A Locked File Doesn’t Have to Freeze the Process

Consumers increasingly use credit locks and freezes to protect their credit files. But when those files can’t be accessed, prequalification or credit applications stall—creating a negative experience for both lender and consumer. Precheck from Equifax provides early insight into file status, enabling you to proactively resolve issues before they disrupt the process. The result: smoother workflows, higher conversion rates, and a better customer experience across prequalification, origination, and prescreen.

Precheck in Action

From digital prequalification to in-store origination and prescreen conversions, Precheck helps lenders detect and resolve locked or frozen files early—reducing abandonment and ensuring smoother approvals.

Prequalification

Confirm status before displaying online credit offers.

Origination

Instantly check file access during checkout or dealership financing.

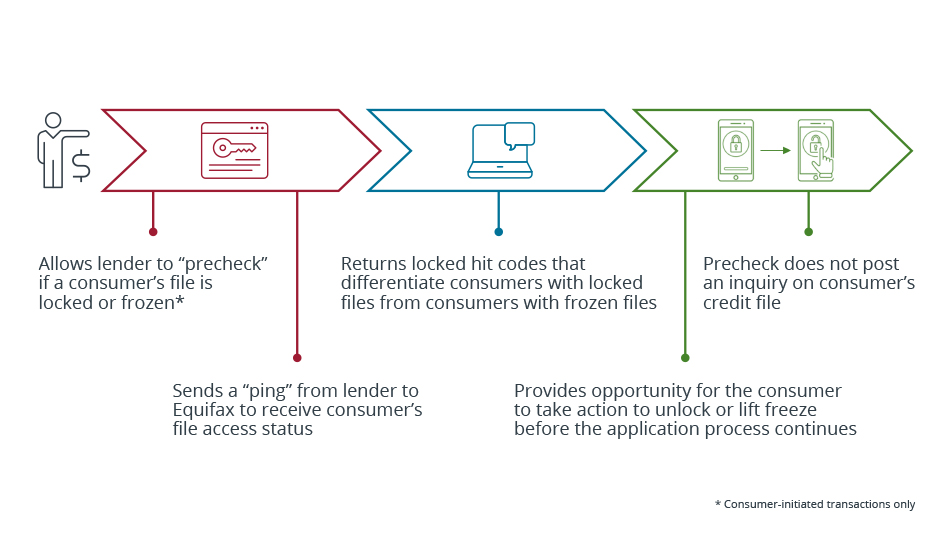

How Precheck Works

Precheck integrates directly into your decisioning workflow. When a consumer applies for credit, lenders send a “ping” to Equifax to instantly check if the file is locked or frozen. If locked, the consumer is prompted to grant access. This proactive step keeps the process moving without generating an inquiry.

Proactive File Verification That Keeps Credit Moving

Precheck gives lenders the visibility needed to avoid stalled applications. By identifying locked or frozen files upfront, you can guide consumers to resolution, reduce frustration, and ensure smoother, faster credit decisioning.

Frequently Asked Questions

Related Products

Explore all the ways Equifax supports credit decisioning with comprehensive data.

Consumer Credit Trends

Explore insights into evolving consumer credit behaviors and trends shaping lending strategies.

Anchor Text

Need Help Deciding?

Connect with our sales team today to get a product consultation.