Multi-source Data in One Simplified Output = Faster Decisions

Credit data is the gold standard for credit risk decisioning, but reading and understanding consumer credit data within a credit report can take time and slow down decisioning. When additional data is needed from other sources, such as employment and income, it can further slow the process.

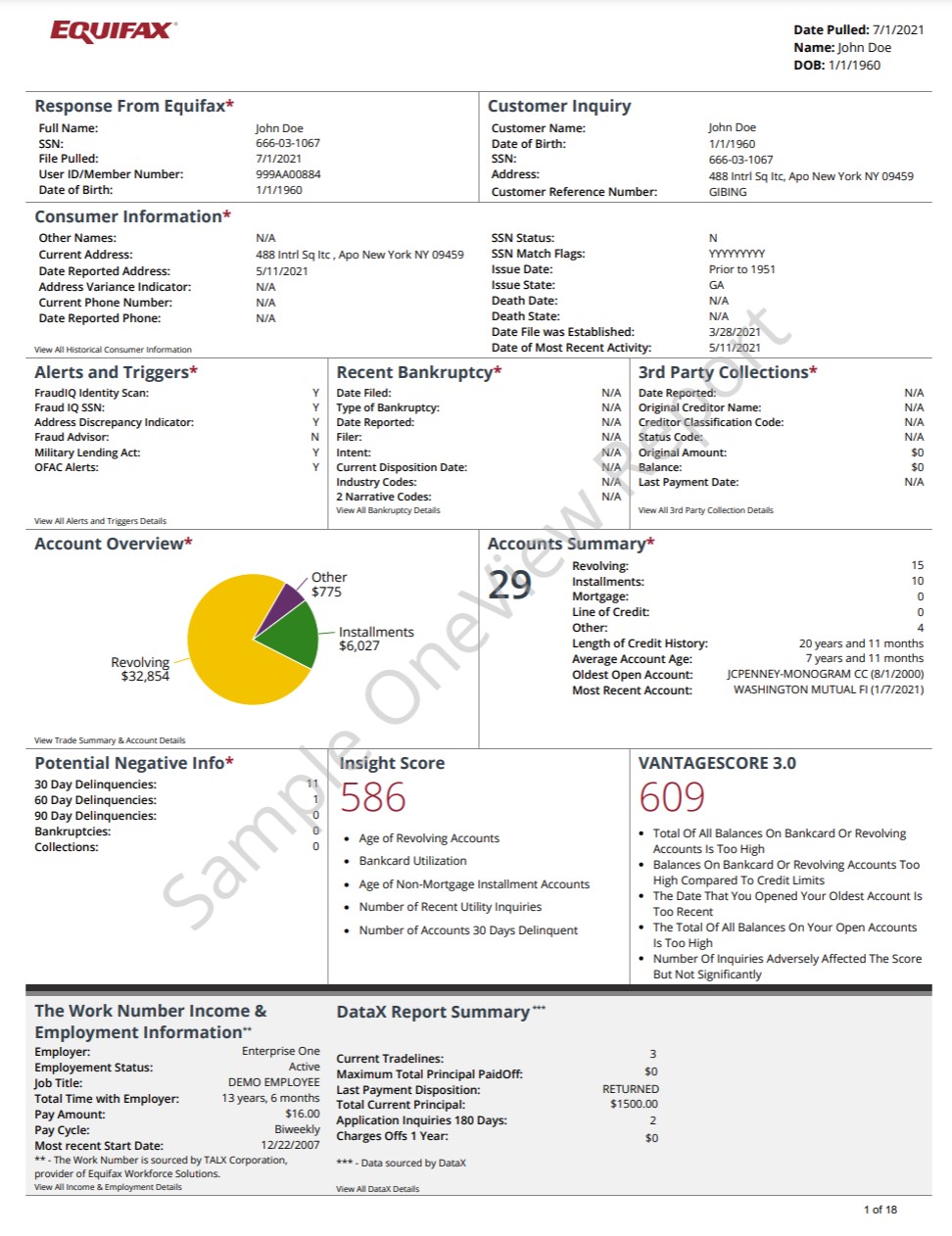

OneView is a groundbreaking solution that helps accelerate and strengthen credit risk decisions by providing expansive data, including traditional consumer credit data, third-party employment and income data and other alternative data, within an easy configurable format. You get the data you want organized in a speed-reading format that’s optimized to promote more informed, faster credit risk decisions, with everything customized to fit the unique demands of your business.

245M+ U.S. consumers are included in traditional credit data, with daily updates from multiple sources.

There are 198M active income and employment records, with data direct from employers via The Work Number®.

OneView reports include 15 core credit category overviews on the first page.

Faster, More Effective Credit Decisions. Smarter Business Growth.

Before OneView, businesses had to piece together consumer file information from disparate sources and try to make sense of all of the information, which was often lengthy and complicated. Now, OneView gives business of all sizes direct access to innovative credit reporting capabilities and dynamic consumer information.

OneView consolidates, streamlines, and simplifies everything in a single format to support faster, better informed credit decisions and smarter business growth.

Win the Race

Make decisions faster—ahead of other lenders—with a customized, streamlined output that features the specific information you need, in the order you want to see it, and how you want to see it with simple text or graphics

Better Control Credit Risk

Easy, One-Stop Access to Multifaceted Consumer Data

To help speed and strengthen your credit decisions, OneView gives you expansive, consolidated view of a broad range of proprietary Equifax data.

The Work Number

With 198M active employment and income records, The Work Number covers more than two-thirds of the non-farm U.S. workforce. It includes employer-provided employment and income data from 4.6M employers across a mix of industries.

Alternative Data

See beyond standard credit with account payment data for "everyday bills" like cable, internet, cell phones, utilities, security services which isn't normally reported in credit files, plus specialty finance data and bank transaction data.

Frequently Asked Questions

Related Resources

Related Products

Understand Your Credit Performance in the Broader Context of the Market

Get an unmatched perspective into anonymous, time-series credit data for the complete U.S. credit file, so you can better understand credit activity across consumer and product segments.

Need Help Deciding?