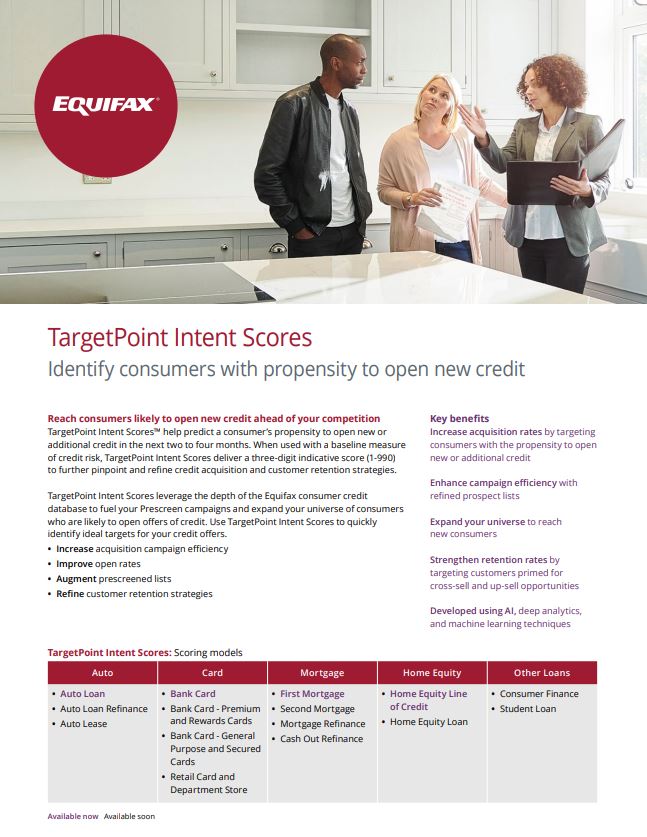

TargetPoint Intent Scores can help credit issuers boost credit acquisition and retain business across best customers. Use the scores to segment consumers by their propensity to open new or additional credit in the next two to four months.

- Leverage industry-specific propensity-to-open scoring models across auto, card, mortgage, and home equity line of credit

- Increase acquisition rates

- Enhance campaign efficiency with refined prospect lists

- Expand your universe to reach new consumers

- Target customers primed for cross-sell and up-sell opportunities

Related Page

TargetPoint Intent Scores