Can You Refinance Your Mortgage to Consolidate Credit Card Debt?

Highlights:

- Refinancing is the process of taking out a new mortgage and using the money to pay off your original loan. Ideally, the new mortgage features lower interest rates or improved loan terms.

- A cash-out refinance — where you take out a new mortgage equal to the amount you owe on your old home loan plus some or all of your home equity — is a common way to consolidate credit card debt.

- Mortgages typically have far lower interest rates than credit cards do. If you're struggling with significant credit card debt, using your mortgage to help pay off your balances may lead to interest savings over time.

If you're a homeowner struggling to pay off credit card debt, you may be overlooking a powerful tool — your mortgage. Under the right circumstances, refinancing your mortgage can help you leverage home equity to consolidate credit card debt. However, the process is not without risks.

How refinancing a mortgage works

When you refinance your mortgage, you take out a new mortgage and use the money to pay off your original loan. Ideally, your new mortgage features lower interest rates or improved loan terms. In this way, refinancing your mortgage may help you save money by adjusting the interest rates or monthly loan payments attached to your current loan.

However, refinancing is not the right solution for every homeowner. First, not everyone will qualify for refinancing. Once you apply, a lender will thoroughly evaluate your financial profile, including your income, credit scores, and loan-to-value ratio (a measurement comparing your mortgage balance to the appraised value of your home). Lenders have different criteria for approval. However, they are generally more likely to approve borrowers with a regular income, home equity between 10% and 20% of their home's value and credit scores of 620 or above.

It's also important to consider the cost of a refinance, which can be significant. The fees alone can amount to between 3% and 6% of your outstanding principal. Your mortgage may also include a prepayment penalty that kicks in if you pay off your old home loan early.

How refinancing your mortgage can help consolidate debt

Consolidation loans, which involve combining existing debts into a new loan, are a popular way to pay off credit card debt. The goal of consolidation is generally to make the repayment process less expensive by securing a new loan with a lower interest rate. It also allows you to combine multiple loan payments, usually to different lenders, into a single payment.

Another option available to homeowners is a cash-out refinance. This type of consolidation allows you to take out a new mortgage equal to the amount you owe on your old home loan plus some or all of your home equity. Your home equity is the difference between your home's value and your mortgage balance. In short, it's the portion of your home that you actually own.

In a cash-out refinance, the bulk of the new loan will be used to pay off your old mortgage. You'll receive the remainder in cash, which will then be used to pay down your credit card debt.

Although the principal on your new mortgage will be higher than your original loan, mortgages typically have far lower interest rates than credit cards do. So, using your mortgage to pay off high-interest credit card debt may lead to serious interest savings over time.

Remember that refinancing is not available for every borrower and often comes with additional fees. So, this kind of debt consolidation is typically only an option if your credit card debt is extensive — think thousands of dollars, not a few hundred. In order to make a cash-out refinance worth the effort, expense and risk, you'll also need to have built enough equity in your home to cover your combined credit card debt.

Pros and cons of a cash-out mortgage refinance

Is a cash-out mortgage refinance the best way to eliminate your credit card debt? No two borrowers are the same, so it's important to consider the pros and cons of this strategy.

Pros

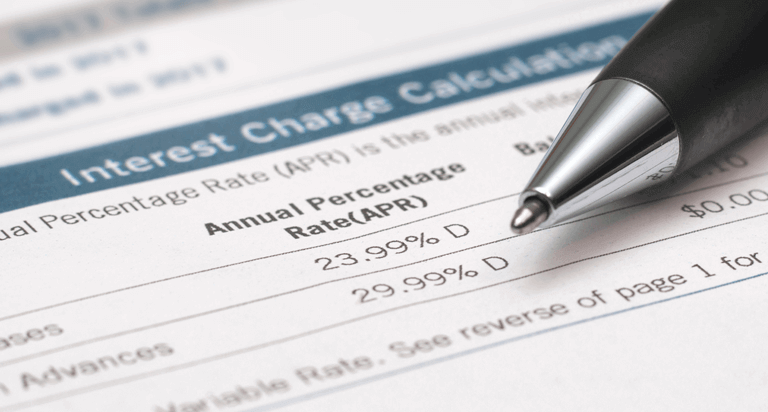

- You may save money with a lower interest rate. Credit card interest rates can be as high as 30%, while mortgage rates are much lower. Cash-out mortgage refinancing can also be less expensive than alternative sources of funding, such as personal loans.

- Paying off credit card debt may increase your credit scores. Using funds from your refinance to pay off credit card debt may impact your credit utilization ratio. Your credit utilization ratio is the amount of revolving credit you're currently using divided by your total available credit. Lenders typically prefer to see a credit utilization ratio of 30 percent or lower. So, using the funds from your refinance to pay off debt can lower your utilization ratio and, in turn, may help improve your credit scores over time.

- You may improve the terms of your mortgage. If financial circumstances have changed since you first took out your mortgage — for instance, if market rates have dropped or your credit scores have gone up — your mortgage refinance may result in more favorable loan terms.

Cons

- You'll lose at least some of your home equity. A cash-out refinance will generally reduce or eliminate the home equity you've built over time. Keep in mind that home equity is a highly valuable asset that strengthens your financial security.

- You may owe more mortgage payments. When you replace your old mortgage with a new one, you effectively extend your loan's term length. For example, if you refinance a 30-year mortgage after five years, you could pay toward your balance for a total of 35 years.

Remember: Refinancing your mortgage can help you address your current high-interest credit card debt. But it won't actually get rid of the debt or prevent you from charging more debt in the future. Make sure to establish positive credit behaviors — like paying your outstanding balance in full each month — to help you take control of your credit card debt for good.

Sign up for a credit monitoring & ID theft protection product today!

For $19.95 per month, you can know where you stand with access to your 3-bureau credit report. Sign up for Equifax CompleteTM Premier today!