Identify Valuable Customers and Build Lasting Relationships

The quickest road to growth is to find your customers who offer the most opportunity to expand relationships. We can help you grow your business and deepen engagement with the right customers – those that can spend, invest, or save more.

With our consumer financial insights and wellness solutions, we empower you to better identify and market to high-potential customers and find customer opportunities that you may have previously overlooked. Work with us to:

- Find customers for cross-sell and upsell efforts

- Identify customers that can spend more with you

- Segment financial customers to bring more assets to your firm and grow share of wallet

- Pinpoint customers with capacity for credit line increases

- Offer solutions to help customers better manage their credit

- Deepen customer connections to build loyalty

Find Opportunities to Grow Relationships

Consumer insights and financial wellness solutions to expand relationships, grow share of wallet, and retain customers.

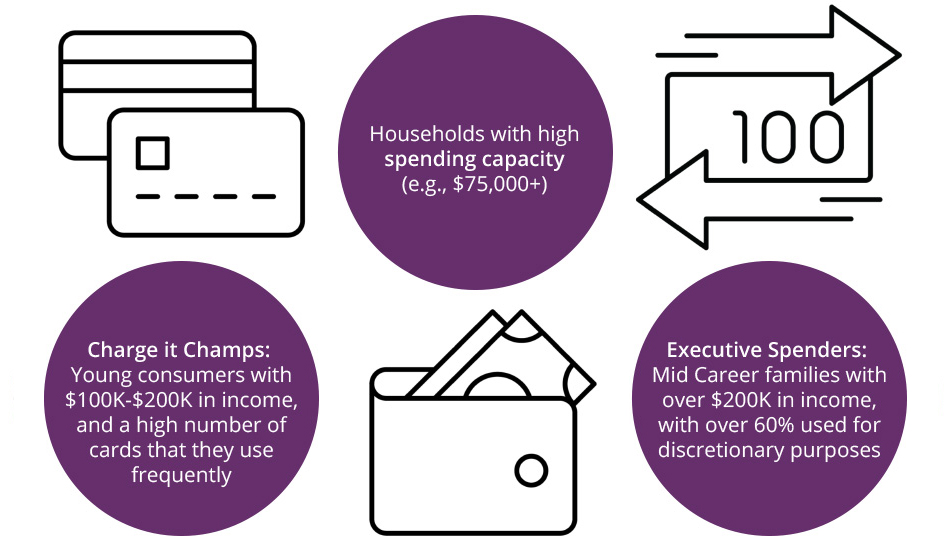

Identify Customers that Can Spend More

Find customers that can increase spending on your products and services with our consumer financial insights. Identify both top customers and occasional spenders that have the financial capacity to take advantage of premium offers, upgrades, and exclusive programs. Plus, prioritize these customers for loyalty programs.

Deepen Lending Relationships

Use account reviews to identify low-risk customers who are a good fit for cross-sell and activation efforts. Identify customers seeking credit at other firms so you can better understand their credit needs. Provide value-added services with our consumer engagement solutions that can help your customers better manage their credit.

Find Customers with Asset Growth Opportunity

Uncover wealthy customers to capture assets and grow wallet share. Use estimated asset measures to identify customers who hold high balances at other firms and thus offer the most potential for asset growth. Discover investment and deposit preferences and behaviors so you can deliver the right offer and message to build relationships.

Expand Relationships to Grow Revenue

One firm gained 100% lift in asset and loan balances using asset-basd segmentation to deliver messages based on financial need.

Consumers are 5x more likely to buy additional products from financial institutions that help them improve financial health.

A bank increased revenue by over $700M by using asset insights to reassign affluent customers to a premium service level.

Source: Equifax analytics and case studies. Results may vary.

Uncover Growth Opportunities and Increase Customer Engagement

Did you know that just 11% of households control 73% of the nation’s wealth? Finding and building relationships with these high spending, high asset, financially resilient consumers can be a challenge.

Equifax can help you shine a light on your customer base. Identify occasional customers that can spend more on your products, financial clients with the potential to grow investments and deposits, or credit customers who are seeking new credit elsewhere. With more insight into your customers’ overall financial picture, you can expand relationships with the right customers.

5 Ways to Deepen Relationships

Learn new strategies using consumer financial insights to elevate sales, grow share of wallet, and retain best customers.

Identify Top Lending Segments

Gain a deeper view of your lending portfolio and identify segments for line increase, usage, cross-sell, or balance consolidation offers.

Tools for Financial Wellness

Customers want help managing their financial wellness. See what they expect from their financial institutions and employers and how you can help.

Related Resources

Target High-Potential Prospects

Target the right prospects and expand your acquisition audiences using advanced consumer financial insights and campaign optimization tools.

Need Help Deciding?