Why VantageScore is the Smarter Choice for Modern Credit Decisioning

VantageScore® usage surged +55% in 2024.

Banks and FinTechs use VantageScore 4.0, including the capital markets.

out the top 10 banks use VantageScore in one or more of their product lines.

Expanding the Scorable Population

VantageScore 4.0 utilizes advanced machine learning techniques and a richer dataset to identify creditworthy individuals who were previously overlooked.

Lending and Financial Services

Automating credit approvals and expanding loan portfolios to include a wider range of creditworthy consumers, especially those with thin credit files.

Retail and E-commerce

Offering credit or financing options to a broader customer base, improving customer acquisition and sales.

How Credit Score Competition Is Reshaping the Mortgage Market

Clayton Collins and VantageScore’s Rikard Bandebo discuss what competition in credit scoring means for lenders, originators and homebuyers, and how alternative data like rent and utility payments are opening access to credit.

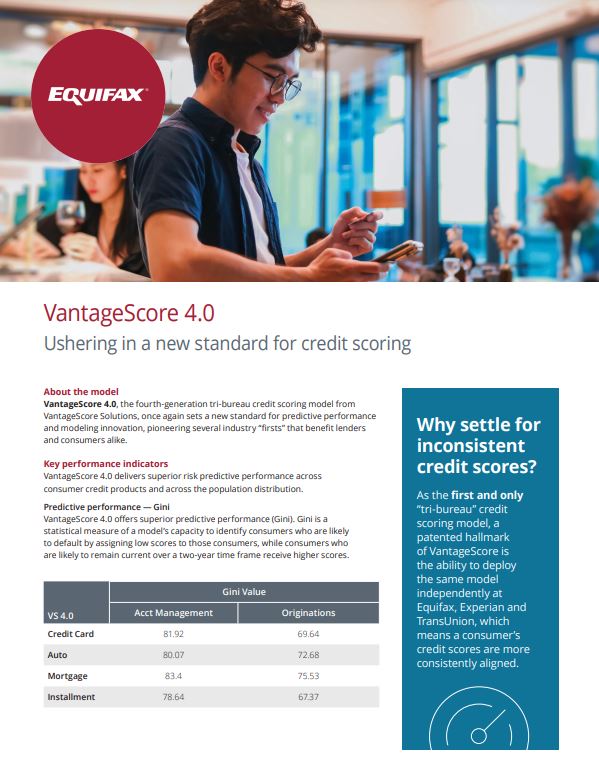

Inclusive, Predictive Credit Scoring for Lending

Data Analysis: Trended vs. Snapshot

First Tri-bureau Credit-scoring Model to Incorporate Trended Credit Data and Alternative Credit Data

This is a monumental leap forward from traditional models that primarily rely on static, point-in-time snapshots of credit history.

Trended Credit Data:

Imagine understanding not just what a borrower's credit utilization is today, but how it has changed over months and years. Trended data provides this historical context, offering a more dynamic view of a borrower's payment behavior, credit utilization, and balances over time.

Alternative Credit Data:

This data includes payment histories for essentials like rental, utilities, and telecommunications. For millions in the U.S., these consistent payments are a strong indicator of financial reliability, yet have historically been excluded from conventional credit scoring models.

Frequently Asked Questions

Related Resources

Related Products

Smarter Investing, Confident Growth

Manage risk and grow your portfolio with confidence using expert insights and strategic tools designed for forward-thinking institutions.

Need Help Deciding?