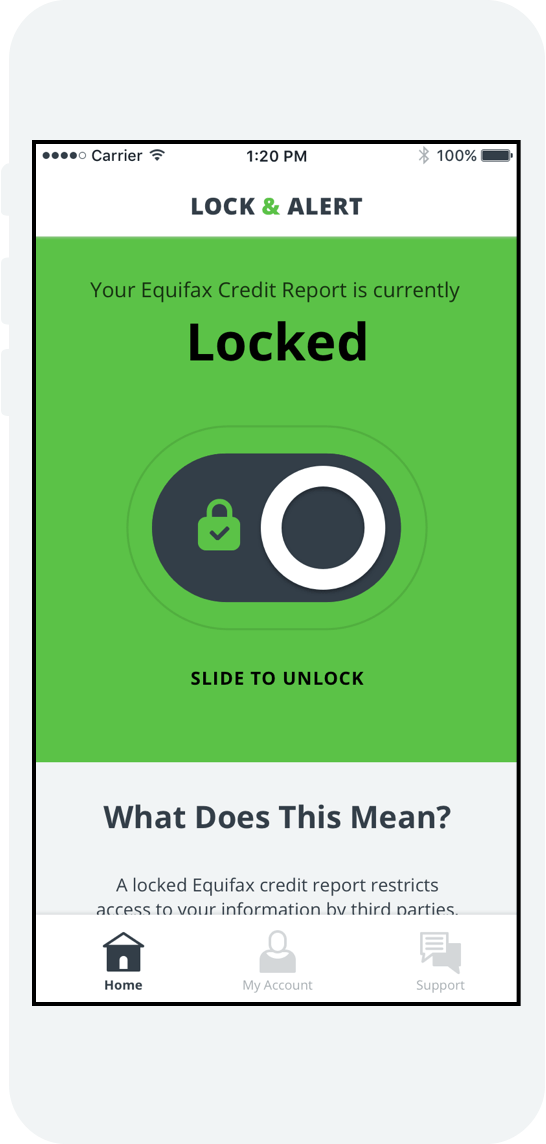

Our easy-to-use app puts control in your hands

The Lock & Alert app makes it convenient to lock and unlock your Equifax credit report.

Get the free Equifax Lock & Alert app:

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.

No, you can only lock and unlock your Equifax credit report with Lock & Alert.

A lock and a freeze have the same impact on your Equifax credit report, but they aren't the same thing. Both generally prevent access to your Equifax credit report to open new credit accounts. Unless you temporarily lift or permanently remove a freeze, or unlock your Equifax credit report, it can't be accessed to open new accounts (subject to certain exceptions). See more about exceptions below.

- Security freezes (also known as credit freezes) are federally regulated and allow you to place, temporarily lift or permanently remove a freeze with a username and password. At Equifax, you can manage your freeze online with your username and password after creating a myEquifax account. Placing, lifting and removing a security freeze is free.

- Credit report locks allow you to lock and unlock your Equifax credit report using identity verification techniques such as a username and password, Touch ID or FaceID technology. The mobile app also can utilize thumbprint and facial recognition verification. With Lock & Alert, you can quickly lock or unlock your Equifax credit report online or via the mobile app. There are no fees to lock or unlock your Equifax credit report if you are enrolled in Lock & Alert.

Please note: You cannot have both a freeze and lock on your Equifax credit report at the same time. If you prefer to switch from one service to the other, you will first need to remove your current service and then replace it with the other.

Exceptions: Freezing or locking your Equifax credit report will prevent access to it by certain third parties. Freezing or locking your Equifax credit report will not prevent access to your credit report at any other credit bureau. Entities that may still have access to your Equifax credit report include:

- Companies like Equifax Global Consumer Solutions, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service;

- Companies that provide you with a copy of your credit report or credit score, upon your request;

- Federal, state, and local government agencies and courts in certain circumstances;

- Companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes;

- Companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe;

- Companies that authenticate a consumer's identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and

- Companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.

Equifax maintains consumers' credit reports and provides information to certain customers, including credit card companies, insurers, and lenders, so they may offer pre-approved offers to consumers as permitted by law. Consumers that prefer not to receive such offers should visit www.optoutprescreen.com, or call toll free at 1-888-5-OPT OUT (or 1-888-567-8688). Consumers may also send an opt-out request in writing to Equifax Information Services LLC, P.O. Box 740123, Atlanta, GA 30374-0123. Consumers should include their complete name, full address, Social Security number, and signature. Equifax will remove the consumer's name from its pre-approved offer database and share the request with the other two nationwide consumer reporting agencies.

Freezing or locking your Equifax credit report will not prevent access to your credit file at any other credit reporting agency. Freezing or locking your Equifax credit report prevents access by potential creditors and lenders, but there are exceptions. These exceptions may include:

- Companies like Equifax Global Consumer Solutions, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service;

- Companies that provide you with a copy of your credit report or credit score, upon your request;

- Federal, state, and local government agencies and courts in certain circumstances;

- Companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes;

- Companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe;

- Companies that authenticate a consumer's identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and

- Companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.

Equifax maintains consumers' credit reports and provides information to certain customers, including credit card companies, insurers, and lenders, so they may offer pre-approved offers to consumers as permitted by law. Consumers that prefer not to receive such offers should visit www.optoutprescreen.com, or call toll free at 1-888-5-OPT OUT (or 1-888-567-8688). Consumers may also send an opt-out request in writing to Equifax Information Services LLC, P.O. Box 740123, Atlanta, GA 30374-0123. Consumers should include their complete name, full address, Social Security number, and signature. Equifax will remove the consumer's name from its pre-approved offer database and share the request with the other two nationwide consumer reporting agencies.

Locking your Equifax credit report is an effective tool you can use to help better protect against unauthorized access to your Equifax credit report and the unauthorized opening of new accounts in your name.

You'll need to unlock your Equifax credit report when you're requesting new credit – for example, buying a car or applying for a loan – and require a credit check. Lock & Alert makes locking and unlocking your Equifax credit report easy: just click or swipe to lock and unlock.

Lock & Alert shows you the most recent status of your Equifax credit report. If your Equifax credit report was locked or unlocked using another product, you will see your credit report in that status when you sign in to Lock & Alert. However, you'll only receive alerts regarding changes in the lock/unlock status of your Equifax credit report if you make the status changes using Lock & Alert.

If you have a lock on your Equifax credit report, you can use Lock & Alert to unlock it. Then you can place a security freeze on your Equifax credit report with Lock & Alert. It’s free to replace a lock with a security freeze.

You can create a myEquifax account with your username and password to remove a security freeze on your Equifax credit report. After you remove the security freeze you'll be able to lock your Equifax credit report. It's free to replace a security freeze with a lock.

Please note: If you temporarily lift a security freeze for a specific date range, locking your credit report through Lock & Alert will cancel the temporary security freeze lift.

Yes, you can sign up for Lock & Alert, but you will need to remove the security freeze before you can lock or unlock your Equifax credit report. You can remove your security freeze online after creating an account on myEquifax.

An existing security freeze will prevent you from taking action such as locking your Equifax credit report. If you want to lock your Equifax credit report, you'll first need to remove the security freeze.

Click here to learn more about how to place, temporarily lift, or permanently remove a security freeze on your credit reports.

Yes. Lock & Alert is only for your Equifax credit report.

Locking your Equifax credit report will prevent access to it by certain third parties. Locking your Equifax credit report will not prevent access to your credit report at any other credit reporting agency. Entities that may still have access to your Equifax credit report include: companies like Equifax Consumer Services LLC, which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service; companies that provide you with a copy of your credit report or credit score, upon your request; federal, state and local government agencies and courts in certain circumstances; companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes; companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe; companies that authenticate a consumer's identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and companies that wish to make pre-approved offers of credit or insurance to you. To opt out of such pre-approved offers, visit www.optoutprescreen.com.