Leverage Measured Deposit Insights to Quickly Drive Deposit Growth

Our deposit-gathering solutions can help you capture new deposits — and retain deposits from your best customers.

By leveraging our foundation of anonymous, directly-measured assets and deposits gathered from our network of leading financial institutions, we provide the insights you need to connect with the right consumers, grow your deposits, and better meet liquidity goals.

- Protect current deposits and identify customers with significant deposits held outside your firm

- Target new consumers and small businesses with high deposits

- Reach consumers likely to experience significant deposit growth

- Inform messages to drive cross-sell

- Find high deposit markets and assess your geographic performance in capturing new deposits

Actionable Solutions to Protect and Grow Deposits

Drive deposit growth from customers, prospects, and businesses. Tailor messages and use digital to optimize campaigns.

Retain and Grow Customer and Prospect Deposits

Capture Business Deposits

Enhance Your Deposit Growth Strategy

One firm used our deposit estimates to identify over $14B in deposits held by current customers at other firms.

Use our deposit solutions to find the 9% of households that hold 58% of the nation’s deposits.

One client captured $52M in new deposits by using email prospect lists segmented by household deposit estimates.

Source: Equifax data and case studies. Results may vary.

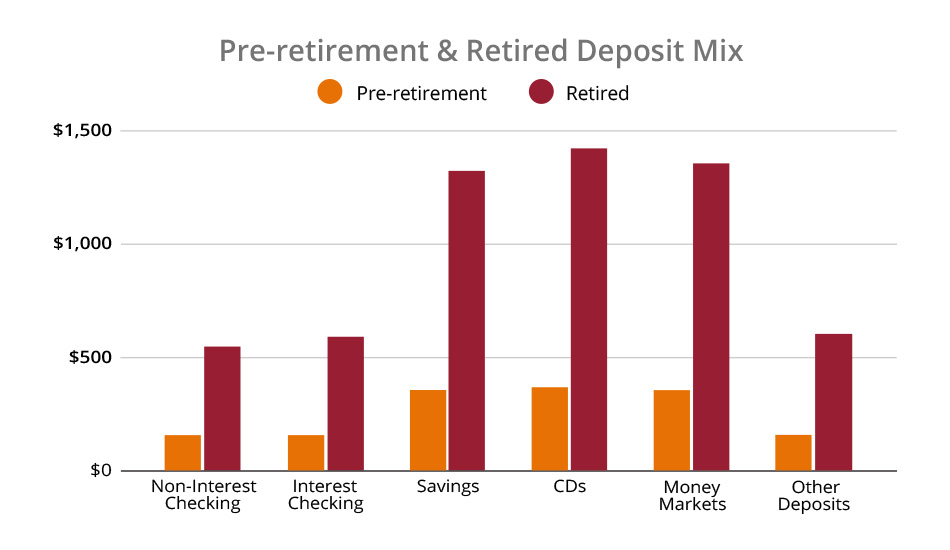

Baby Boomer Deposit Opportunity

Pre-retired and retired consumers hold significant deposits. Tailor high-yield promotions to meet their product preferences.

No One Knows Consumer and Commercial Assets and Deposits Like We Do

We are the only source that provides deposit solutions based on directly-measured wealth.

Our foundation of direct-measured anonymous U.S. consumer assets gathered from our exclusive network of leading financial institutions allows us to provide a unique view into the household wallet - including both investments and deposits. Use this foundation to drive your deposit-gathering strategies and protect deposits amongst best customers.

We also directly measure assets held by small businesses and track information on over 21 million active businesses, enabling you to reach audiences with the most potential to expand business-banking relationships.

Add Deposits to Grow Liquidity

Discover how a credit union quickly captured $52 million in new deposits using email prospect lists segmented by household deposit estimates.

Add Deposits to Fuel Liquidity

Learn how a financial institution identified $14+ billion in deposits held by current customers at other firms and expected to bring over $70 million in new deposits.

Explore Wealth Trends

Discover changes in U.S. household wealth. Learn statistics for Mass Market, Mass Affluent, and Affluent households and find geographies with growing assets and deposits.

Freedom First CU Grows Deposits

Learn how to identify and reach prospective members with significant deposit potential. In this video, Freedom First Credit Union explains how it used WealthComplete® to send emails to a high-wealth group. As a result, they exceeded their goal and gathered over $52 million dollars in deposits in two months.

Related Resources

Expand Customer Relationships

Grow relationships and deepen customer connections. Explore our solutions to help identify accounts for cross-sell, promote usage, and enable customers to better manage their credit.

Need Help Deciding?