Is There a Credit Card for People with Bad Credit?

Highlights:

- Even with poor or bad credit, there are still credit card options available to you.

- Secured and subprime credit cards are among the options that may be more accessible to borrowers with poor or bad credit.

- If your credit score isn't where you need it to be, you may be able to use a credit card to establish better credit habits moving forward.

Lenders review your credit score as one significant factor when deciding whether to approve you for new credit. Credit score ranges may vary based on the scoring model used to calculate them. However, most lenders consider a credit score below 579 to be poor.

A poor credit score may suggest to lenders that you've had trouble managing your finances in the past. As a result, you could have a harder time securing a new credit account in the future. If you're on the hunt for a new credit card but struggling with bad credit, keep these strategies in mind.

Can you get a credit card with bad credit?

The good news is that, even with a poor or bad credit score, there are still credit card options available to you — just not as many as you might find if your score were higher. Your credit score is also not a fixed number. It fluctuates over time as your credit history develops. So, if your score isn't where you need it to be, you can use a credit card to establish better credit habits moving forward.

What types of credit cards are good for people with bad credit?

The requirements for credit card approval vary with each card issuer. However, certain card types may be more accessible to borrowers with bad credit:

- Pre-approved offers. Start your search by reviewing any pre-approved credit card offers sent to you by your bank or other reputable financial institutions. Despite how it sounds, a pre-approved credit card offer does not mean you have been fully approved. Instead, it means that a card issuer has reviewed your credit information and determined that you meet at least some of their requirements for approval. You'll still have to complete an application and approval is not guaranteed, but these offers may give you a leg up over other options.

- Secured credit cards. Secured credit cards function much like standard or unsecured credit cards, but they require you to make a deposit up front, usually in the same amount as your credit limit. The lender then uses this deposit as collateral in the event you fail to keep up with your debt payments. With many secured cards, you'll receive the deposit back if you close the account.

Because secured credit cards are backed by the borrower's own money, they can be more accessible to people with bad credit. However, they won't be the best option if you can't afford the up-front payment needed for the deposit.

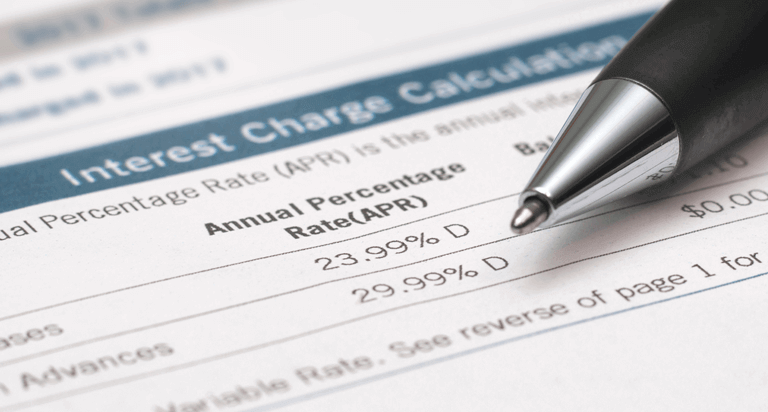

- Subprime credit cards. Some issuers offer credit card options targeted at borrowers with poor or no credit — often referred to as subprime borrowers. In exchange for accessibility, these cards usually carry high interest rates, low credit limits or up-front deposits similar to those required for a secured card. Because of the unfavorable terms attached to them, a subprime card may not be the best long-term option. However, it could be a useful tool to help rebuild your credit in the short term.

- Authorized users. If you can't secure approval for your own credit card, consider becoming an authorized user on the card of a spouse, parent or other loved one. An authorized user is someone added to an account by the card's owner. The authorized user can then use the credit card as if it were their own; however, the ultimate responsibility to pay any charges remains with the primary cardholder.

Authorized user accounts may be included on your credit report, even if the primary cardholder is the only one using the card. If the primary cardholder has a history of responsible credit behavior, that behavior may also positively impact your credit score. But be careful: Negative credit information related to the account could be reflected in your credit history as well, so this strategy works best if the primary cardholder has good credit habits.

Becoming an authorized user is not a replacement for an individual credit card. However, it might help you improve your credit score and make it easier to secure approval for a card of your own.

How to apply for a credit card with bad credit

Before applying for a new credit card, consider taking the following steps:

- Check your credit score and credit report. This can help you get a better sense of your financial situation. You can receive multiple Equifax credit reports with a free myEquifax account. Sign up and look for “Equifax Credit Report” on your myEquifax dashboard. For a free monthly VantageScore 3.0 credit score, click "Get my free credit score" on your myEquifax dashboard to enroll in Equifax Core Credit™. A VantageScore is one of many types of credit scores. You can also visit AnnualCreditReport.com to access a free credit report from each of the three nationwide consumer reporting agencies—Equifax, TransUnion and Experian—every 12 months.

- Do your research before you apply. Take time to compare different credit card options and look closely at the fees and interest rates for each. Credit card applications may result in what's known as a “hard inquiry” on your credit report. Hard inquiries serve as a timeline of how frequently you've applied for new credit and may stay on your credit report for two years, although they typically only affect your credit score for one year.

Too many hard inquiries too close together could negatively affect your credit score and suggest to lenders you're looking for more credit than you can reasonably pay back. Try only to apply for cards you're interested in and don't apply for more cards than you need as each application may impact your credit score.

If you have a poor or bad credit score, a credit card isn't outside of your reach. However, it's important to do your research before applying so that you can make the best decision for your credit health moving forward.

Get your free credit score today!

We get it, credit scores are important. A monthly free credit score & Equifax credit report are available with Equifax Core CreditTM. No credit card required.