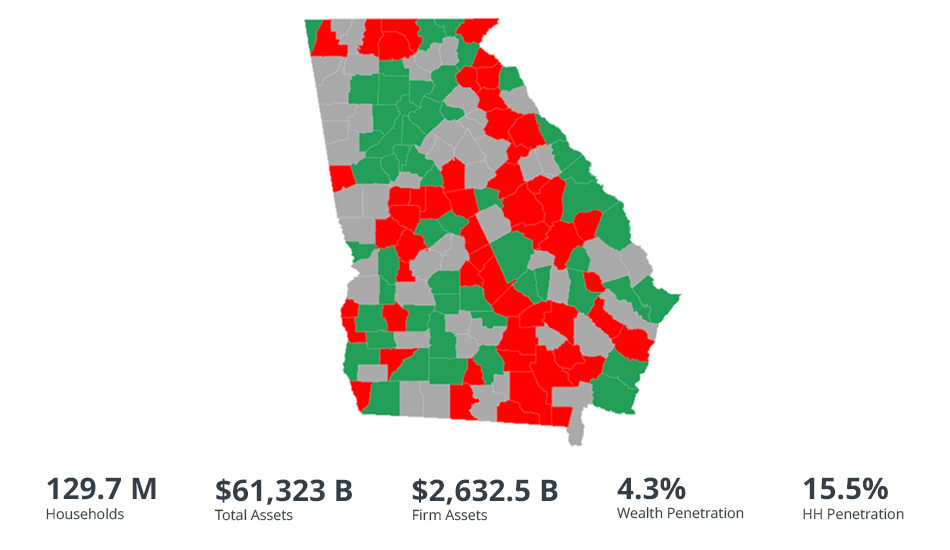

Assess Market Size by Assets and Understand Your Share

Grow Market Share and Inform Branch Planning

With MarketMix Premier, firms can identify growing geographies for assets, investments, and deposit products. Plus, enhance branch planning and resource allocation to meet demand.

Top 10 Bank Redefines Branch Goals

Discover how one bank used MarketMix to segment branches by estimated market-level asset opportunity and discover under and over-performing branch locations.

Spot Change in Demand for Deposits

Banks and credit unions can use MarketMix Premier to compare their portfolio’s distribution of deposit products to the market within target geographies. Discover if demand for CDs, money markets, or other products is increasing to help you capture your share.

Enhance Analysis with the MarketMix App

Analyze Your Market Performance in Capturing Assets

Unlike other market assessment systems that rely on asset estimates or assets by branch location, MarketMix Premier is based on a foundation of anonymous, direct-measured asset data by the household location. This enables financial services firms to better understand where assets are concentrated, which markets present new opportunities from growth in assets, and which markets may warrant decreased focus due to asset declines.

If your firm is seeking a better understanding of its share of assets across regions or wants to find growing markets, improve site location analysis, or better monitor regional sales performance, then MarketMix Premier can help you reach these goals.

Assess Markets by Product Categories

Explore demand for investments across stocks, mutual funds, annuities, bonds, and other securities, plus the total for all. Discover market size, portfolio allocation, and share across investment products so you can better promote desired products across target markets.

Evaluate by Deposit Categories

Examine deposit balances and penetration by market across interest checking, non-interest checking, savings, CDs, money markets, and other deposits. Gain insight on demand by product across target geographies so you can tailor your deposit gathering offers and promotions.

Frequently Asked Questions

Related Products

Analyze Market Potential

Explore how our market-level data on consumer assets, credit, and small businesses can help your firm understand trends, assess market performance, and inform regional strategies.