Market Pulse Q&A: Experts Answer Your Top Questions on Consumer Credit, Auto Lending, and More

Highlights:

-

Delinquency Stability: The 60+ DPD delinquency performance remains unchanged year-over-year, suggesting many families are still managing due to wages outpacing cost increases and an expected boost from higher Q1/Q2 tax refunds.

-

Auto Lending & Maintenance Trends: Auto maintenance and repair costs have increased significantly (up 44% since 2019). Credit unions are largely avoiding 9- and 10-year auto loans to protect members from affordability issues and negative financial outcomes.

Both before and during each Market Pulse webinar, our audience submits their burning questions to our expert panelists.

For our January Market Pulse webinar, our panel included Dr. Robert Wescott, President of Wescott Strategic Advisors, Jesse Hardin, Senior Advisor at Equifax, and Emmaline Aliff, Advisory Leader at Equifax, Jeremy Robb, Interim Chief Economist at Cox Automotive, Yazel Pardo, VP of Credit Risk and Analytics at Patelco Credit Union, and Rikard Bandebo, EVP, Chief Strategy Officer, and Chief Economist at VantageScore. Below are their answers on questions around economic trends, delinquency, risk management, and more.

Q: Based on the trends, what is your view on the market and economy for the next 12 months and consumer sentiment?

Dr. Robert Wescott, Wescott Strategic Advisors: I think there are three key things to watch in 2026. The first would be the recently passed federal tax cuts. Do they start filtering into people’s pockets and giving a pleasant upward surprise? If so, that’s good for consumer confidence. The second would be labor market changes. Did we start to see more job creation? If we do, that would also be good for consumer confidence.

And the final thing would be the stock market. If there’s a downward trend in the stock market, which has been really supporting upper-income households, that would be bad for overall consumer confidence. But if the stock market stays strong, I think that could continue to support heightened consumer confidence in 2026.

Q: To what do you attribute the unchanged 60+ DPD delinquency performance year-over-year?

Jesse Hardin, Equifax: For many, wages are still outpacing inflation. This would suggest, while the burden of higher prices in everyday life is not ideal, many families are still making ends meet and not going delinquent to do so. It also may suggest the shock of pandemic-era revenge spending and higher prices has ebbed some.

This is not to overshadow the difficulty of this K-shaped economy for many families. Another reason to be optimistic; as Jeremy Robb indicated, we expect higher tax refunds this year as a result of recent legislation. History shows delinquency falls in Q1 & Q2 during tax refund season.

Q: Slide 24 [on inflation impact on core automotive sectors] is quite interesting. Are there any insights into warranty and maintenance plans?

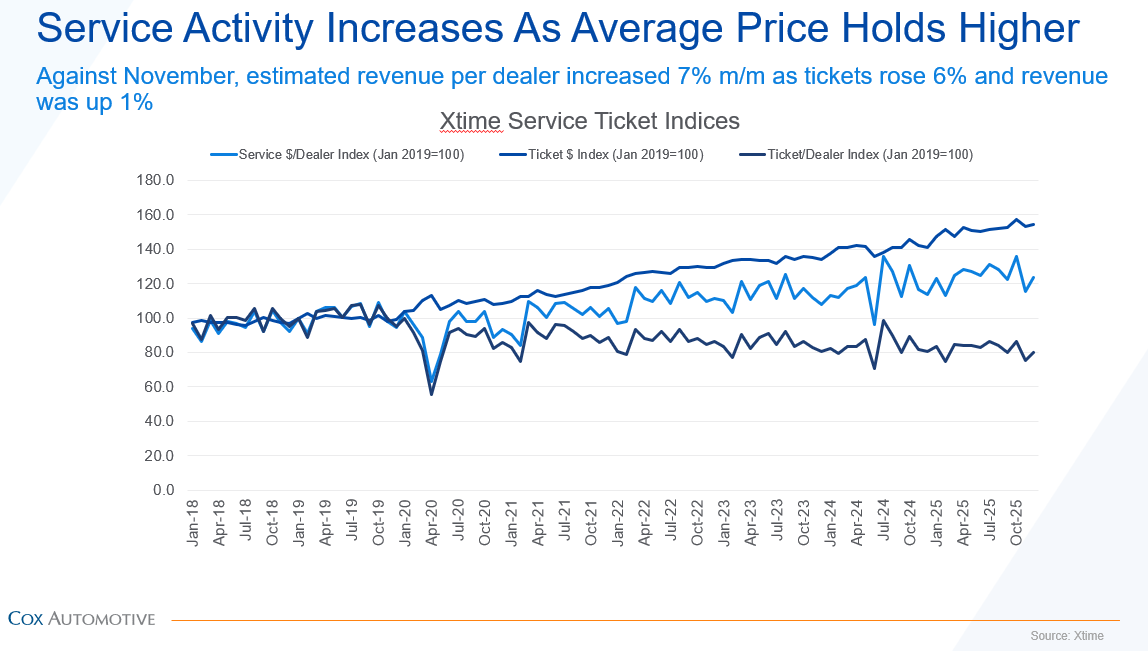

Jeremy Robb, Cox Automotive: While we

don't have any off-the-shelf insights on that front, maintenance

and repair costs are up 44% since 2019 – and the average repair

ticket is up 54% using our Xtime© data since 2019 – though the

number of tickets (repairs) we track per dealer are down 21% over

the time period.

Q: Can you see credit unions starting to do longer terms for auto loans?

Yazel Pardo, Patelco Credit Union: Credit unions tend to look out for the member's financial well-being. While longer terms may make payments more palatable, they can hide affordability issues, could create poor financial behavior, and might create poor financial outcomes (i.e. more interest paid, negative equity, etc). So, I don't see a lot of credit unions opting for the nine and ten year auto loans.

Q: Is VantageScore a single value used by Patelco, or does it supplement what they were currently using?

Pardo: Patelco uses VantageScore as the primary factor influencing credit risk and risk-based pricing, but we do look at other attributes to determine affordability and take into consideration the broader credit picture, including member relationship when making a credit decision.

Recommended for you