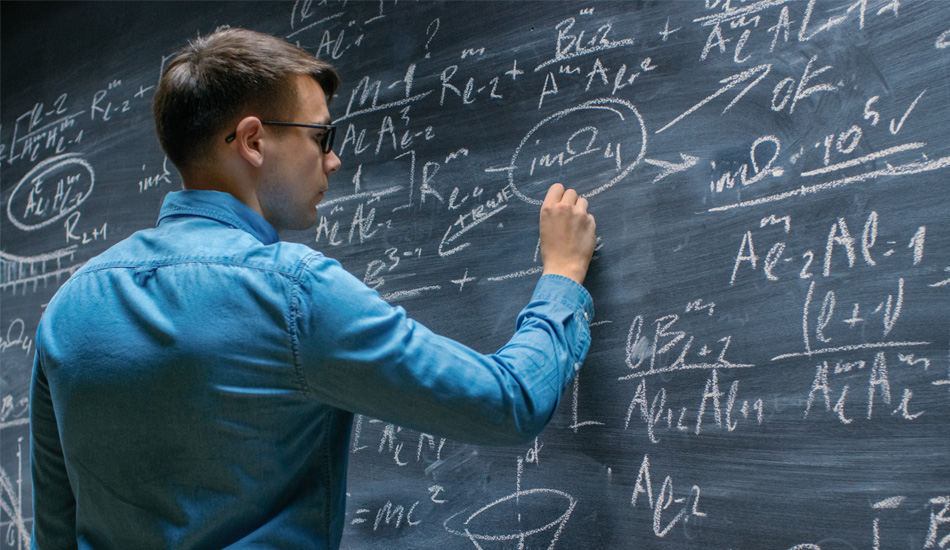

Have Confidence in Consumer Identities with Effective Verification

Digital Identity Trust (DIT) confirms identity authenticity by using multi-dimensional data sources including phone number, email, address, SSN, date of birth and mobile device verification. As more transactions occur over digital channels, it is imperative that organizations can confidently verify the identity of online customers and securely facilitate transactions.

DIT helps ensure the consumer you are engaging with is real, is affiliated with other inputs and has no risk flags present. With DIT, you can proactively mitigate fraud, reduce financial losses and comply with the Customer Identification Program (CIP) and Customer Due Diligence (CDD) portions of the KYC framework.

coverage of US Adults

Up to 97% approval rate based on data inputs provided

reason codes available to identify potential fraud

How It Works

Reduce Fraud Losses and Compliance Risks with Digital Identity Verification

Frequently Asked Questions

Related Resources

Related Products

Digital Acceleration and the Customer Journey

As customer preference for digital transactions grows, businesses are reevaluating what online interactions look like to better serve their customers and also improve the strength of their business.

Need Help Deciding?