Why Did My Credit Score Drop for No Reason?

Highlights:

- Credit scores may drop if you miss a payment or make a change to one of your credit accounts.

- In some cases, a sudden drop in your credit scores may be due to identity theft.

- Monitoring your credit report is key to noticing changes to your credit scores.

Your credit scores are always changing, whether you use your credit cards often or not. Even simple decisions can cause unexpected shifts. This may cause you to wonder why your credit score dropped. There's always a reason behind the change, making it a good idea to track your scores. Here are some common reasons why your credit scores may have dropped.

You've Missed a Payment

Your payment history is one of the top factors in determining your credit scores. When you borrow money, the lender expects you to make regular and on-time payments until you pay off your balance. Even a single late payment may cause your credit scores to drop.

Late payments mean that you may be having trouble meeting your financial obligations. A late payment can also stay on your Equifax® credit report for up to 7 years. This makes it hard to qualify for new credit. Even if you're approved for a loan or a credit card, you may have to pay a higher interest rate. Lenders usually charge higher rates because they risk more by loaning you money.

You Made a Change to Your Credit Accounts

Late payments aren't the only reason for credit scores to drop. Each credit scoring model uses several factors to determine your credit scores. This includes the length of your credit history and the amount of new credit you have. If you close an account after paying it off, your average age of accounts decreases. This affects the length of your credit history, which may cause your credit scores to decrease.

Every time you apply for a new loan or line of credit, a hard inquiry, or hard credit pull, occurs. A hard inquiry indicates you're seeking new credit. New credit is one of the many factors used to determine your credit scores. By opening a new account, your credit score may see a temporary decline.

Your Credit Utilization Went Up

Another potential explanation is that your credit utilization ratio increased. Credit utilization is the amount of revolving credit you use compared to your total revolving credit limit. For example, let's say you have two credit cards, Card A and Card B. Card A has a $1,000 credit limit and carries a balance of $450. Card B has a $2,000 credit limit and carries a balance of $300. This means your total outstanding debt is $750, and your total available credit is $3,000. Therefore, your credit utilization ratio is $750 divided by $3000, which equals 0.25, or 25%.

Someone Stole Your Identity

If your credit scores drop for no reason, it may be because someone has stolen your identity. Once someone has your personal information, they can cause many financial issues. They may be able to open credit cards, personal loans and other accounts in your name. If they don't pay those debts, your credit scores will drop.

Protect yourself by watching out for these signs of identity theft:

- Inaccuracies on your credit reports.

- Mail or telephone calls from creditors you don't recognize.

- Unexpected credit denials.

- Missing bank or credit card statements.

If someone steals your identity, report the theft. Call (877) 438-4338 or submit an online report at IdentityTheft.gov. You should also contact the three major credit bureaus to freeze your credit.

Have Questions About Your Credit Scores?

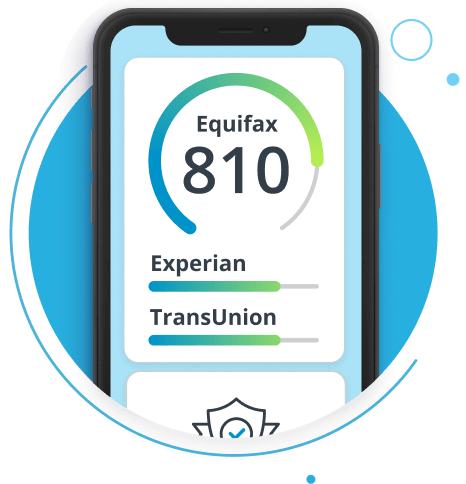

As one of the three nationwide consumer reporting agencies — Equifax, Experian® and TransUnion® — Equifax can help if you have questions about credit scores. Equifax Complete™ Premier combines identity theft and credit monitoring. If your credit scores drop, it will help you to know when it happens and why.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.