Getting a Credit Card: 4 Things for Young Adults to Know

Highlights:

- Young adults who may not know how to use credit cards can experience financial trouble.

- As a first step, check to see if you need a credit card.

- Plan for how you're going to make the credit card payments and shop for the right card for you.

Being a young adult can be a fun and exciting time. They may be going off to college or moving out on their own. Regardless of their next step, they will be responsible for their finances for the first time. But young adults who may not know how to manage money and how to use credit cards may find themselves in trouble.

Here are a few things to know when it comes to credit cards.

1. Consider if you need a credit card

First, think about whether you need your own credit card — and be honest. What do you need the credit card for? Do you have a job and a strategy for paying back any debt you might accumulate? Do you know how to save for emergencies? These are important things to consider when you're deciding to get a credit card.

If you aren't ready to get a credit card yet, there are some alternatives. If you want to start to build a credit history, become an authorized user on a parent or guardian's credit card. That means you're added to a primary credit card account. The account will show on your credit reports if the credit card company reports to any of the three nationwide credit reporting agencies. These include: Equifax® , Experian® and TransUnion® — (NCRAs) bureaus. Authorized users aren't responsible for the financial obligations on the account. But, they can benefit if the account holder pays off the account balance on time. Authorized user accounts show in your credit reports and build your credit history. It's important that the primary cardholder has a history of responsible credit behavior. This may include on-time payments and a low level of debt compared to available credit. When this happens, the account could also improve your credit scores. If you need a credit card for emergencies, consider an emergency savings fund.

2. Plan it out

Before you apply for a credit card, determine the monthly payments you can afford. What's your monthly income? If you're in college, do you need to budget for books and food? Remember that you need to adjust your spending to match your situation. If you're paying your credit card bills with income from a job, and you need to work fewer hours during exam time, for instance, you will have less money to spend.

3. A word about minimum payments and debt

The required minimum payment is included in the monthly credit card statement. The minimum payment is the lowest amount you can pay each month and not have late fees. If you miss a credit card payment by 30 days or more, the late payment may have already been reported to the NCRAs and will remain on your credit reports for seven years. It is always best to pay off the balance in full every month. If you only make the credit card minimum payment, significantly more interest will build by carrying a balance on the credit card over time. Paying only the minimum amount increases the length of the debt and the amount of money you'll end up spending.

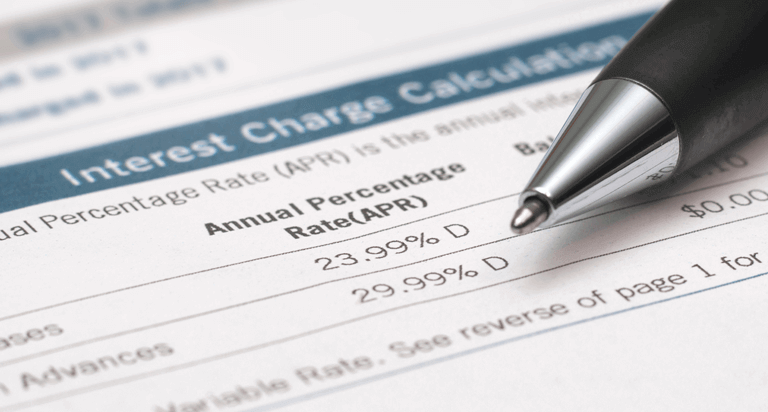

Lenders and creditors are required to tell you on your credit card statements how long it will take you to pay off your debt if you only make the minimum payment. Besides paying back what you borrow, you also pay interest on any balance remaining at the end of each month. Interest is the price you pay to borrow money. If you only make the minimum payment, and you have a balance at the end of the month, the lender will charge interest. The more interest you incur over time, the longer it will take you to pay off what you owe. Remember that the way you use credit now may affect your future.

4. Learn how to shop around for the right credit card

Are you in college and looking to get a credit card? Some financial institutions offer credit cards to help you build a credit history.

Anyone under age 21 needs a co-signer. The only exception is if you earn enough yearly to show the credit card issuer that they can repay the balances. But it's still important to review any credit card offers you may receive. Make sure you understand all the terms mentioned in the offer. Look into any promotional interest rate that may expire and later increase.

When you apply for a credit card, the company will review one or more of your credit reports from the three NCRAs. That's known as a “hard inquiry.” Several hard inquiries at the same time may impact credit scores. That's why it's not a good idea to apply for many credit cards at the same time.

If you decide to get a credit card, ask the credit card company if they report to any of the three NCRAs. Then, you can get into the habit of checking your credit reports often. You want to make sure the information is accurate and complete.