How to Build Business Resilience with Small Business Data

Small business continues to dominate news headlines. Each month, we release the latest Equifax small business lending, delinquency, and default data—known as our Small Business Indices. We analyze specific industries and regional trends with an eye toward implications for the commercial credit markets.

What Are the Small Business Indices?

What are the Small Business Indices and what do they measure?

Our Small Business Indices are a measure of small business loans in the U.S. Updated monthly, these indices share the pulse on not only the economy, but also the general lending landscape across different industries. Additionally, the Small Business Indices pull data from a vast array of sources and give a full picture of the lending market. That way you can develop the perspective to make informed decisions.

Who is the Small Business Lending Index for?

With one of the largest databases in the US, the indices are optimized for economists, policy makers, lenders, equity hedge funds, and government entities.

Key Definitions

Small Business

For the purposes of the indices, we define a small business for any given month as any borrower that owes less than a million dollars across the Equifax credit and payment database.

Small Business Lending Index (SBLI)

Volume of new commercial small business loans and leases issued over the past 30 days in the US and Canada.

Small Business Delinquency Index (SBDI)

The percentage of small business loans more than 30-90, 91-91-180, and 31-180 days past due in the US and Canada, according to Equifax commercial data.

Small Business Default Index (SBDFI)

The percentage of small business loans and leases that have defaulted within the last 12 months in the US only, according to Equifax commercial data.

Data-Based Decision-Making

How can organizations use the Small Business Indices?

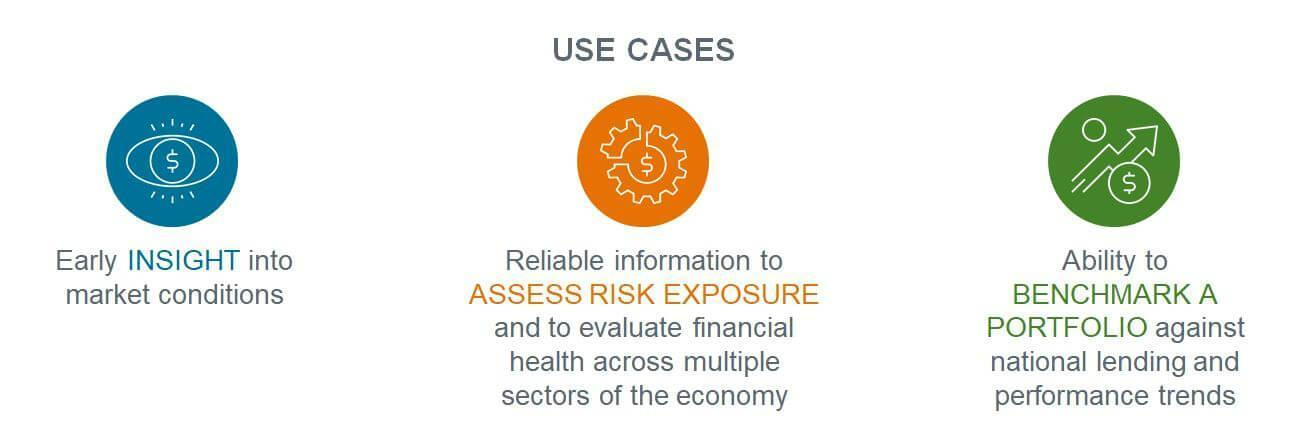

Because small businesses generally respond to changes in economic conditions more rapidly than larger businesses do, the Small Business Indices serve as a leading indicator of the economy. Equifax Small Business Indices provide insights to executives, economists, policy makers, investors, and regulators. These insights help them understand each stage of the business cycle and set credit oversight policies. In order for organizations to set policies effectively, it is important that they have:

-

Early insight into market conditions

-

Reliable information to assess risk exposure and to evaluate findings across multiple sectors of the economy

-

The ability to benchmark a portfolio against national lending and performance trends

How can a lender use these types of indices and models?

Lenders can use the Small Business Indices in many different ways, including to benchmark their own origination and performance trends, to set credit policies, and in their own model builds.

A Case Study Example

One Equifax customer is a national lender who is using the Small Business Indices data on a monthly basis to benchmark their portfolio.

First, decision-makers at the organization look at the Small Business Lending Index to see where lending is diminishing or going up, both regionally and by industry. They look at lending activity in certain states with their footprint to determine where they should increase marketing efforts or scale back their business. They look at lending activity by industry, specifically the industries they focus on.

Then, they look at both the delinquency and default indices to understand where they should be doing more or less business—and adjusting credit policies. It’s a tool that you can utilize to manage your business. Given the uncertainty of the current environment, understanding what's happening in your portfolio is critical.

By identifying overall portfolio risk in conjunction with this data, they can see around corners and stay on top of what's happening. Most importantly, they can understand upcoming trends to get ahead of the game. As a lender, the sooner you understand what's happening in the economy, the quicker you can make more informed decisions.

How to Access the Small Business Indices

How often does Equifax update the Indices and where can users access them?

We publish the indices at the beginning of each month to reflect the most recent changes in the data, and we offer the indices in the form of datasets available for purchase.

You can check out our indices for yourself on our website and on the Risk Insight Suite (RIS). RIS is an interactive platform where users can compare origination, delinquency and default trends across states and industries.

How can you learn more?

Anyone interested can contact their relationship manager if they're already a customer of Equifax. To stay on top of the latest data, click here.

Recommended for you