Bring More Borrowers into View with Alternative Finance Credit Data

The DataX Credit Report provides a more inclusive view of consumer creditworthiness by integrating verified alternative finance data sources such as rent or lease-to-own, short term loans. Designed for fintechs, non-traditional providers, and lenders, it helps businesses evaluate consumers with limited or no traditional credit history, automate credit approvals, and reduce fraud and default risk. With real-time access and a robust scoring framework, DataX empowers smarter decisions and supports greater financial inclusion.

Use Cases Across Industries

Alternative Finance and Specialty Finance

Rapidly assess applicants with limited credit history and automate personal loan approvals.

BNPL Providers

Make real-time decisions at checkout using alternative credit data, expanding access for new-to-credit consumers.

DataX Can Help You Score More Customers

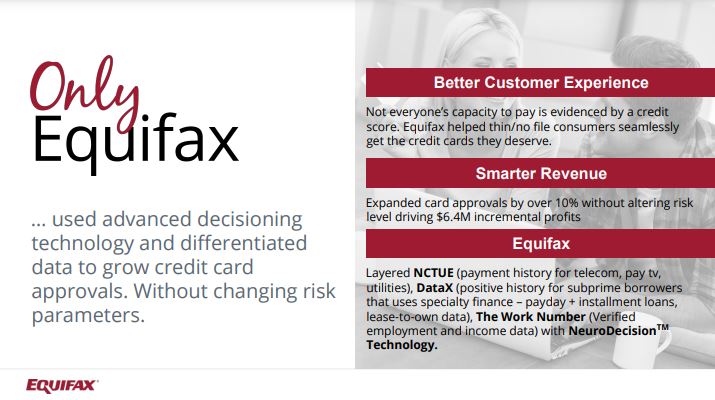

By leveraging unique, exclusive access to industry-leading alternative finance and non-traditional data, DataX helps propel your lending practices by better assessing risk and identifying more prospects and areas for growth.

A Smarter Way to Evaluate New Customers

With verified, real-time alternative data, the DataX Credit Report unlocks lending opportunities that traditional credit reports miss—helping you grow your customer base while managing risk with confidence.

Frequently Asked Questions

Related Resources

Related Products

Explore More Credit Risk Solutions

Improve your credit decisions and risk management. Discover how Equifax solutions help you accurately assess applicants, effectively manage portfolios, and reduce fraud.

Anchor Text

Need Help Deciding?

Connect with our sales team today to get a product consultation.