Simplify Regulatory Compliance with AML Connect

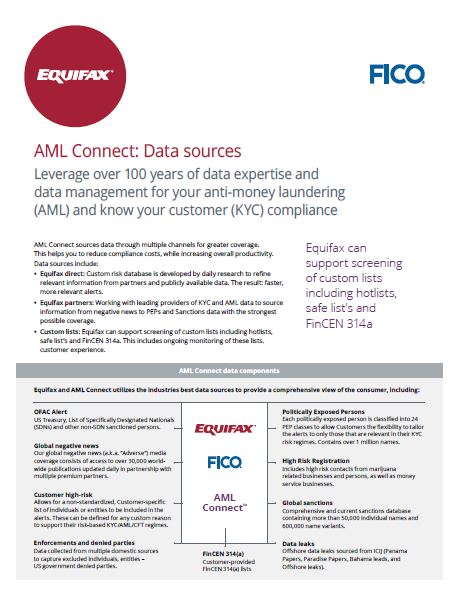

AML Connect uses robust consumer data to deliver a comprehensive, end-to-end Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance service.

A cloud-hosted solution from Equifax provides real-time and batch screening, ongoing portfolio monitoring, and remediation services. We also offer analyst review services helping to ensure you only receive validated alerts.

Streamline AML & KYC with Real-Time Screening and Monitoring

Complex regulations and manual processes can expose your business to risk and impair progress. Our cloud-hosted AML Connect solution provides a comprehensive, end-to-end service for regulatory compliance. Implement real-time screening, continuous monitoring, and expert remediation services to reduce false positives and empower business growth.

Frequently Asked Questions

Related Resources

Complete KYC Coverage from Equifax

AML Connect gives you access to a single, integrated solution that helps you gain a comprehensive view of your consumers. By screening multiple data sources, the solution helps improve your customer due diligence and strengthen the KYC process.

Need Help Deciding?