10, 2026