Small Business Lending Increased in October 2025

THE EQUIFAX OCTOBER SMALL BUSINESS LENDING INDEX (SBLI) showed that nominal small business lending volumes increased 5.9% month-over-month and 2.8% year-over-year. The SBLI three-month moving average increased 0.8% month-over-month and 1.2% year-over-year.

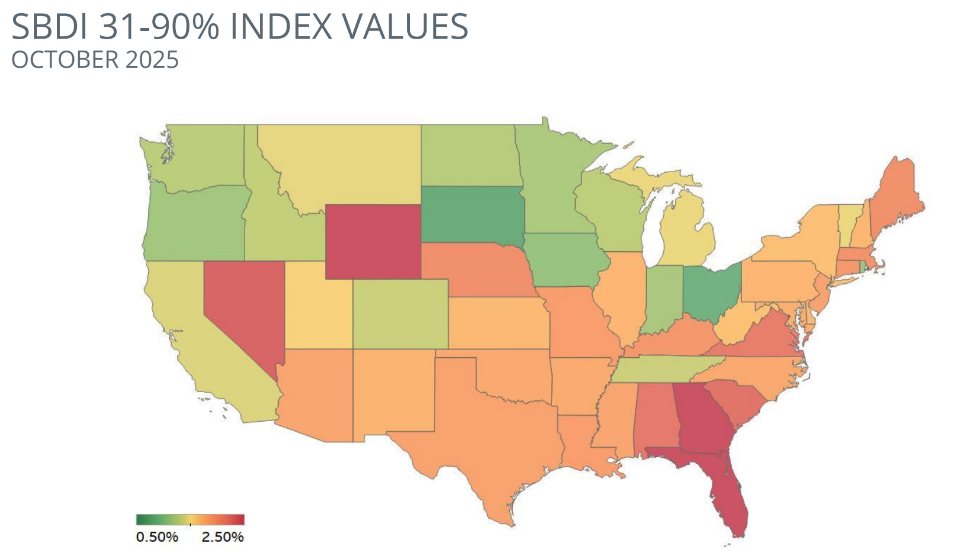

Meanwhile, the Equifax Small Business Delinquency Index (SBDI) 31-90 Days Past Due measured 1.69% in October, down three basis point month-over-month and down 13 basis points from October 2024. The SBDI 91–180 days past due remained level at 0.71% from September 2025 to October 2025. The Small Business Default Index (SBDFI) measured 3.23% and was down six basis points month-over-month.

In October, Small Business Lending increased 5.9% from October and is up 2.8% year-over-year. Small business credit quality continues to improve: while severe delinquencies (91-180) days remain flat, short-term delinquencies (31-90 days) and defaults are falling, with defaults down 20 basis points compared to last October.

Although the U.S. economy has been resilient to a range of headwinds in 2025, there are emerging signs that growth is slowing, particularly among small businesses (which tend to be more exposed to shifts in economic momentum). Looking to 2026, Equifax will closely monitor the Supreme Court’s decision on the legality of emergency tariffs and the extent to which the Federal Reserve continues to ease monetary policy, particularly given the prospect of a new, potentially more “dovish” Federal Reserve chair.

Regional Analysis

Small Business Lending:

In October, 34 states had a year-over-year increase in 12-month rolling lending volumes. Of the 10 largest* states, eight showed an increase from 2024. Georgia had the strongest improvement at 6.6%. California decreased the most at -9.2%. Of all states, Oklahoma (+12%) and Kansas (+9%) had the highest growth numbers compared to the same period last year. Alaska (-15%) and California (-9%) posted the largest decreases from October 2024 of all states.

Month-over-month, nominal lending activity was down in 24 states in the preceding 12 months, including six of the 10 largest states. All four of the remaining states where lending declined showed decreases of less than 1%. Ohio (+2.2%), New York (+1.2%), and Georgia (+1.2%) had the highest growth of the 10 largest states in the 12-month period ending in October 2025 as compared to the 12-month period ending in September 2025. Of all states, Alaska (-3% month-over-month) and California (-3% month-over-month) decreased the most.

Small Business Delinquency and Default:

Defaults decreased in 36 states year-over-year and decreased in 32 states month-over-month. Year-over-year, New York improved the most, declining by 33%, while Utah had the largest default rate increase, jumping 17%. Texas (4.5%), Florida (4.4%), and Louisiana (4.2%) had the highest overall default rates among all states. Pennsylvania (2.0%), North Dakota (2.0%), and Michigan (2.1%) had the lowest. Of the 10 largest states, only Texas increased default rates in October 2025, rising 0.5% month-over-month and 4% year-over-year. The remaining states decreased default rates month-over-month, led by New York which dropped by 6.6%.

In 31-90 day delinquency, 32 states had a decrease in delinquency month-over-month. Wyoming (3.2%), Florida (2.9%), Georgia (2.7%), and Nevada (2.3%) had the highest delinquency rates in October 2025, while South Dakota (0.8%), Ohio (0.9%), and Iowa (1.1%) had the lowest. Wyoming showed the largest year-over-year increase in delinquency, rising 58 basis points since last October. Of the 10 largest states, Michigan (+16 basis points) and Illinois (+11 basis points) had the largest year-over-year increases. North Carolina decreased 35 basis points from October 2024, and California dropped 21 basis points.

Industry Analysis

Small Business Lending:

-

In October 2025, nominal small business lending fell in four of the 17 tracked industries month-over-month, holding steady in Information, Accommodation and Food Services, and Wholesale Trade.

-

12-month rolling lending activity weakened most month-over-month (-2%) in Educational Services.

-

Compared to October 2024, lending rose the most in Arts, Entertainment, and Recreation (+5%) and Real Estate and Rental and Leasing (+5%), followed by Construction (+4%). Lending fell in Information (-8%), Educational Services (-6%), Transportation and Warehousing (-5%), and Other Services (except Public Administration) (-5%).

Small Business Delinquency and Default:

-

In October 2025, the annualized SBDFI rose or held steady month-over-month in five of the 17 tracked industries, with the largest increase in Other Services (except Public Administration) (+3%).

-

From October 2024 to October 2025, the SBDFI increased in 10 of the 17 tracked industries, led by Arts, Entertainment, and Recreation (+10%), Agriculture, Forestry, Fishing and Hunting (+9%), and Other Services (except Public Administration) (+6%).

-

From October 2024 to October 2025, the 31-90 day SBDI was flat in the Construction industry. All other segments improved, with Transportation dropping 15% and Health Care decreasing 10%.

Produced monthly, the Small Business Indices help lenders and businesses track changes in the small business marketplace by providing insights into lending, default and delinquency trends. To learn more and view the latest reports, check out our Small Business Indices page.

*By population