Can You Remove Late Payments from Your Credit Reports?

Highlights:

- Your payment history is the biggest contributing factor to your credit scores. Late payments can have a significant impact on them.

- If you pay within 30 days of the original due date, a late payment will generally not show up on your credit reports.

- Late payments may remain on your credit reports for up to seven years. They generally have less influence on your credit scores as time passes though.

When taking out a loan or borrowing credit, it is important to pay what you owe. It's best practice to avoid late payments on loans and credit cards whenever possible. But sudden financial hardship can happen to anyone. It's important to know how late payments can affect your credit scores. Here's what you can do to prevent late payments from showing up on your credit reports.

How do late payments affect your credit health?

Your payment history is the biggest contributing factor to your credit scores. As a result, even a single late payment can harm your credit health. The exact impact of a late payment depends on several factors, like how long the payment has been past due.

Creditors usually don't notify consumer reporting agencies of late payments for 30 days. After that, late payments will appear on your credit reports. When this happens, your credit scores will likely drop. Your credit reports will note how many days the payment is past due in 30-day increments. The longer you take to make the late payment, the more severe the consequences.

The impact of a late payment also depends on where your credit scores were before the late payment. If you have an excellent credit history, one late payment will have a larger impact on your credit scores. If you have a lower credit score, you already have negative credit behavior in your credit scores. If enough time passes without payment, a creditor may use a collection agency or sell your debt to a third party. In this instance, the collection agency or debt buyer may contact you to secure payment. Having a debt in collections can further harm your credit scores.

How long does a late payment stay on your credit reports?

The effects of late payments are long-lasting but not permanent. The credit agencies will remove a late payment from your credit reports after seven years. As time goes on, late payments generally have less influence on your credit scores. It's unwise to leave debts unpaid in the hopes that they will disappear. Debt collectors can still try to recover the debt you owe, which may include legal action against you.

Can you remove late payments from your credit reports?

If you pay within 30 days of the original due date, a late payment will generally not show up on your credit reports. After 30 days, you can only remove late payments that are incorrect.

It's a good idea to check your credit scores and reports often. If you believe any information in one of your credit reports is incorrect, you can file a dispute. Contact both the creditor and the relevant consumer reporting agency. Notify them of information that's incomplete or inaccurate.

What should you do about a late payment?

If you think you may struggle to pay what you owe, contact your creditor in advance. Some creditors may be willing to work out repayment arrangements. This may be especially helpful if you are facing exceptional financial circumstances. By taking action before a late payment, you may be able to avoid damage to your credit scores. Plus, you can get ahead of expensive late fees or penalties. Try to make partial payments, even if you can't afford the full amount. The impact of a single late payment may be manageable. But a series of late payments is likely to have serious consequences.

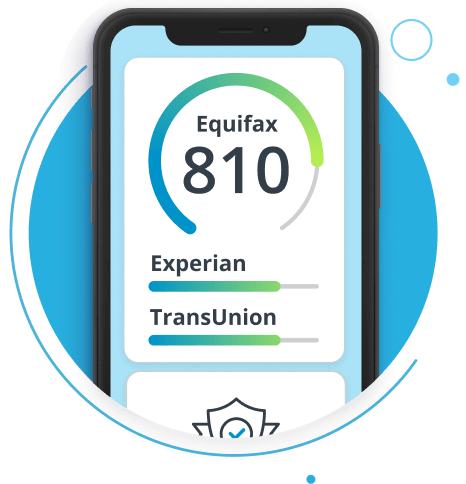

Equifax® can help you track your credit

It's a good idea to check your credit scores and reports often. You can receive free Equifax credit reports with a myEquifax™ account. Sign up and look for "Equifax Credit Report" on your myEquifax dashboard. You can also get free credit reports at AnnualCreditReport.com. Track your credit and help better protect your identity with Equifax Complete™ Premier.

Don't wait another day to build your credit confidence. With Equifax Complete™ Premier, know where you stand with access to your 3-bureau credit report.