The Most Predictive FICO Scores Ever—Powered by Equifax

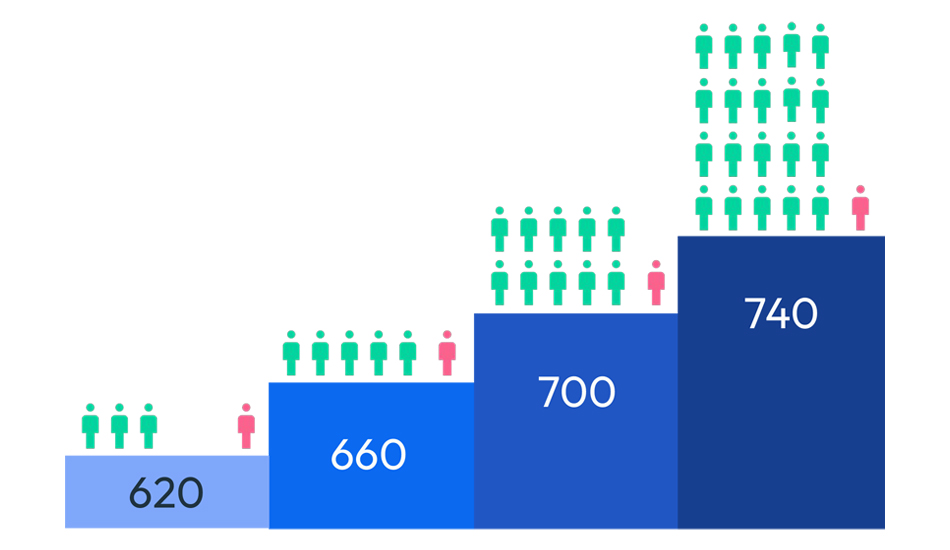

The FICO Score 10 Suite, built on Equifax credit data, outperforms all prior FICO versions in predicting repayment behavior. It includes FICO Score 10, FICO Score 10T (with trended data), and industry-specific scores for auto and bankcard lending. This suite offers lenders flexibility: backward compatibility with prior versions plus enhanced predictive power from trended data. The result is a sharper view of consumer credit risk, helping institutions lower delinquency rates, approve more qualified customers, and deliver consistent experiences.

0

%

Bankcard: 13% delinquency reduction vs FICO Score 8.

+

0

pts

Auto lending: 2.5 KS point gain vs FICO Score 8.

How the FICO Score 10 Suite Delivers

FICO Score 10 and 10T use recent Equifax bureau data to rank-order repayment risk. FICO Score 10T integrates 24 months of trended data, analyzing balance and payment trajectories for deeper consumer insights. Both models generate reason codes and integrate seamlessly into decision platforms, enabling fast, precise credit strategies.

Why Choose FICO Risk Score from Equifax

Equifax and FICO combine unmatched credit data with the most powerful scoring models available. With proven delinquency reductions, stronger predictive lift, and seamless regulatory compliance, the FICO Score 10 Suite empowers lenders to grow responsibly and profitably—no matter the market cycle.

Frequently Asked Questions

Frequently Asked Questions

Related Resources

Related Products

Explore all the ways Equifax helps you assess credit risk:

Market Pulse Credit Trends

Get timely, in-depth analysis on the financial landscape. Our reports and insights on consumer and business credit can help you understand market shifts and make confident decisions.

Anchor Text

Need Help Deciding?

Connect with our sales team today to get a product consultation.