What is an APR on a Credit Card?

Highlights:

- Your credit card's APR represents the annual cost of borrowing money. It accounts for your interest rate and any fees associated with the card.

- APRs provide more information about the cost of a loan than an interest rate alone. So, APRs can be a helpful reference when you're comparing different financing options.

- Your credit card's interest rate and APR are typically influenced by your credit scores. So, one way to potentially reduce your APR is to work on improving your credit scores.

Your credit card's annual percentage rate (APR) is a figure that reflects the yearly cost of borrowing money. Ignoring this important measurement can be a costly mistake, so here are a few things to know about the APR on your credit card.

How does an APR work?

Generally speaking, an APR measures the annual cost of borrowing money. It accounts for your interest rate and any fees you pay related to a loan or other type of credit, such as origination fees, closing costs and insurance. APRs may be used to reflect the price of any credit account, including credit cards, loans and lines of credit. But because credit cards don't typically carry the same fees as mortgages and other loans, your credit card's APR may be identical to its interest rate.

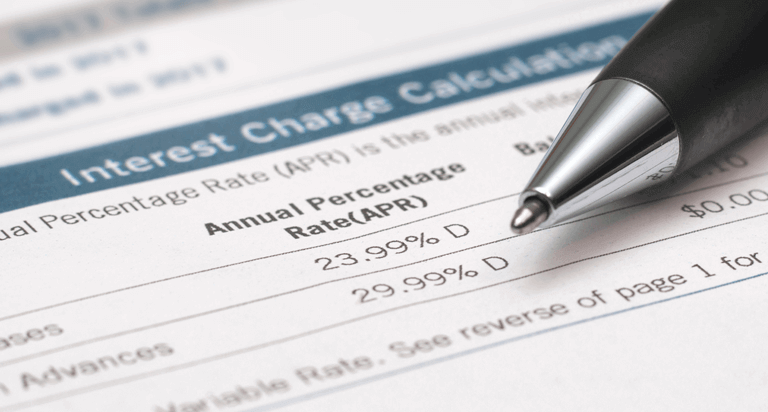

Every credit card comes with an APR, which credit card providers are legally required to disclose to consumers during the application process. Once you've opened a new account, you'll also find your APR listed on your monthly billing statement. It's important to note that your APR can change over time. Your credit card issuer must generally notify you of the change at least 45 days in advance.

What are the types of credit card APR?

Many credit cards actually have several different APRs for different types of card activity. These might include the following:

- Purchase APR. This represents the cost of purchases made with your credit card. You're typically charged a purchase APR only when you fail to pay your outstanding balance in full by the date your monthly payment is due.

- Introductory APR. These promotional APRs apply to your credit card for a limited period after you've opened the account. They're often set much lower than your standard APR — sometimes as low as 0% — in order to attract new cardholders.

- Penalty APR. These rates are typically very high and may be charged when you miss a payment or otherwise violate the terms of your account. The penalty APR takes the place of your purchase APR for a certain amount of time. Credit card issuers generally set their own requirements in order to remove the penalty APR. For example, you might be required to pay the penalty APR for a designated period of time or make a certain number of consecutive, on-time payments.

- Cash advance APR. Some credit cards charge a separate APR for borrowing cash. These rates are typically much higher than your purchase APR.

Understanding your APR vs. interest rate

Like your APR, your credit card's interest rate also represents the price you pay to borrow money. However, interest rates don't include fees, penalties and other expenses. To get a fuller picture of your borrowing costs for a particular account, you should instead refer to your APR.

This distinction means that APRs can be a helpful reference when you're comparing different financing options. For instance, if you plan to purchase an engagement ring, you may debate between using your credit card or applying for a personal loan. A personal loan's administrative fees aren't reflected in its interest rate, but they are included in the loan's APR. So, comparing your credit card's APR to the loan's APR can help determine which form of credit is more cost-effective.

How to get a better credit card APR

Credit card APRs are often quite high, especially compared to other types of credit. And because compounding interest makes it all too easy to rack up unmanageable credit card debt, securing a lower APR may lead to significant savings.

If you're looking to reduce your APR, start by monitoring your credit history and taking steps to improve your credit scores. Because credit scores are typically a factor in setting your APR, higher scores generally qualify you for a lower APR. To help improve your credit scores, focus on improving your payment history and paying off credit card outstanding balances.

If you're looking to add a new credit card to your wallet, shop around by comparing APRs. Many credit cards come with low or 0% promotional APRs intended to entice new customers, but remember that those introductory rates generally jump significantly after a certain period of time. And, when you're using your new credit card to make purchases, keep your APR front of mind. If you do, you'll be better equipped to manage your finances and minimize the cost of credit.