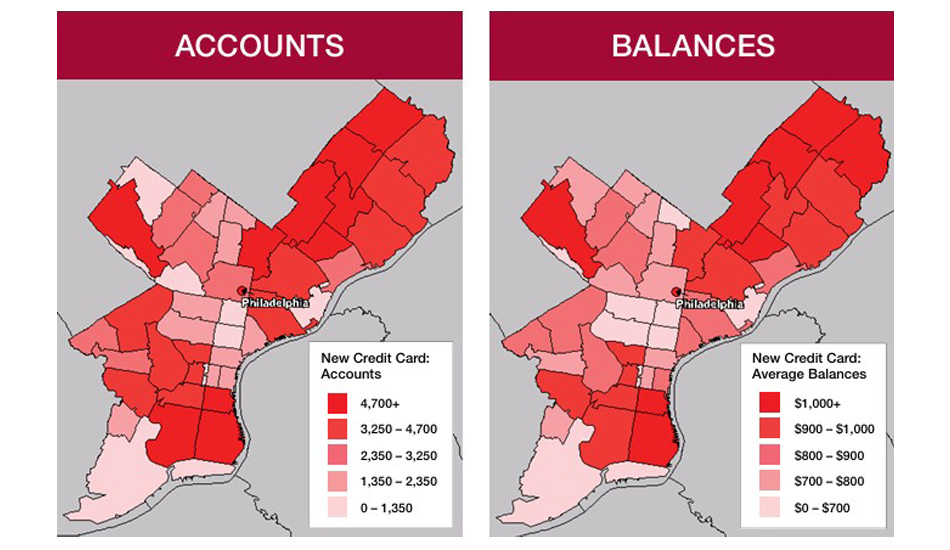

Assess Market Size by Credit and Understand Your Share

With CreditMix, banks, credit unions, lenders, and other financial services firms can evaluate their target markets by outstanding credit — in terms of market size, market share, and credit health. CreditMix can also be used by firms to gain insight into their performance in capturing credit within desired markets and evaluate markets by capacity to pay, financial stress, and credit activity.

CreditMix data is based on aggregated total outstanding credit. Data offered by CreditMix shows both the number and credit balance for hundreds of credit variables including mortgage and non-mortgage categories, mapped and broken down to custom or standard geographic regions.

Enhance Market Analysis with CreditMix

Use CreditMix to better understand market demand for credit products and find opportunities to expand marketing efforts.

Analyze Your Market Performance in Capturing Credit

With CreditMix, companies can gain insights on credit use by region and better understand the consumer credit health within target geographies. Because CreditMix data relies on a foundation of estimates of credit usage at the household level, insights are likely to be more accurate than measures that rely on credit use for individuals that have joint or shared accounts (i.e. a mortgage) which may sometimes overestimate credit use.

Evaluate Capacity to Pay

Use CreditMix to assess whether consumers in a designated market are likely to be able to afford products or services based on their credit card and other credit behaviors.

Analyze Financial Stress by Market

Explore what share of customers are likely to be financially strapped by understanding past due accounts, collections, and bankruptcies within a designated territory.

Track Credit Activity

Assess your firm’s share of the market for recently opened credit accounts across bank card, auto loans, and consumer finance accounts.

Frequently Asked Questions

Related Products

Analyze Market Potential

Explore how our market-level data on consumer assets, credit, and small businesses can help your firm understand trends, assess market performance, and inform regional strategies.

Need Help Deciding?