India's developing mixed economy faces distinct financial challenges, including a significant wealth gap, high unemployment and acute economic vulnerability. Spurring economic development in its many rural districts is a challenge. In this case, financial innovation means taking a new approach to help improve access to financial resources for previously underserved communities.

To create meaningful impact, specific hurdles — unique to India — need to be addressed:

- Infrastructure

Limited access to bank branches and/or Internet and cellular service - Experience

Lack of familiarity with financial technology, digital payments, and credit/lending practice - History

Lack of credit history and ways to build a history

Joint Liability Group Loans

In 2018, the Indian government implemented the Aspirational Districts Program (ADP) — which is designed to transform 112 of the most under-developed districts across the country. As part of the ADP, financial tools were developed to help drive inclusive economic growth:

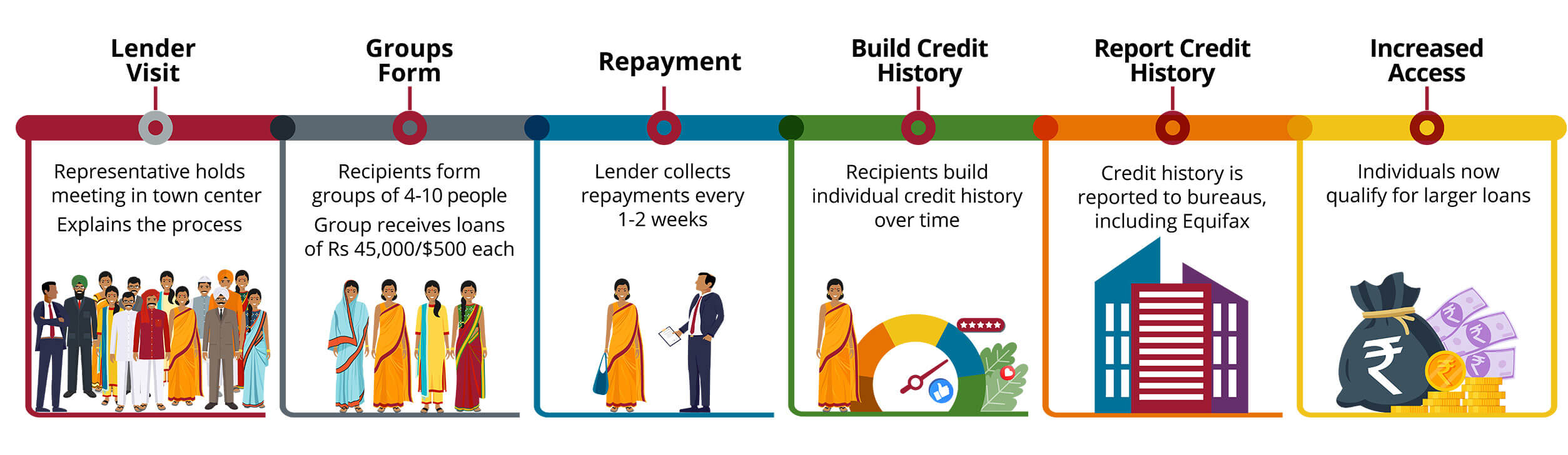

- Microfinancing loans can be obtained from a variety of lenders and typically range from $500 to $700 per person.

- Joint Liability Group (JLG) Loans are loans in which the repayment responsibility is shared among groups of 4-10 people from the same community.

A JLG loan addresses India's unique challenges by allowing recipients to join together and receive loans for their individual businesses as a collective group. Through these loans, individuals have more options to grow their business and personal credit, while lenders are able to extend their network and reach new customers.

These loan programs primarily focus on women in rural areas. JLG loans allow individuals with small businesses—often skilled crafts such as jewelry or pottery—to secure loans to build their business at a small scale.

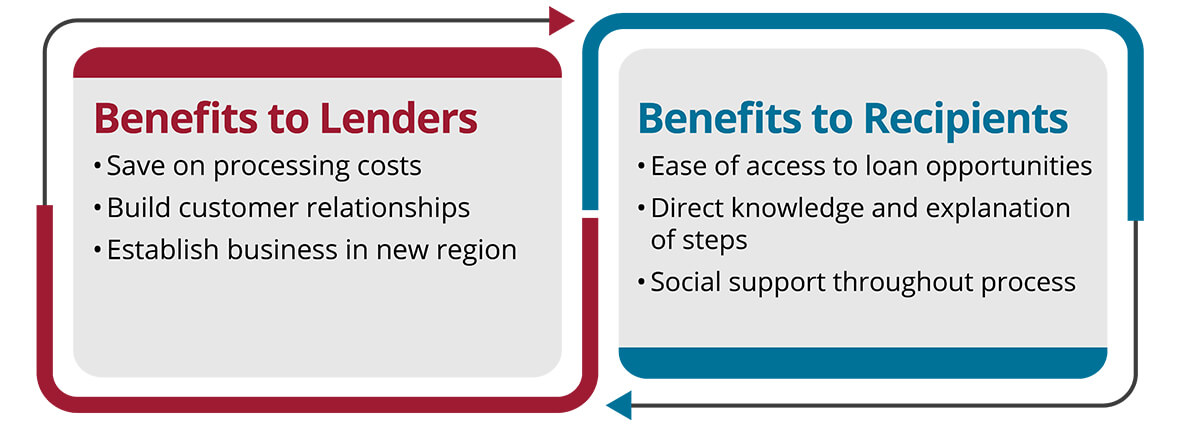

The process works well for both lenders and loan recipients:

“This method of lending is unique to India,” says Deshvir Ahluwalia, Chief Revenue Officer of Equifax India. “These programs help expand access to credit, and the social support in learning to manage the loan is powerful as it helps build knowledge and credit history.”

How it Works

As lenders report positive repayment history to Equifax, loan recipients begin to establish an individual credit history. Over time, recipients build their credit scores and grow their businesses, supporting local economic growth which can lead to even greater financial opportunities. The data can also benefit lenders and the government to help make decisions about expanding the program's reach.

As of October 2024, Equifax has helped approximately 120 million borrowers in India begin building their individual credit report, with more than 75 million active customers who have received and are currently repaying these loans.

Actively participating in innovative programs that expand access to financial resources is core to our Purpose of helping people live their financial best. Read more about our financial inclusion efforts.

Learn more about microfinance industry insights from Equifax India.