Innovative Credit and Financing Solutions in India

June 09, 2025

Making an Impact: Expanding Financial Opportunity

How Data and AI Innovation Help Drive Financial Inclusion

February 21, 2025

Enabling Australian homeowners to get the most out of their money

November 19, 2024

A Military Veteran’s Tips for the Civilian Credit Journey

September 30, 2024

Equifax Volunteers: Driving Financial Inclusion

At Equifax, our Purpose is to help people live their financial best—and every day our global employees put that Purpose into action.

July 19, 2024

Alternative Data’s Role in Financial Inclusion

May 06, 2024

Unlocking Economic Opportunities for Formerly Incarcerated People

January 12, 2024

Technology’s Role in Financial Inclusion

Our culture of innovation drives us to constantly innovate new solutions for businesses and government agencies to help them make better, more insightful decisions.

November 12, 2023

Kiwi Kids Learning to Live Their Financial Best

In New Zealand, credit scores and the role they play in accessing credit is not widely known among consumers. However, a partnership between Equifax and financial education platform, Banqer, is working to change that.

November 05, 2023

Supporting Access to Government Benefits

Equifax data solutions streamline access to critical government benefits like Medicaid, SNAP, and TANF through The Work Number, a database with employment records from 2.8M U.S. employers.

October 22, 2023

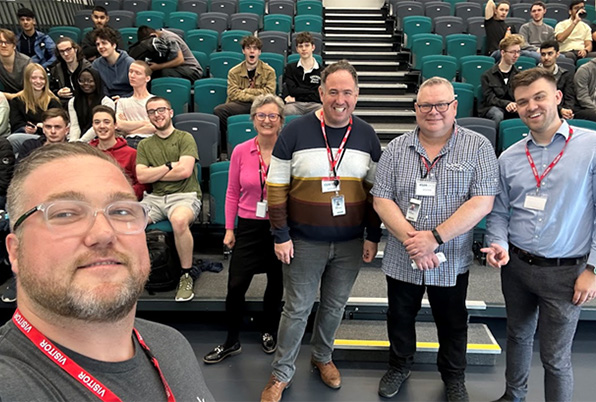

Financial Education for UK Youth

In 2023, Equifax UK partnered with Speakers for Schools to design a financial education outreach program for teenagers in the UK to make informed financial decisions.

August 07, 2023

A Connection to Home Ownership

The Equifax Foundation and Prosperity Connection work together to provide education, coaching, and resources to enhance financial well-being and homeownership opportunities.

June 05, 2023

Consumer Tools & Education Materials

Navigate the path to financial success with the help of educational tools, videos and resources from the Equifax Knowledge Center.

May 22, 2023

Accessing Financial Opportunity via Community Resources

Equifax partners with On The Rise to improve financial wellness and literacy to the Vine City community located in West End Atlanta.

April 21, 2023

Partnering with Academia to Identify Solutions for Underbanked Consumers and Small Businesses

In collaboration with Equifax, Georgia Tech conducts research to improves the financial lives of 63 million Americans and small businesses.

February 20, 2023

Bridging the Gap for Canadian Newcomers and Their Credit

Equifax expands credit access to thousands of Canadian newcomers by using alternative data to provide payment history for those with limited credit histories.

February 20, 2023