Target the top 5% of households by Affluence Index and achieve 700% higher purchase amounts compared to lowest 5%.

With economic insights, one firm could narrow its ITA audience by 30% and achieve same or better response and booking rates

Increase revenue up to 25% by using Affluence Index to enhance loyalty program marketing strategies.

Equifax analytics and case studies. Results may vary.

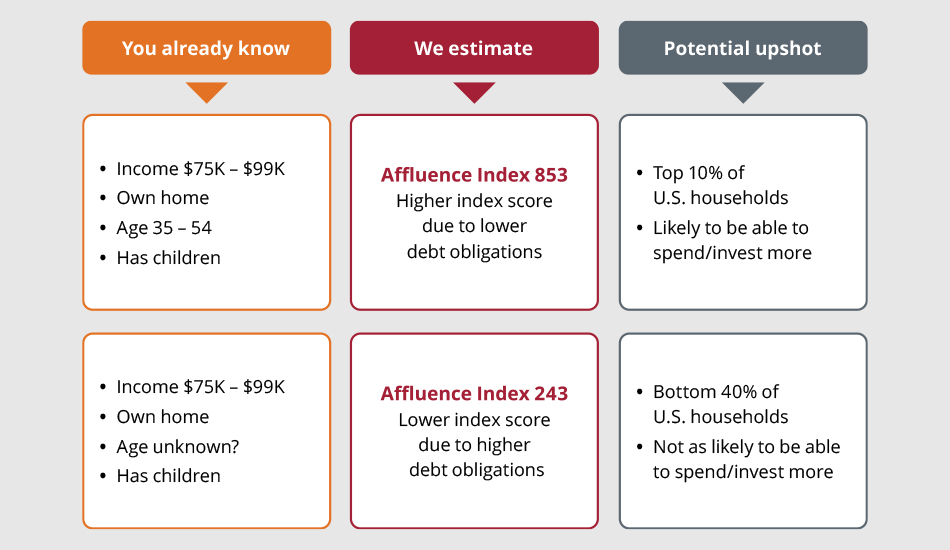

Understand Consumer Affluence

The higher the affluence of a customer, the more likely they will be able to keep spending or investing, despite changing economic conditions. Use Affluence Index to find new customers, drive revenue, and deliver appropriate offers.

Enhance Account Acquisition

Use Affluence Index to expand your universe of potential customers. Find and reach new consumers that are likely to have the capacity to buy your goods or invest with your firm.

Drive Sales and Revenue

As economies fluctuate, better understand who has the ability to spend or invest more and who is likely to be cutting back. Plus create targeted promotions and offers that fit each segment for more effective cross-sell and upsell.

Build Relationships with Affluent Consumers

It is no secret that many consumers look the same when using traditional segmentation measures. That can make it challenging for consumer marketers and lenders to find audiences that have the right financial profile for their promotions. Use Affluence Index to overcome this challenge, reveal consumers that have the right financial profile for their promotions, and apply affluence measures across traditional and digital campaigns.

Used by Many Industries

Affluence Index can be used by retail, auto, travel companies, financial firms, and more. Marketing and analytics teams can use the Index to improve campaign targeting, support Invitation to Apply (ITA), segment before Prescreen, identify new audiences, and tailor messaging.

Enhance Digital Marketing

Affluence Index is also available in an online format to help digital marketers enhance targeting for online campaigns. Use Affluence Index Digital Targeting Segments to focus online ad spend on consumers that likely have the capacity to purchase your products and services.

Leverages DaaS Environments

Easily access Affluence Index in cloud applications or DaaS environments to seamlessly integrate with your data and marketing campaign processes.

Frequently Asked Questions

Explore our Consumer Economic Insights

Our unique insight into the household wallet distinguishes our marketing data from all other options. Discover how our economic insights can help fuel acquisition, cross-sell, and retention efforts.

Need Help Deciding?