Reach Consumers With the Propensity to Open New Credit

TargetPoint Intent Scores are designed to augment your Prescreen criteria by enabling you to reach consumers that are likely to open new credit in the near future - namely, in the next two to four months. These consumers have the same characteristics as those who recently opened new credit, so they are more likely to be receptive to your offers.

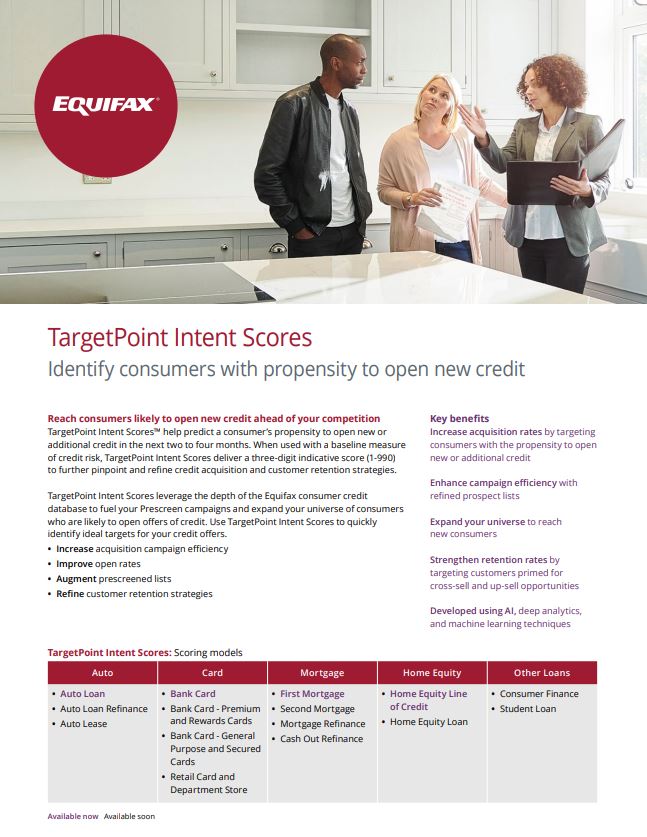

TargetPoint Intent Scores offers multiple product-specific models across auto, card, mortgage, home equity, consumer finance, and student loan. Lenders choose desired models combined with a measure of credit risk in order to enhance targeting criteria for specific campaigns and offers. Use TargetPoint Intent Scores to help gain more new customers and expand current relationships.

One client could capture 50% more loans over its existing response model by using Intent Score - Consumer Finance model

Using Intent Scores to target top 5% of near prime consumers could lead to capturing 60.8% of new auto tradelines opened.

Using Intent Scores to target the top 5% of prime consumers could lead to capturing 18.2% of new bank cards opened.

Equifax analytics and case studies. Results may vary.

Use TargetPoint Intent Scores throughout the Customer Lifecycle

TargetPoint Intent Scores can be used to identify consumers for acquisition, cross-sell, and retention. Fine-tune Prescreen campaigns, reach consumers that might not otherwise be targeted, enhance response models, and inform upsell/cross-sell strategies.

Supplement Prescreen Response Models

Many lenders rely on response models to fuel Prescreen, but there could be room to improve. Discover how one lender could generate 50% more consumer finance loans over existing response model by incorporating TargetPoint Intent Scores — using the same marketing spend.

Reach Consumers Likely to Open New Credit

How It Works

Capture Consumers Who are More Likely to Say Yes to Your Offers

Frequently Asked Questions

Related Resources

Related Products

Combine TargetPoint Intent Scores with TargetPoint Triggers

Boost targeting and response by combining Intent Scores with in-market alerts. Reach consumers with both the propensity to open credit in the near future and who have taken action to open new credit.

Need Help Deciding?