How to Pay Off Credit Card Debt Fast

Highlights:

- Because most credit cards have high annual percentage rates (APRs), the debt you accumulate can snowball, meaning the longer your debt sits unpaid, the larger it grows.

- Exceeding your minimum payments each month, targeting one debt at a time to pay off and consolidating debt held across different accounts are all strategies for reducing credit card debt.

- In some cases, credit card providers are willing to work with customers facing financial hardship and may offer repayment plans that allow you to postpone payments or take advantage of a reduced interest rate.

Credit cards can be powerful tools to help borrowers achieve financial goals or build a credit history. However, many credit card users are unaware of how quickly debt can add up. Without careful spending, it’s easy to find yourself facing significant bills.

What is credit card debt?

Credit card debt refers to the amount you owe across one or more credit cards. Your debt may increase as you make new charges with your card, and from the interest that’s charged on what you’ve already borrowed.

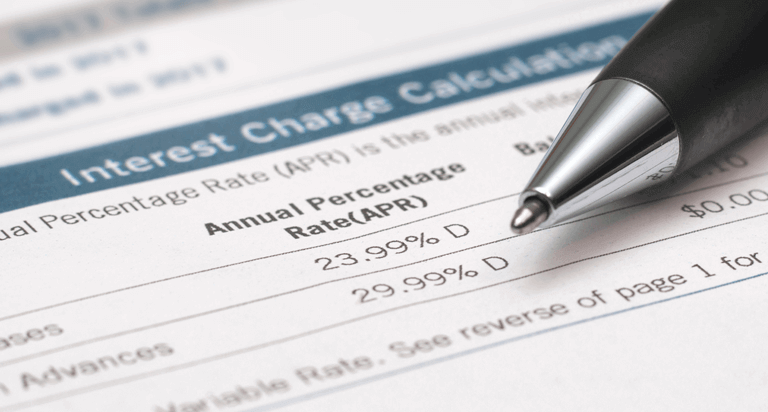

A credit card typically comes with a set interest rate called an annual percentage rate (APR). Your APR represents the total annual cost of borrowing money, expressed as a percentage. Credit card APRs can be substantial, typically ranging between 15% and 20%, and in some cases going as high as 30%.

What’s more, credit card interest is usually compounded daily. This means that any interest you owe is added back to your existing balance and becomes part of the principal. As a result, your credit card debt can grow on a daily basis, even if you haven’t been making additional purchases.

All of these factors together mean that the credit card debt you accumulate can snowball — the longer your debt sits, the larger it grows. So, it’s in your best interest to pay down credit card debt quickly, whenever possible.

Strategies to help pay off credit card debt fast

Are your credit card balances piling up with no relief in sight? These strategies can help you pay off your debt fast and avoid feeling overwhelmed.

1. Review and revise your budget.

When trying to tackle any debt, your first priority should be to make sure you have a budget in place and review it to understand your monthly income and expenses. This can help you avoid creating more debt while you work to pay down what you already owe.

Track your income and expenses over the course of a month to identify patterns of overspending. Look for places where you can divert unnecessary spending toward additional debt payments. For example, you might reduce how often you eat out or cancel unused streaming services. Put any extra cash found from tightening your budget toward your outstanding credit card debt.

2. Make more than the minimum payment each month.

Inexperienced borrowers often find themselves racking up debt by only paying the monthly minimum. Your minimum payment is the smallest amount that you’re required to pay toward your credit card’s balance each month. The credit card company will charge interest on the outstanding balance. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

If eliminating credit card debt is your goal, you’ll need to pay more than your minimum payment. The less you pay each month, the bigger your outstanding credit card balance. The bigger your outstanding balance, the more you’ll pay in interest charges.

Paying only the minimum can create a cycle where your payments end up covering your interest charges, rather than reducing your principal balance. Therefore, it’s wise to pay as much as you can each month to make a larger dent in what you owe.

3. Target one debt at a time.

If you have debt from multiple credit cards, you might start by focusing your payments on just one account. (However, be sure to pay the monthly minimums on any other cards to avoid incurring late fees.)

There are two common approaches to targeting a single card for debt reduction:

- The snowball method has you pay toward your smallest debt first until that card is completely paid off. You then move on to the next smallest debt and the next smallest after that. The idea here is to build momentum in your repayment process.

- The avalanche method has you focus first on repaying your highest-interest debt until it’s completely gone. You then move on to the debt with the next-highest interest rate and so on. Paying more money toward your highest-interest debts may help you save money in interest payments in the long run.

4. Consolidate credit card debt.

Debt consolidation is the process of taking out a new, lower-interest loan or credit card and using it to pay off existing debt. Under the right circumstances, consolidation can make your repayment process less costly than it might be otherwise. Common ways to consolidate debt include the following:

- Balance transfer credit cards. These credit cards allow you to shift old debt onto a new credit card with a reduced APR — sometimes as low as 0%. However, these favorable rates are often temporary. If you fail to pay off your debt before the introductory APR ends, you may find yourself stuck with expensive interest charges. These cards may also come with a costly balance transfer fee.

- Debt consolidation loans. Lenders offer personal loans to borrowers as a way to get rid of high-interest credit card debt with a lump sum of money. Once your credit card balances are paid, you’ll then make regular payments toward your new personal loan over a longer period of time, typically with a lower interest rate than you had on your credit cards.

- Home equity loans. This type of loan could be a good debt consolidation option for some homeowners. However, home equity loans can be risky, as they use your home as collateral to insure what you borrow. If you can’t pay back what you owe, your lender may be able to foreclose on your home.

Before you apply for a new loan or credit card, do the math to make sure consolidation makes financial sense. You’ll also need to look out for introductory interest rates that may expire and fees that can cost you even more money in the long run.

5. Contact your credit card provider.

In some cases, credit card providers are willing to work with customers facing financial hardship. Creditors may offer repayment plans that allow you to postpone payments or take advantage of a reduced interest rate. However, you’ll have to qualify based on your income, debt and other financial details.

Throughout your debt repayment process, it’s also a good idea to keep an eye on your credit reports. You can get free Equifax® credit reports by creating a myEquifax account. Checking your credit reports is an important piece of managing your overall financial health.

Get your free credit score today!

We get it, credit scores are important. A monthly free credit score & Equifax credit report are available with Equifax Core CreditTM. No credit card required.