January 2026 Consumer Pulse: The Latest Consumer Credit Trends

Highlights:

-

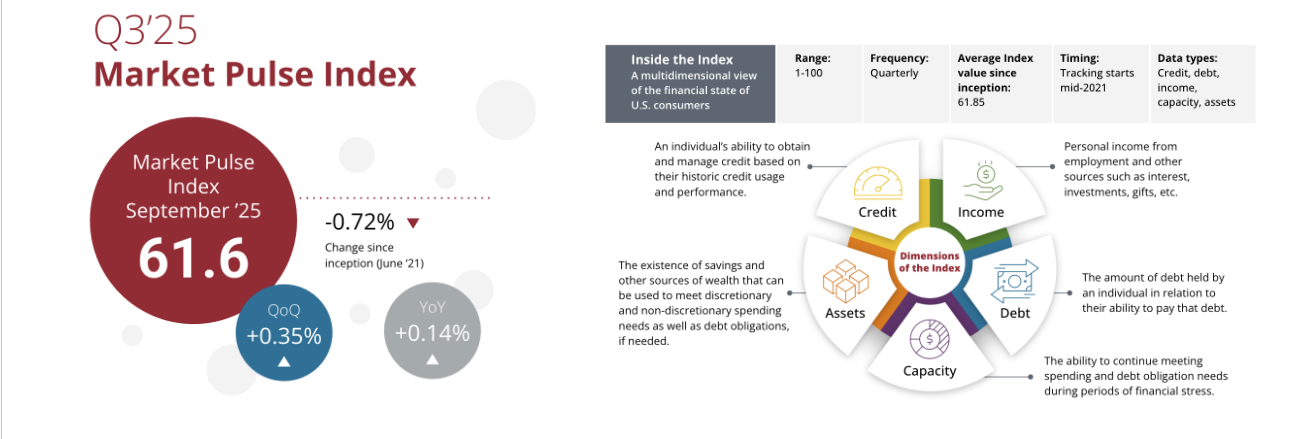

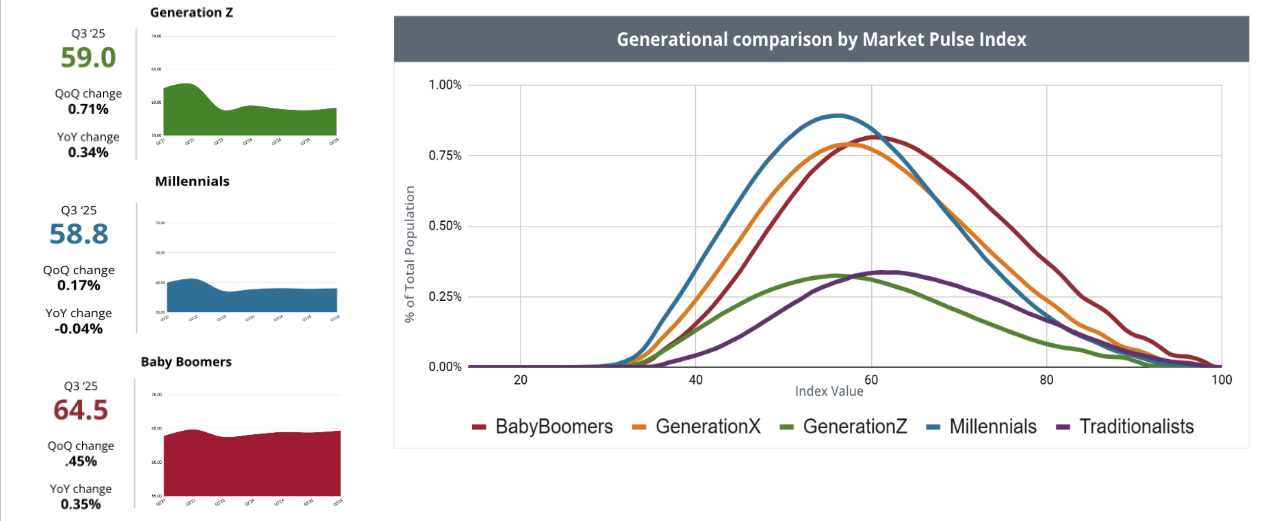

Stabilizing Financial Health: The Q3 2025 Market Pulse Index shows a slight increase to 61.6, suggesting potential financial stabilization among vulnerable credit tiers, though a "K-shaped" economy continues to impact younger generations differently than older ones.

-

Rising Debt and Shifting Originations: Total U.S. consumer debt has surpassed $18 trillion as of November 2025, with auto originations seeing a 5.7% year-over-year balance increase driven largely by banks and subprime volume.

The January Market Pulse webinar showcased insights from Equifax Senior Advisor Jesse Hardin around current consumer credit trends.

Q3 2025 Market Pulse Index Insights: Examining the Financial State of the U.S. Consumer

As of September 2025, the Market Pulse Index, which measures U.S. consumer financial health on a scale of 1 to 100, with 100 representing the greatest financial strength, measured 61.6 when averaged across the entire U.S. consumer population, a slight increase quarter-over-quarter and year-over-year. The current Index may be an early indication that portions of the most vulnerable credit tiers are seeing some level of financial stabilization.¹

According to the latest Index report, older generations are seeing a

stabilization of accumulated assets. Meanwhile, younger generations

continue to experience impacts from the current K-Shaped

economy.¹

Reactive strategies can’t keep pace with shifting consumer behaviors. Watch our Credit Trends Video to instantly identify emerging portfolio risks and growth opportunities before the market moves.

January 2026 Key Insights: Today’s Consumer Credit Trends

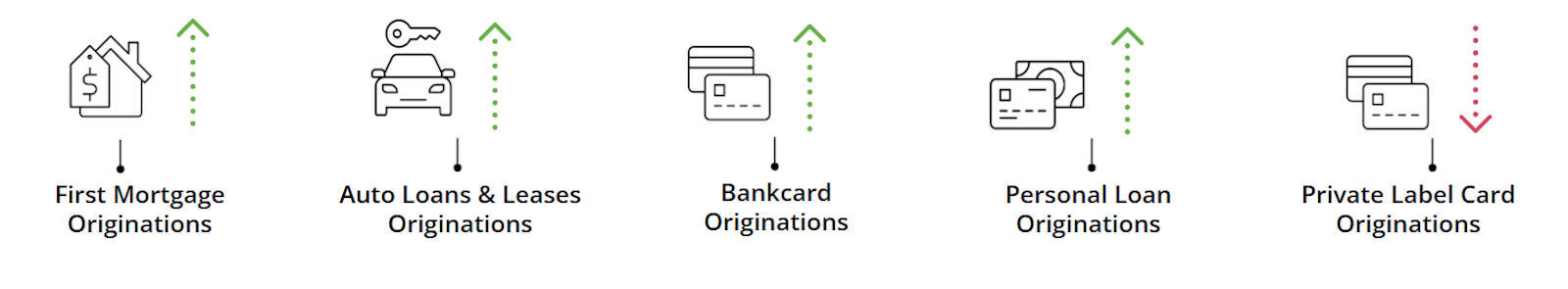

Through September 2025, consumer originations rose

year-over-year across all lending categories, but Private Label Card

was lower year-over-year.² As of

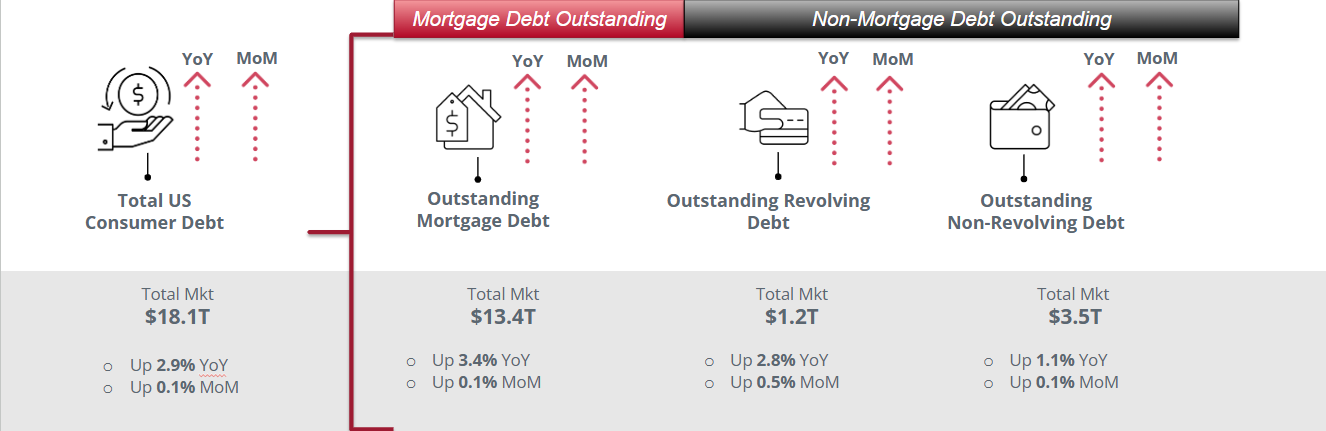

November 2025, outstanding mortgage (including first mortgages,

HELOCs, and HELOANs), revolving consumer debt (including bankcard,

private label cards, and other revolving products), and non-revolving

debts (including auto loans and leases, student loans, and personal

loans) continue to climb year-over-year, with overall U.S. consumer

debt standing over $18 trillion.³

As of

November 2025, outstanding mortgage (including first mortgages,

HELOCs, and HELOANs), revolving consumer debt (including bankcard,

private label cards, and other revolving products), and non-revolving

debts (including auto loans and leases, student loans, and personal

loans) continue to climb year-over-year, with overall U.S. consumer

debt standing over $18 trillion.³

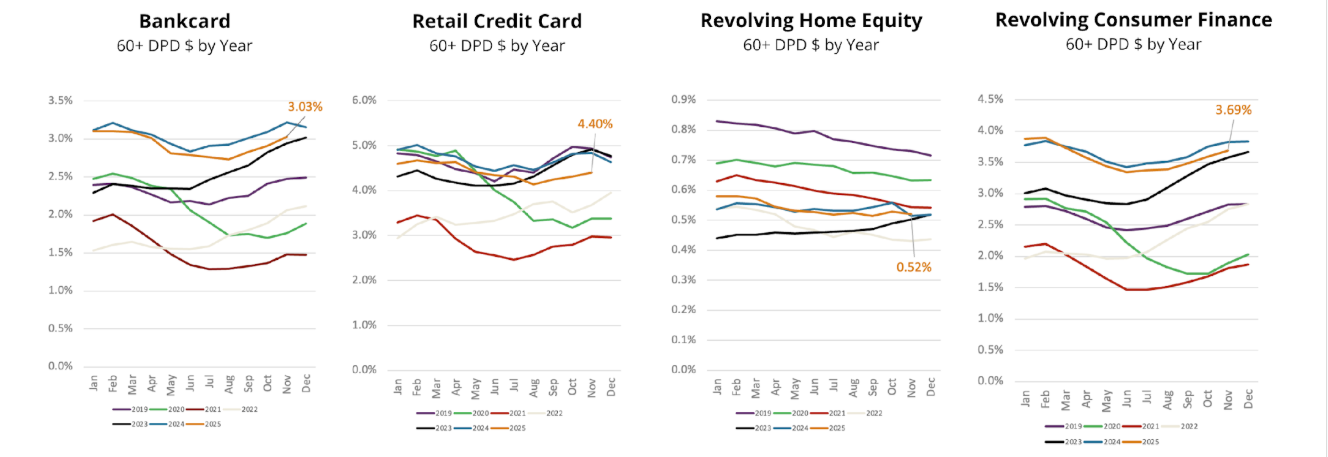

As of November 2025, bankcard and retail credit card delinquency are

trending lower than the previous year. Revolving home equity

delinquency are still well below than prior years.³

November 2025 saw first mortgage delinquency continuing to increase,

while auto and unsecured personal delinquencies are trending below

2024 levels. Student loan delinquency continues to fall.³

January 2026 Key Insights: Today’s Auto Industry Trends

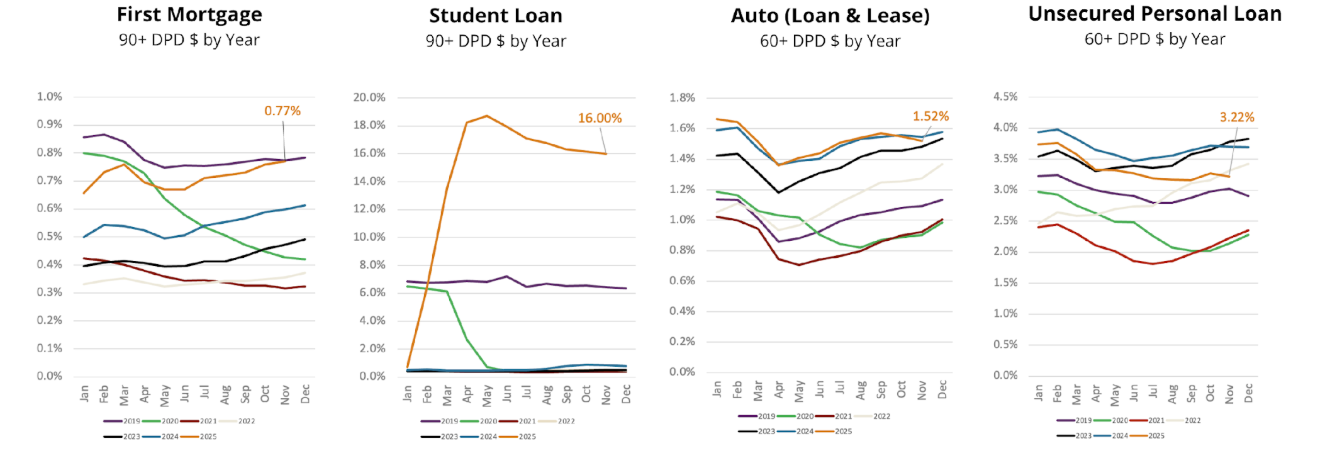

Auto originated balance was up 5.7% year-over-year, while

the number of accounts increased 1.4%, with subprime originations

making up 16.7% of origination volume and representing a 6.3% unit

increase year-over-year, which is an increase of 4.1%

year-over-year. Banks are leading growth, up 15.4%

year-over-year.⁴

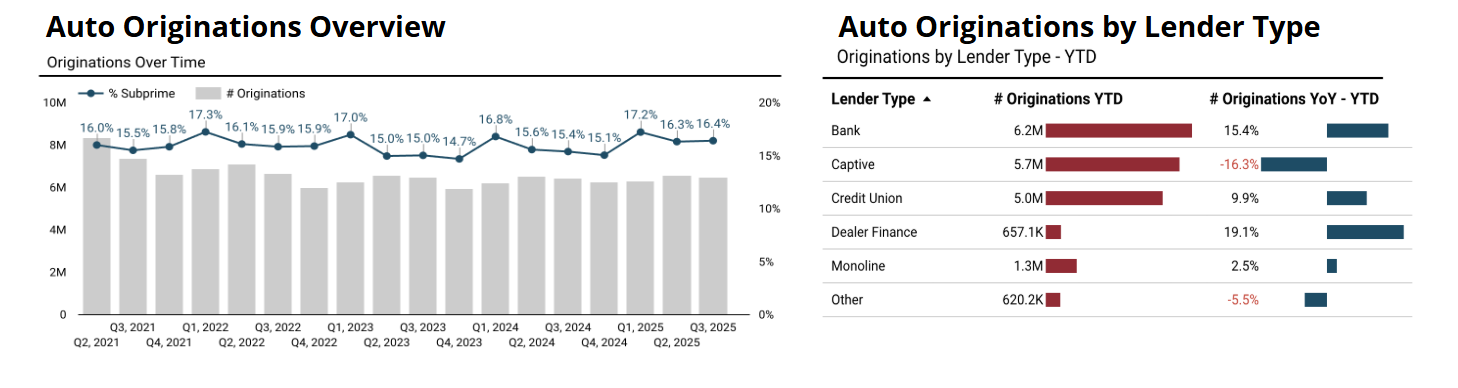

Baby Boomers are originating more auto loans with banks and

captives, while Gen Z are originating more loans with credit unions

and millennials are originating with banks and dealers.⁴

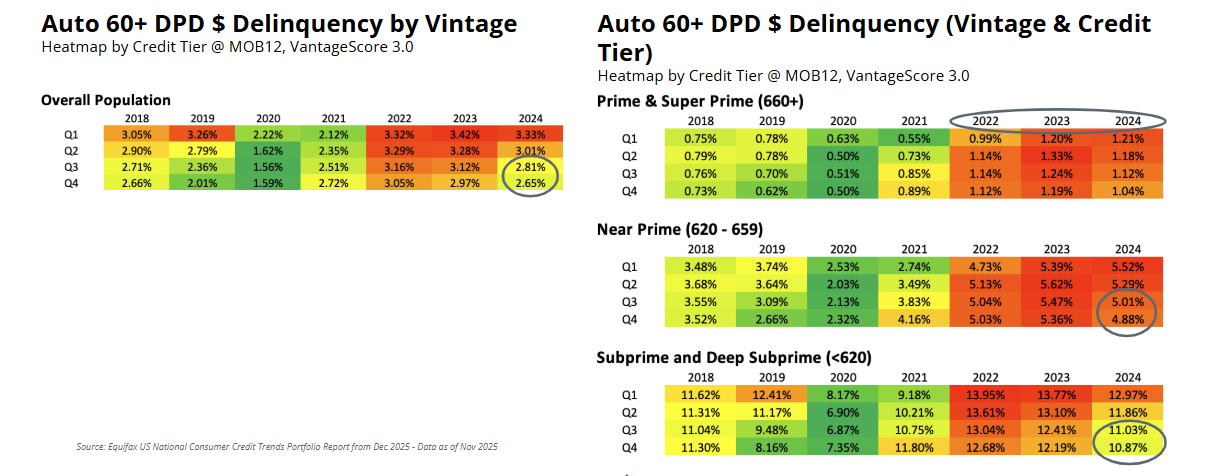

2022 and 2023 auto vintages continue to perform worse than

pre-pandemic and pandemic vintages, but newer vintages are showing

more normal trends.³

Keep Your Business Goals Within Sight

Find our monthly Small Business Insights, National Consumer Credit Trends reports, the Market Pulse podcast, and more at our Market Pulse hub.

Broaden your perspective with insights that inspire bold innovation, confident adaptation, and decisive leadership through Trend and Insights.

Sources:

-

Equifax Monthly Market Pulse Auto Insights Report from January 2025 - Portfolio Data as of November 2025 and Origination Data as of September 2025

(c) Equifax Inc. 2025. All Rights Reserved. The statistics provided herein are for informational and illustrative purposes only and shall not be used for any other purpose.

*The opinions, estimates, and forecasts presented herein are for general information use only. This material is based upon information that we consider to be reliable, but we do not represent that it is accurate or complete. No person should consider distribution of this material as making any representation or warranty with respect to such material and should not rely upon it as such. Equifax does not assume any liability for any loss that may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice. The opinions, estimates, forecasts, and other views published herein represent the views of the presenters as of the date indicated and do not necessarily represent the views of Equifax or its management.

Recommended for you